이미지 확대보기

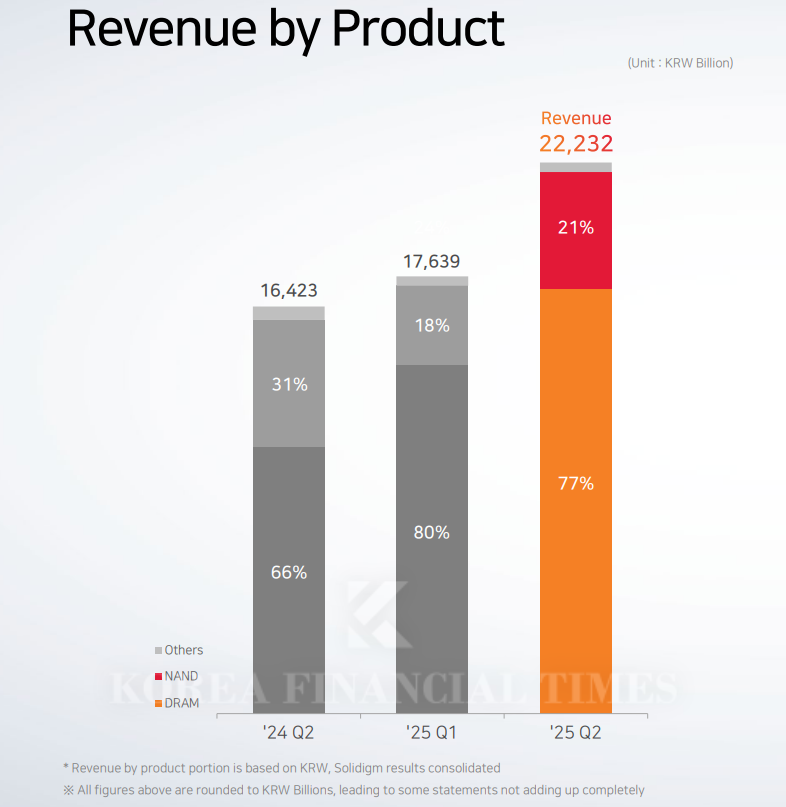

이미지 확대보기On July 24, SK hynix announced that it achieved revenue of KRW 22.232 trillion, operating profit of KRW 9.2129 trillion, and net income of KRW 6.9962 trillion in the second quarter of 2025. Both revenue and operating profit surpassed the company’s previous records set in the fourth quarter of 2024, and the operating margin reached 41%.

This strong performance was again led by HBM, a memory semiconductor for artificial intelligence (AI). SK hynix stated, “As global big tech firms are actively investing in AI, demand is continuing to grow,” adding that it will maintain its plan to double year-on-year sales in the HBM sector.

SK hynix’s financial soundness has become even more solid as the company continues to post operating margins above 40%. At the end of the second quarter, cash and cash equivalents totaled KRW 16.96 trillion, marking an 75% increase from KRW 9.69 trillion a year earlier. During the same period, the net debt ratio dropped by 20 percentage points to 6%.

이미지 확대보기

이미지 확대보기Market attention is now focused on next year’s outlook. U.S. investment bank Goldman Sachs downgraded its rating on SK hynix last week from “Buy” to “Neutral,” citing concerns that HBM prices could decline next year.

The next-generation HBM4, which SK hynix is set to launch in full scale in 2025, may face margin pressure. Competitive order bidding with Samsung Electronics and NVIDIA, as well as joint development efforts with TSMC, are expected to weigh on profitability.

Gwak Horyung (horr@fntimes.com)

[관련기사]

- SK hynix Rides HBM3E Wave—Is the Era of KRW 10 Trillion Quarterly Operating Profit Here?

- 'DRAM Leader' SK hynix — Can It Make a Mark in 'Non-Memory' Too?

- SK Group Doubles Cash Generation on Semiconductor Gains... Energy Sector Increases Borrowing

- SK hynix Posts Over KRW 7 Trillion in Q1 Operating Profit… “Strong Demand for HBM to Persist”

- SKT Appoints Group's Strategic Expert, Marking Pinnacle in 'AI Company' Transformation

가장 핫한 경제 소식! 한국금융신문의 ‘추천뉴스’를 받아보세요~

데일리 금융경제뉴스 Copyright ⓒ 한국금융신문 & FNTIMES.com

저작권법에 의거 상업적 목적의 무단 전재, 복사, 배포 금지

!['From Heavy Industry to Humanoids' — Doosan Robotics Charts a New Future in Physical AI [K-Humanoid Wars, Part 3]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=284&h=214&m=5&simg=2026030310061306979141825007d12411124362.jpg&nmt=18)

!['Samsung's Bet on the Future' — Rainbow Robotics, Korea's Humanoid Pioneer [K-Humanoid Wars, Part 2]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=284&h=214&m=5&simg=2026022413501808272141825007d12411124362.jpg&nmt=18)

![Tesla's Humanoid Rival Has Arrived — Boston Dynamics Eyes $70 Billion Valuation [K-Humanoid Wars, Part 1]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=284&h=214&m=5&simg=2026022010243207659141825007d12411124362.jpg&nmt=18)

![Samsung's 'Last Chance': Lee Jae-yong Pushes HBM4 as Make-or-Break Moment [KFT Topic]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=284&h=214&m=5&simg=2026012623242806011141825007d122461258.jpg&nmt=18)

![Tesla's Humanoid Rival Has Arrived — Boston Dynamics Eyes $70 Billion Valuation [K-Humanoid Wars, Part 1]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=110&h=79&m=5&simg=2026022010243207659141825007d12411124362.jpg&nmt=18)

!['Samsung's Bet on the Future' — Rainbow Robotics, Korea's Humanoid Pioneer [K-Humanoid Wars, Part 2]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=110&h=79&m=5&simg=2026022413501808272141825007d12411124362.jpg&nmt=18)

!['From Heavy Industry to Humanoids' — Doosan Robotics Charts a New Future in Physical AI [K-Humanoid Wars, Part 3]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=110&h=79&m=5&simg=2026030310061306979141825007d12411124362.jpg&nmt=18)