이미지 확대보기

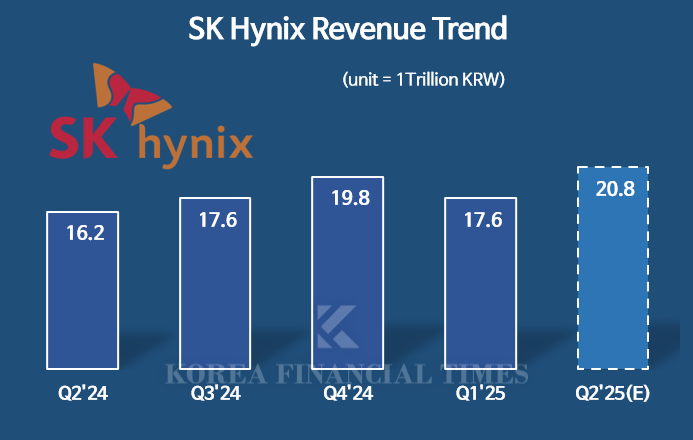

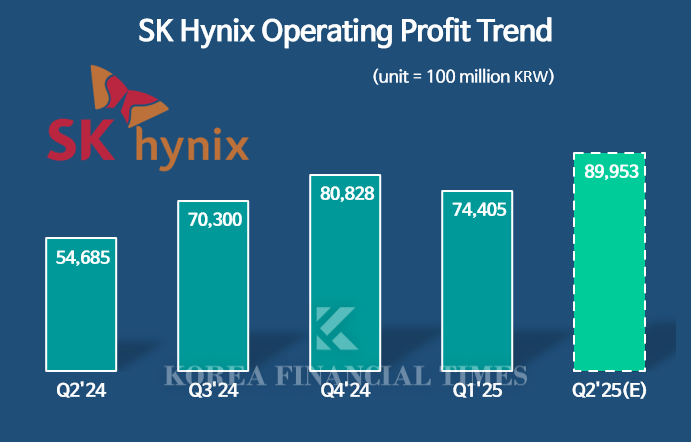

이미지 확대보기According to corporate analysis reports released this week by five brokerages—NH, LS, BNK, SangSangIn, and Heungkuk Securities—the average estimated sales for SK hynix in Q2 are KRW 20.78 trillion, with average operating profit at KRW 8.99 trillion. Compared to Q2 last year, this represents a 27% increase in sales and a 64% jump in operating profit. Versus Q1 this year, sales and operating profit are expected to rise by 18% and 19%, respectively.

These estimates would mark a new all-time high for the company, surpassing the previous record of KRW 19.77 trillion in sales and KRW 8.08 trillion in operating profit set in Q4 2024. A new record is anticipated just two quarters later.

Expectations for SK hynix’s performance have risen sharply following Micron’s recent earnings announcement. On June 25 (local time), Micron reported sales of $9.3 billion (approx. KRW 12.64 trillion) and earnings per share of $1.91 for the March–May period. Sales exceeded forecasts by 5%, and net profit surpassed expectations by 20%, delivering an earnings surprise. Micron attributed its strong results to robust AI-driven demand, particularly for HBM.

Micron currently supplies HBM3E (5th generation) to NVIDIA, naturally raising expectations for SK hynix, the leader in this field.

Despite expectations that a stabilizing USD/KRW exchange rate would dampen export company earnings in Q2, SK hynix is forecast to achieve record results thanks to strong sales of high-value HBM. The securities industry estimates that HBM accounts for about 45% of the company’s DRAM sales, with HBM3E 12-high products making up more than half of that. The HBM3E 12-high, used in NVIDIA’s Blackwell Ultra AI accelerators, reportedly commands a price more than 60% higher than the previous 8-high version.

Momentum is expected to accelerate in the second half as the share of HBM3E 12-high sales continues to grow. Brokerages project that SK hynix will record operating profits in the KRW 10 trillion range for both Q3 and Q4.

SK hynix has partnered with Taiwan’s foundry giant TSMC for HBM4. Unlike with HBM3E, where SK hynix produced the base die (the first layer of the semiconductor) in-house, the company will outsource this to TSMC for HBM4.

Lee Min-hee, a researcher at BNK Securities, commented, “HBM4 will see profit margins fall by about 15–20 percentage points due to higher costs, but since it will command a price premium of over 30% compared to HBM3E 12-high, overall profitability is expected to increase.”

Gwak Horyung (horr@fntimes.com)

[관련기사]

가장 핫한 경제 소식! 한국금융신문의 ‘추천뉴스’를 받아보세요~

데일리 금융경제뉴스 Copyright ⓒ 한국금융신문 & FNTIMES.com

저작권법에 의거 상업적 목적의 무단 전재, 복사, 배포 금지

!['From Heavy Industry to Humanoids' — Doosan Robotics Charts a New Future in Physical AI [K-Humanoid Wars, Part 3]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=284&h=214&m=5&simg=2026030310061306979141825007d12411124362.jpg&nmt=18)

!['Samsung's Bet on the Future' — Rainbow Robotics, Korea's Humanoid Pioneer [K-Humanoid Wars, Part 2]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=284&h=214&m=5&simg=2026022413501808272141825007d12411124362.jpg&nmt=18)

![Tesla's Humanoid Rival Has Arrived — Boston Dynamics Eyes $70 Billion Valuation [K-Humanoid Wars, Part 1]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=284&h=214&m=5&simg=2026022010243207659141825007d12411124362.jpg&nmt=18)

![Samsung's 'Last Chance': Lee Jae-yong Pushes HBM4 as Make-or-Break Moment [KFT Topic]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=284&h=214&m=5&simg=2026012623242806011141825007d122461258.jpg&nmt=18)

![Tesla's Humanoid Rival Has Arrived — Boston Dynamics Eyes $70 Billion Valuation [K-Humanoid Wars, Part 1]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=110&h=79&m=5&simg=2026022010243207659141825007d12411124362.jpg&nmt=18)

!['Samsung's Bet on the Future' — Rainbow Robotics, Korea's Humanoid Pioneer [K-Humanoid Wars, Part 2]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=110&h=79&m=5&simg=2026022413501808272141825007d12411124362.jpg&nmt=18)

!['From Heavy Industry to Humanoids' — Doosan Robotics Charts a New Future in Physical AI [K-Humanoid Wars, Part 3]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=110&h=79&m=5&simg=2026030310061306979141825007d12411124362.jpg&nmt=18)