이미지 확대보기

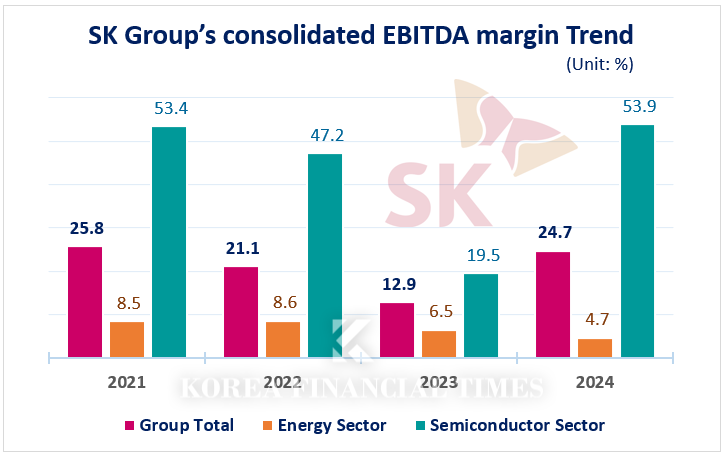

이미지 확대보기According to the Korea Ratings data package, SK Group’s consolidated EBITDA margin reached 23.8% in 2024, nearly doubling from 12.3% in 2023 in just one year.

이미지 확대보기

이미지 확대보기SK Group’s main concern is the pronounced reliance on semiconductors. The EBITDA margin of semiconductor affiliates such as SK hynix and SK siltron surged from 19.5% in 2023 to 53.9% in 2024. In contrast, the EBITDA margin of the energy affiliates, which account for the largest portion of sales, declined from 6.5% to 4.7% over the same period.

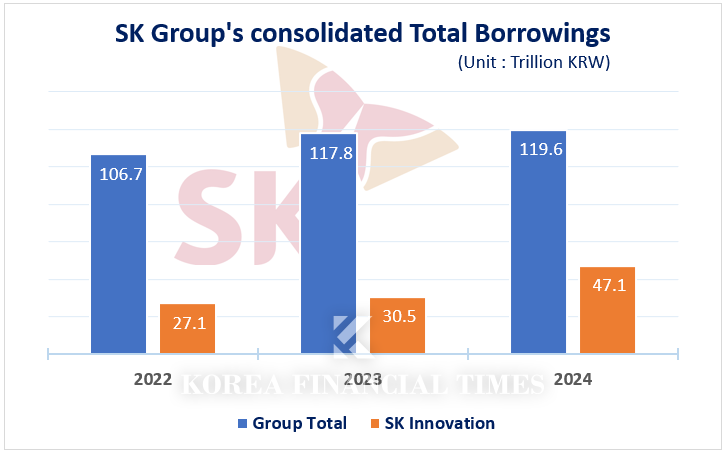

SK innovation, which accounts for 81% of sales among SK’s energy affiliates, is experiencing poor performance across all major business segments, including refining, chemicals, and batteries. As a result, even though its cash generation capacity is weakening, it faces a structural burden to continue large-scale investments such as battery facility expansions.

Consequently, dependence on external financing has increased, leading to a vicious cycle of expanding borrowings.

In fact, SK innovation’s consolidated total borrowings surged by approximately 54%, from KRW 30.535 trillion in 2023 to KRW 47.129 trillion in 2024.

The merger of SK innovation with SK E&S, which has strong cash generation capacity, in November last year was also a measure to overcome its financial crisis. Subsequently, in February this year, three SK innovation affiliates—SK on, SK Enterm, and SK International Trading—also underwent mergers. However, with SK on expected to remain in the red this year due to the prolonged EV market downturn, concerns are rising that additional support measures may be necessary.

이미지 확대보기

이미지 확대보기Gwak Horyung (horr@fntimes.com)

[관련기사]

- SK hynix Posts Over KRW 7 Trillion in Q1 Operating Profit… “Strong Demand for HBM to Persist”

- SK Innovation's Credit Rating Downgrade Spiral... Battery Division Faces KRW 1 Trillion Loss Concerns This Year

- Chairman Chey Tae-won of SK Group gives 'high praise at CES'... Who is he praising?

- "Why SK On Pins Its Hopes on Hyundai and Kia's Performance in the U.S."

- SKT Appoints Group's Strategic Expert, Marking Pinnacle in 'AI Company' Transformation

가장 핫한 경제 소식! 한국금융신문의 ‘추천뉴스’를 받아보세요~

데일리 금융경제뉴스 Copyright ⓒ 한국금융신문 & FNTIMES.com

저작권법에 의거 상업적 목적의 무단 전재, 복사, 배포 금지

![Samsung Electronics and SK Hynix Engage in High-Stakes AI Chip War [KFT Topic]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=284&h=214&m=5&simg=2026013013432407964141825007d12411124362.jpg&nmt=18)

![Hyundai Mobis Posts Record Results, Pivots to Robotics and Electrification [KFT Topic]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=284&h=214&m=5&simg=2026012911595100522141825007d12411124362.jpg&nmt=18)

![One Year In: CEO Hyun Shin-kyun Transforms LG CNS into KRW 6 Trillion AI Powerhouse [KFT Topic]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=284&h=214&m=5&simg=2026012807381208149141825007d12411124362.jpg&nmt=18)

!['Chung Eui-sun Declares Robot Management Era'... Hyundai Motor Group to Lead Robotics Age with 'Physical AI' [KFT Topic]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=284&h=214&m=5&simg=20260106111449071567492587736121125197123.jpg&nmt=18)

![Lee Jae-yong and Chey Tae-won, Korea's 'Semiconductor Duo,' Head to China... What's the Status of Local Operations? [KFT Topic]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=284&h=214&m=5&simg=2026010608232205705141825007d12411124362.jpg&nmt=18)

!['Beyond Mobile to Robotics': LG Innotek Continues Portfolio Expansion [KFT Topic]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=284&h=214&m=5&simg=2026010508201109906141825007d12411124362.jpg&nmt=18)

![Doosan Enerbility Eyes Return to 'A' Credit Rating After 9 Years on Nuclear Power and Gas Turbine Boom [KFT Topic]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=284&h=214&m=5&simg=2026010208511504157141825007d12411124362.jpg&nmt=18)

!["Samsung Is Back," Chip Chief Declares, Eyeing Record Profit on HBM Recovery [KFT Topic]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=110&h=79&m=5&simg=2026011408580109459141825007d12411124362.jpg&nmt=18)

![Koo Kwang-mo's Vision for AI and Robotics Drives LG Group's Transformation [KFT Topic]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=110&h=79&m=5&simg=2026012123034202714141825007d122461258.jpg&nmt=18)

!['Expansion' S-OIL vs. 'Caution' GS Caltex [KFT Topic]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=110&h=79&m=5&simg=2026012010260905723141825007d12411124362.jpg&nmt=18)

![One Year In: CEO Hyun Shin-kyun Transforms LG CNS into KRW 6 Trillion AI Powerhouse [KFT Topic]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=110&h=79&m=5&simg=2026012807381208149141825007d12411124362.jpg&nmt=18)

![Samsung's 'Last Chance': Lee Jae-yong Pushes HBM4 as Make-or-Break Moment [KFT Topic]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=110&h=79&m=5&simg=2026012623242806011141825007d122461258.jpg&nmt=18)