이미지 확대보기

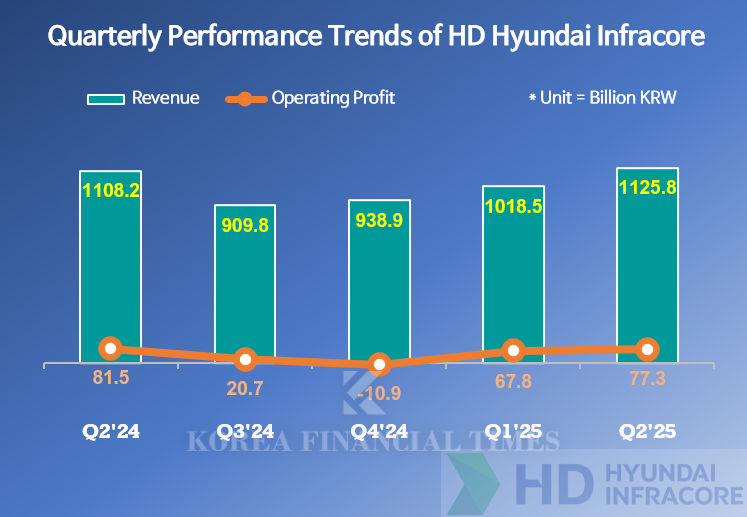

이미지 확대보기On the 23rd, HD Hyundai Infracore announced in its earnings conference call that it recorded consolidated sales of KRW 1.1846 trillion and operating profit of KRW 105.8 billion in the second quarter of this year. Compared to the same period last year, sales increased by 7% and operating profit jumped by 30%.

Sales returned to growth year-on-year for the first time in seven quarters, mainly thanks to recovering demand in key regions. Europe, including the UK and Italy, showed a particularly notable sales recovery. The rise in operating profit was attributed to reduced promotional expenses and increased sales of medium and large-sized products in emerging markets.

Cheon Jong-ho, Managing Director of IR at HD Hyundai Infracore, said, "The recovery in North American sales has been somewhat delayed," adding, "As tariff and interest rate uncertainties are expected to ease in the second half, a rebound is anticipated."

Looking ahead, HD Hyundai Infracore is also strengthening its network to prepare for reconstruction demand once the Russia-Ukraine war ends.

"Although the war is prolonging beyond expectations, it will eventually come to an end," a company official remarked. "We are actively building relationships with government agencies through our Ukrainian subsidiary to respond to reconstruction demand."

HD Hyundai Infracore, which is set to merge with HD Hyundai Construction Equipment on January 1 next year, will see its shares suspended from trading starting December 29.

Separately, regarding the share buyback and cancellation announced earlier this year, an HD Hyundai Infracore official said, "We have completed the repurchase of 3,739,794 self-owned shares worth KRW 31.4 billion," noting, "With the board's approval for the cancellation on this day, we plan to cancel the shares on August 6."

Shin Haeju (hjs0509@fntimes.com)

[관련기사]

가장 핫한 경제 소식! 한국금융신문의 ‘추천뉴스’를 받아보세요~

데일리 금융경제뉴스 Copyright ⓒ 한국금융신문 & FNTIMES.com

저작권법에 의거 상업적 목적의 무단 전재, 복사, 배포 금지

![용산 '신동아' 45평, 12.5억 오른 34억원에 거래 [일일 아파트 신고가]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=284&h=214&m=5&simg=2023110915385506755b372994c951245313551.jpg&nmt=18)

![용산구 ‘효창한신’ 42A평, 6.95억원 오른 14억원에 거래 [일일 아파트 신고가]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=284&h=214&m=5&simg=2025061908193804321e41d7fc6c2183101242202.jpg&nmt=18)