This was the reaction from an industry insider to news that SK keyfoundry, SK hynix’s non-memory subsidiary, is aggressively expanding into power semiconductors to escape the loss-making 8-inch foundry market.

◇ A Return After 18 Years

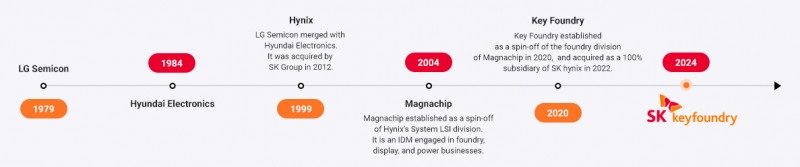

SK keyfoundry is a wholly owned subsidiary of SK hynix. Its roots go back to LG Semicon, founded in 1979. In 1999, during the Asian financial crisis, LG Semicon was merged with Hyundai Electronics in a government-led “Big Deal.” The enlarged semiconductor company sought survival in the market but failed to overcome excessive debt and a liquidity crisis following the “princes’ feud” within Hyundai Group.After leaving Hyundai and rebranding as Hynix, the company sold its non-memory division to a private equity fund in 2004, which became MagnaChip Semiconductor.

In 2022, SK hynix acquired MagnaChip’s foundry business, now known as SK keyfoundry. Eighteen years later, the business has returned to the SK hynix fold.

이미지 확대보기

이미지 확대보기SK hynix already operates a foundry division, SK hynix System IC, which was spun off in 2017. This unit contract-manufactures general-purpose semiconductors based on 8-inch wafers—such as camera sensors (CIS), display driver ICs (DDI), and power management ICs (PMIC)—for smartphones, TVs, monitors, and laptops. Its business overlaps with SK keyfoundry.

The key difference is that SK hynix System IC focuses on customers through its Wuxi, China subsidiary, while SK keyfoundry operates offices in San Jose, USA, and Shanghai, China.

Last year, SK hynix System IC sold part of its Chinese subsidiary and began domestic workforce restructuring. Meanwhile, SK keyfoundry expanded by acquiring SK Powertech from SK Inc.

◇ Post-Acquisition Losses and Halved Revenue

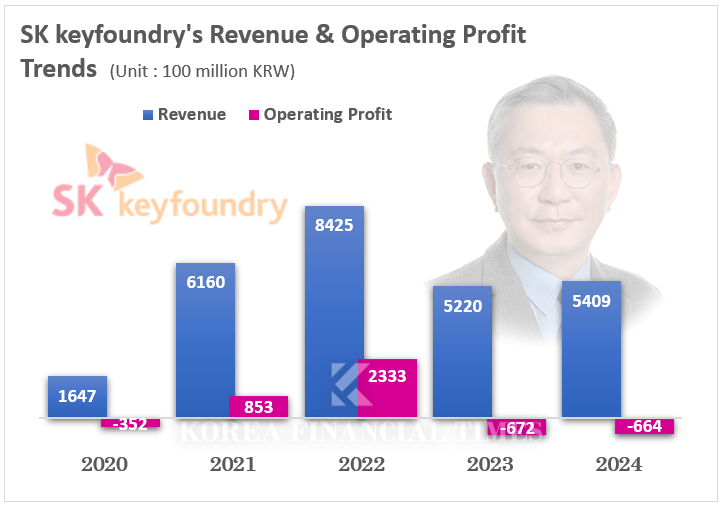

Unlike its parent SK hynix, which is thriving, SK keyfoundry has struggled with poor performance. With little business overlap with SK hynix, it must secure orders from external clients. The 8-inch foundry sector was hit hard by the post-pandemic slump in IT device demand.In 2022, the year of the acquisition, prospects were positive.

That year, SK keyfoundry posted sales of 842.5 billion KRW and operating profit of 233.3 billion KRW—a record, with sales up 37% and operating profit up 174% year-on-year.

But performance plummeted from the following year. In 2023, sales fell 38% to 522 billion KRW, and the company swung to an operating loss of 67.2 billion KRW. Last year’s results were similarly weak.

An industry insider said, “Since 2023, Chinese 8-inch foundry companies like SMIC have aggressively ramped up capacity, likely impacting Korean firms with high exposure to the Chinese market.”

◇ Betting on Power Semiconductors

SK keyfoundry’s acquisition of SK Powertech came at a time when expanding into high-value-added businesses was urgent. The deal was a win-win, aligning with SK Inc.’s need for liquidity.In March this year, SK keyfoundry signed a contract to acquire SK Inc.’s entire 98.59% stake in SK Powertech for 25 billion KRW.

SK Powertech specializes in silicon carbide (SiC) power semiconductors, and was acquired by SK Inc. in 2022. Power semiconductors are essential for controlling current and power conversion in electric vehicles, electronics, and 5G networks. SiC is a new material that offers less power conversion loss at high voltage, current, and temperature compared to conventional silicon.

SK keyfoundry plans to source SiC wafers from SK Siltron, manufacture products, and supply them to the group’s battery affiliates, investing accordingly.

However, during a portfolio rebalancing, SK Siltron was put up for sale, prompting the sale of SK Powertech as well. Ultimately, instead of an external sale, SK hynix—flush with liquidity—indirectly absorbed the business.

◇ Foundry Specialist at the Helm

SK keyfoundry’s board was filled with SK hynix personnel immediately after the August 2022 acquisition, including foundry expert CEO Lee Dong-jae, Kim Dal-joo (Growth Support), Jin Bo-geon (Corporate Culture), and Choi So-jung (Corporate Development).CEO Lee Dong-jae, born in 1962, graduated from Sungkyunkwan University with a degree in electronic engineering. He started his career as a semiconductor engineer at Samsung Electronics, working there for 15 years, then spent 11 years at Singapore foundry Chartered Semiconductor (now GlobalFoundries), before returning to Korea in 2009 as head of development planning at SK Engineering & Construction (now SK ecoplant). Since 2014, he has led SK hynix’s foundry and new business divisions, served as CEO of SK hynix System IC, and now heads SK keyfoundry.

Recently, CEO Lee stated, “We will broaden our power semiconductor lineup and establish ourselves as a specialized power semiconductor foundry.”

Gwak Horyung (horr@fntimes.com)

[관련기사]

가장 핫한 경제 소식! 한국금융신문의 ‘추천뉴스’를 받아보세요~

데일리 금융경제뉴스 Copyright ⓒ 한국금융신문 & FNTIMES.com

저작권법에 의거 상업적 목적의 무단 전재, 복사, 배포 금지

!['From Heavy Industry to Humanoids' — Doosan Robotics Charts a New Future in Physical AI [K-Humanoid Wars, Part 3]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=284&h=214&m=5&simg=2026030310061306979141825007d12411124362.jpg&nmt=18)

!['Samsung's Bet on the Future' — Rainbow Robotics, Korea's Humanoid Pioneer [K-Humanoid Wars, Part 2]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=284&h=214&m=5&simg=2026022413501808272141825007d12411124362.jpg&nmt=18)

![Tesla's Humanoid Rival Has Arrived — Boston Dynamics Eyes $70 Billion Valuation [K-Humanoid Wars, Part 1]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=284&h=214&m=5&simg=2026022010243207659141825007d12411124362.jpg&nmt=18)

![Samsung's 'Last Chance': Lee Jae-yong Pushes HBM4 as Make-or-Break Moment [KFT Topic]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=284&h=214&m=5&simg=2026012623242806011141825007d122461258.jpg&nmt=18)

![Tesla's Humanoid Rival Has Arrived — Boston Dynamics Eyes $70 Billion Valuation [K-Humanoid Wars, Part 1]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=110&h=79&m=5&simg=2026022010243207659141825007d12411124362.jpg&nmt=18)

!['Samsung's Bet on the Future' — Rainbow Robotics, Korea's Humanoid Pioneer [K-Humanoid Wars, Part 2]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=110&h=79&m=5&simg=2026022413501808272141825007d12411124362.jpg&nmt=18)

!['From Heavy Industry to Humanoids' — Doosan Robotics Charts a New Future in Physical AI [K-Humanoid Wars, Part 3]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=110&h=79&m=5&simg=2026030310061306979141825007d12411124362.jpg&nmt=18)