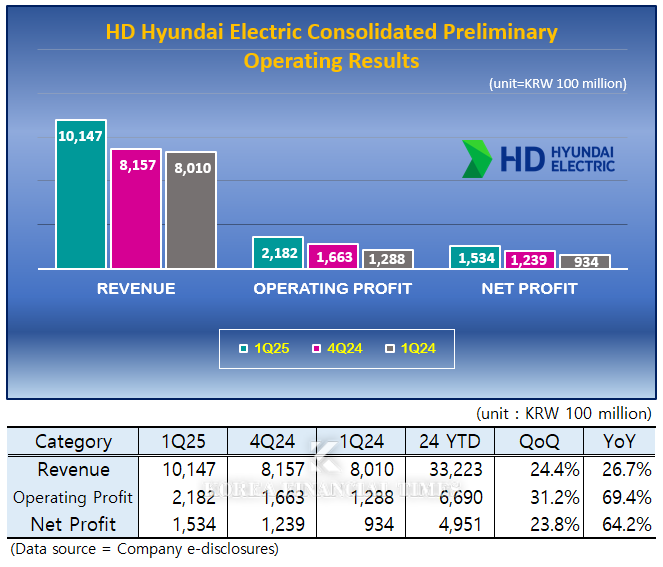

HD Hyundai Electric Co., Ltd. (CEO: Kim Young-ki) made this statement during its earnings conference call held on April 22, following its announcement of record-breaking quarterly revenue of KRW 1.0147 trillion in Q1, marking a notable earnings surprise.

The Power Equipment division — the company’s core cash cow — led the overall performance, recording KRW 463.7 billion in sales, up 46.1% YoY. Overseas subsidiaries also contributed significantly, with shipments from Q4 2024 reflected in Q1 results. In particular, the North American subsidiary saw robust profitability from high-margin projects.

이미지 확대보기

이미지 확대보기“This marks the first time since our spin-off in 2017 that we’ve exceeded KRW 1 trillion in quarterly revenue,” said HD Hyundai Electric. “The share of revenue from the North American market, known for strong profitability, has significantly increased.” The company added, “Given our strong pipeline of high-margin orders, we expect to maintain a similar level of profitability in the coming quarters.”

While recent developments surrounding reciprocal tariffs initiated by the United States have garnered attention, HD Hyundai Electric projects minimal impact.

“We have already begun negotiations with our North American clients. Most of them have responded positively to potential price increases,” the company stated. “We believe we can hedge a significant portion of our exposure to tariff-related risks.”

Regarding the market environment, the company noted, “The second Trump administration recently signed an executive order related to the energy emergency, and power demand is projected to grow by 3–4% compared to last year.” It added, “Continuous investment in power infrastructure will be necessary to meet this demand, and customers also foresee ongoing supply-demand imbalances.”

The company further clarified that, “To date, there have been no delays or cancellations of orders attributable to reciprocal tariffs.”

Addressing concerns over potential future impacts if orders continue under such tariff conditions, HD Hyundai Electric emphasized, “We are actively negotiating tariff risk hedging mechanisms with clients and are not concerned about a decline in profit margins.”

The company explained that its clients fall into two categories: “First, customers with existing short-term supply contracts containing finalized terms — they have expressed willingness to negotiate favorably if tariffs are imposed. Second, customers with whom we are pursuing new contracts under the understanding that the cost of reciprocal tariffs will be passed on to them.”

HD Hyundai Electric maintains a strategy of hedging 50% of its net exposure with maturities of less than one year.

Shin Haeju (hjs0509@fntimes.com)

[관련기사]

- "Thriving in the New Power Era" – HD Hyundai Electric Achieves a Staggering 20% Operating Profit Margin in 2024

- Hyundai Motor Suffers KRW 700 Billion Loss in China, While Kia Achieves Profit Turnaround

- Why HD Hyundai Heavy Industries Focuses on 'Surface Ships' and Hanwha Ocean on 'Submarines'

- Hyundai E&C · Hyundai Engineering, Consecutive Safety Accidents and Performance Decline... Crisis of the "Construction Powerhouse"

- 'Breakthrough thinking'... Hyundai Steel to Build a Steel Mill in the U.S.

가장 핫한 경제 소식! 한국금융신문의 ‘추천뉴스’를 받아보세요~

데일리 금융경제뉴스 Copyright ⓒ 한국금융신문 & FNTIMES.com

저작권법에 의거 상업적 목적의 무단 전재, 복사, 배포 금지

![용산구 ‘나인원한남’ 88평, 9억 상승한 167억원에 거래 [일일 아파트 신고가]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=284&h=214&m=5&simg=2025071010042800278b372994c952115218260.jpg&nmt=18)

![용산 ‘한가람’ 25평, 9.6억 내린 16.2억원에 거래 [이 주의 하락아파트]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=284&h=214&m=5&simg=2023031509425002992b372994c951191922428.jpg&nmt=18)

![용산 ‘한가람’ 25평, 9.6억 내린 16.2억원에 거래 [이 주의 하락아파트]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=110&h=79&m=5&simg=2023031509425002992b372994c951191922428.jpg&nmt=18)