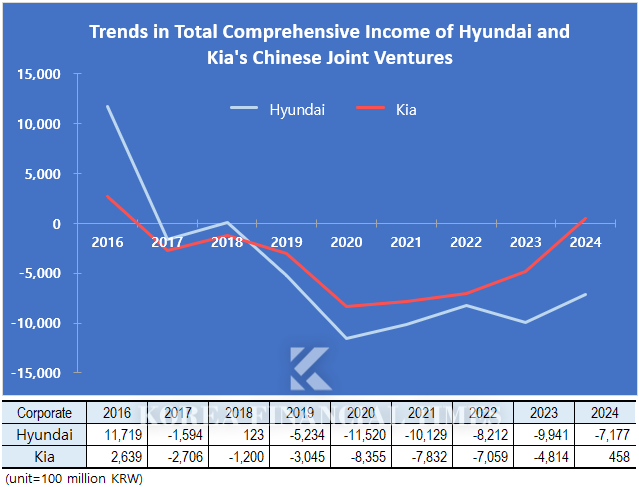

Beijing Hyundai Motor Company (BHMC), Hyundai's joint venture in China, recorded a comprehensive loss of KRW -717.7 billion last year. Although this marks an improvement of approximately KRW 300 billion compared to the KRW -1 trillion loss in 2023, the company has been incurring significant losses for six consecutive years. Due to these ongoing losses, Hyundai ceased equity method accounting for BHMC last year and reduced its book value to zero. Back in 2016, when Hyundai achieved its highest sales in China, BHMC’s book value stood at KRW 2.2258 trillion.

The challenges faced by both Hyundai and Kia in China's domestic market are similar. Over the past decade, declining sales have led to significant lineup reductions, resulting in diminished market presence. In 2024, Hyundai sold approximately 125,000 units and Kia sold 78,000 units in China, representing a year-on-year decline of 3% for both companies. Compared to their peak sales in 2016, these figures represent only one-sixth of their former volumes. Market share has also plummeted, with Hyundai at 0.6% and Kia at 0.3%, bringing their combined share below 1%.

The key factor differentiating the performance of Hyundai and Kia is exports. According to Kia's investor relations materials, the company exported 140,000 units from its Chinese factories last year—more than three times Hyundai's volume of 45,000 units. By Q3 of last year, Kia’s Chinese factory utilization rate exceeded 96%.

Kia began leveraging its Chinese factories as export bases two years earlier than Hyundai, starting in 2021. Its Yancheng plant in southeastern China strategically targets markets such as the Asia-Middle East (43%) and Latin America (30%). Although current sales volumes remain modest, Kia has also started exporting its EV5 electric vehicle model designed specifically for overseas markets from China. The company plans to increase exports from its Chinese plants to around 250,000 units this year.

이미지 확대보기

이미지 확대보기Gwak Horyung (horr@fntimes.com)

[관련기사]

- Hyundai Motor Group Chairman Chung Eui-sun to Receive Salary from Kia Starting This Year

- "Why SK On Pins Its Hopes on Hyundai and Kia's Performance in the U.S."

- 'The CEO and the business haven't changed, but...' Hyundai Rotem's Transforms in 2 Years [The answer is TSR]

- Chung Eui-sun's confidence... 'New car lineup' with unprecedented full change starting next year

- Sonata, 'Power of Taxi', Succeeds in Rebounding Sales Despite Recession

가장 핫한 경제 소식! 한국금융신문의 ‘추천뉴스’를 받아보세요~

데일리 금융경제뉴스 Copyright ⓒ 한국금융신문 & FNTIMES.com

저작권법에 의거 상업적 목적의 무단 전재, 복사, 배포 금지

![Tesla's Humanoid Rival Has Arrived — Boston Dynamics Eyes $70 Billion Valuation [K-Humanoid Wars, Part 1]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=284&h=214&m=5&simg=2026022010243207659141825007d12411124362.jpg&nmt=18)

![Samsung's 'Last Chance': Lee Jae-yong Pushes HBM4 as Make-or-Break Moment [KFT Topic]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=284&h=214&m=5&simg=2026012623242806011141825007d122461258.jpg&nmt=18)

![Hanwha Aerospace Stock Surges 3,500% in Six Years on 'Extraordinary Strength' [KFT Topic]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=284&h=214&m=5&simg=2026012609443900770141825007d12411124362.jpg&nmt=18)

![Tesla's Humanoid Rival Has Arrived — Boston Dynamics Eyes $70 Billion Valuation [K-Humanoid Wars, Part 1]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=110&h=79&m=5&simg=2026022010243207659141825007d12411124362.jpg&nmt=18)

!['Samsung's Bet on the Future' — Rainbow Robotics, Korea's Humanoid Pioneer [K-Humanoid Wars, Part 2]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=110&h=79&m=5&simg=2026022413501808272141825007d12411124362.jpg&nmt=18)