On March 14 (local time), global credit rating agency Moody's downgraded SK Innovation's credit rating from 'Baa3' to 'Ba1'. Baa3 was the lowest investment-grade rating, and this adjustment signifies a downgrade to below investment grade. Moody's cited "continued underperformance in the battery sector (SK On) and high debt burden" as reasons.

A greater concern is the uncertain short-term outlook for the battery sector. SK On reported an operating loss of KRW 1.127 trillion last year due to the electric vehicle chasm effect. Securities firms forecast a similar loss of around KRW 1 trillion this year, with no significant signs of recovery.

The poor profitability of the battery business could also negatively impact domestic credit ratings. Korea Ratings currently maintains SK Innovation's credit rating at AA (stable). One of the factors for a credit rating downgrade is "if the ratio of net borrowings to EBITDA (earnings before interest, taxes, depreciation, and amortization) consistently exceeds 7 times".

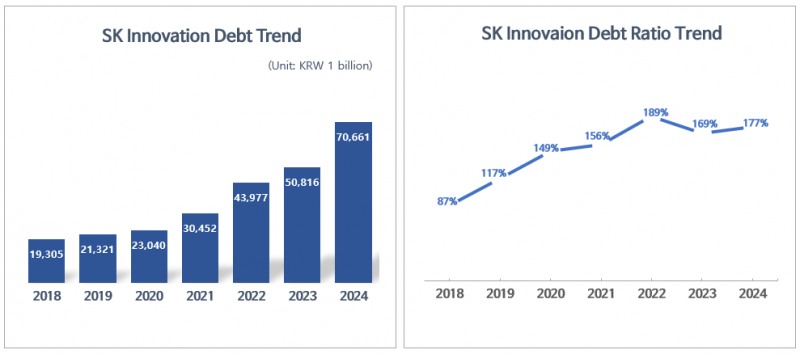

According to SK Innovation's IR materials, as of the end of last year, the company's net borrowings were KRW 27.5266 trillion, with an EBITDA of KRW 276.4 billion. The net borrowings to EBITDA ratio stands at 10.3 times, meeting the criteria for a credit rating downgrade.

Gwak Horyung (horr@fntimes.com)

[관련기사]

- 'Solid Performance Amidst Recession' - S-Oil · GS Caltex, What’s Their Secret?

- LG Energy Solution, Samsung SDI, SK On Brace for Prolonged EV Battery Slump

- SK Innovation KRW -160 billion, S-Oil KRW -430 billion... Earnings shock predicted for refinery business

- SK Innovation-SK E&S Merger Over Final Threshold

- Last Year’s Jackpot, Pharma Firms Bet Everything on the Next Blockbuster Drug

- 'Crisis' Samsung overhauls DS with proven tech talent...Empowered Jeon Young-hyun

가장 핫한 경제 소식! 한국금융신문의 ‘추천뉴스’를 받아보세요~

데일리 금융경제뉴스 Copyright ⓒ 한국금융신문 & FNTIMES.com

저작권법에 의거 상업적 목적의 무단 전재, 복사, 배포 금지

![Samsung Electronics and SK Hynix Engage in High-Stakes AI Chip War [KFT Topic]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=284&h=214&m=5&simg=2026013013432407964141825007d12411124362.jpg&nmt=18)

![Hyundai Mobis Posts Record Results, Pivots to Robotics and Electrification [KFT Topic]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=284&h=214&m=5&simg=2026012911595100522141825007d12411124362.jpg&nmt=18)

![One Year In: CEO Hyun Shin-kyun Transforms LG CNS into KRW 6 Trillion AI Powerhouse [KFT Topic]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=284&h=214&m=5&simg=2026012807381208149141825007d12411124362.jpg&nmt=18)

!['Chung Eui-sun Declares Robot Management Era'... Hyundai Motor Group to Lead Robotics Age with 'Physical AI' [KFT Topic]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=284&h=214&m=5&simg=20260106111449071567492587736121125197123.jpg&nmt=18)

![Lee Jae-yong and Chey Tae-won, Korea's 'Semiconductor Duo,' Head to China... What's the Status of Local Operations? [KFT Topic]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=284&h=214&m=5&simg=2026010608232205705141825007d12411124362.jpg&nmt=18)

!['Beyond Mobile to Robotics': LG Innotek Continues Portfolio Expansion [KFT Topic]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=284&h=214&m=5&simg=2026010508201109906141825007d12411124362.jpg&nmt=18)

![Doosan Enerbility Eyes Return to 'A' Credit Rating After 9 Years on Nuclear Power and Gas Turbine Boom [KFT Topic]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=284&h=214&m=5&simg=2026010208511504157141825007d12411124362.jpg&nmt=18)

!["Samsung Is Back," Chip Chief Declares, Eyeing Record Profit on HBM Recovery [KFT Topic]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=110&h=79&m=5&simg=2026011408580109459141825007d12411124362.jpg&nmt=18)

!['Expansion' S-OIL vs. 'Caution' GS Caltex [KFT Topic]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=110&h=79&m=5&simg=2026012010260905723141825007d12411124362.jpg&nmt=18)

![Koo Kwang-mo's Vision for AI and Robotics Drives LG Group's Transformation [KFT Topic]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=110&h=79&m=5&simg=2026012123034202714141825007d122461258.jpg&nmt=18)

![One Year In: CEO Hyun Shin-kyun Transforms LG CNS into KRW 6 Trillion AI Powerhouse [KFT Topic]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=110&h=79&m=5&simg=2026012807381208149141825007d12411124362.jpg&nmt=18)

![Samsung's 'Last Chance': Lee Jae-yong Pushes HBM4 as Make-or-Break Moment [KFT Topic]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=110&h=79&m=5&simg=2026012623242806011141825007d122461258.jpg&nmt=18)