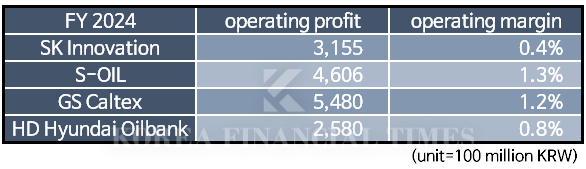

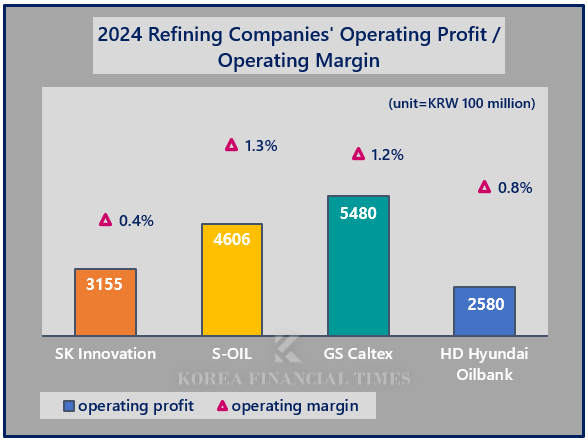

The combined annual operating profit of South Korea’s four major refiners stood at approximately KRW 1.58 trillion in 2024, a sharp decline to nearly one-third of the KRW 4.47 trillion recorded in 2023.

이미지 확대보기

이미지 확대보기GS Caltex Leads the Industry in Profitability ... S-OIL Invests in Petrochemical Expansion

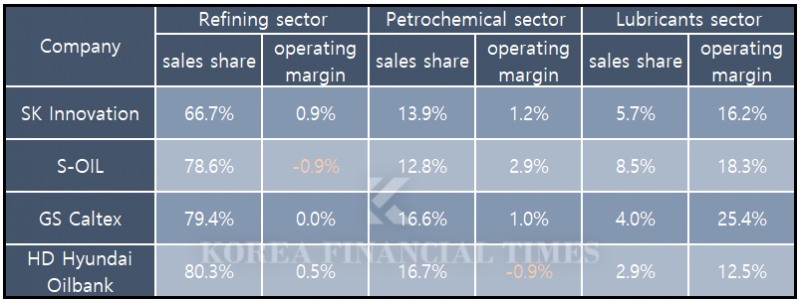

GS Caltex recorded the highest operating profit among its peers, posting KRW 548 billion. The company’s lubricant business has consistently delivered strong margins, standing out from competitors. While rivals in the sector maintain an average operating margin of around 15%, GS Caltex surpassed 25%. This success is attributed to the company’s strategic focus on high-value automotive lubricant finished products.S-OIL recorded the highest operating margin (1.3%) among the four major refiners. Although it was the only company in the sector to post a deficit in its refining operations, its relatively strong performance in the struggling petrochemical sector helped offset losses. It was the only one of the four to post a loss in its refining business, but it offset this with relatively solid profitability in petrochemicals, where all were struggling.

S-Oil plans to start the Shahine Project in Ulsan in 2026, investing KRW 9 trillion to build a large-scale petrochemical complex. It is expected that the project will disrupt the domestic petrochemical landscape, leveraging the raw material prices and technological competitiveness of its parent company, Saudi Aramco. S-OIL plans to nearly double the proportion of its revenue derived from petrochemicals, increasing it from the current 12-13%.

이미지 확대보기

이미지 확대보기HD Hyundai Oilbank and SK Innovation Face Challenges

HD Hyundai Oilbank struggled due to setbacks in its petrochemical business. Its joint venture with Lotte Chemical, HD Hyundai Chemical, posted an operating loss of KRW 70 billion.Outlook for 2025: Cautious Optimism Amid Global Uncertainty

The industry outlook for this year is expected to be similar to last year. Global economic sluggishness and stable international oil prices are anticipated to continue.There is, however, a variable: former U.S. President Donald Trump. The domestic industry holds mixed feelings of “half expectation, half concern.”

If the Trump administration enforces a policy of strengthening tariffs, it could have a positive impact on the domestic refining industry. The increase in the proportion of expensive U.S. refineries could raise margins for oil products overall. However, uncertainty surrounding implementation and potential side effect of a global trade reduction make it difficult to gauge the actual impact on the industry.

Gwak Horyung (horr@fntimes.com)

[관련기사]

- LG Energy Solution, Samsung SDI, SK On Brace for Prolonged EV Battery Slump

- HD Hyundai Oil Bank, Low Profitability but High Dividend Reason...

- SK Innovation KRW -160 billion, S-Oil KRW -430 billion... Earnings shock predicted for refinery business

- 'Reacting' to falling interest rates... S-Oil, Samsung C&T, etc. rush to issue high-grade bonds [Debt Capital Markets]

가장 핫한 경제 소식! 한국금융신문의 ‘추천뉴스’를 받아보세요~

데일리 금융경제뉴스 Copyright ⓒ 한국금융신문 & FNTIMES.com

저작권법에 의거 상업적 목적의 무단 전재, 복사, 배포 금지

!['From Heavy Industry to Humanoids' — Doosan Robotics Charts a New Future in Physical AI [K-Humanoid Wars, Part 3]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=284&h=214&m=5&simg=2026030310061306979141825007d12411124362.jpg&nmt=18)

!['Samsung's Bet on the Future' — Rainbow Robotics, Korea's Humanoid Pioneer [K-Humanoid Wars, Part 2]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=284&h=214&m=5&simg=2026022413501808272141825007d12411124362.jpg&nmt=18)

![Tesla's Humanoid Rival Has Arrived — Boston Dynamics Eyes $70 Billion Valuation [K-Humanoid Wars, Part 1]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=284&h=214&m=5&simg=2026022010243207659141825007d12411124362.jpg&nmt=18)

![Samsung's 'Last Chance': Lee Jae-yong Pushes HBM4 as Make-or-Break Moment [KFT Topic]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=284&h=214&m=5&simg=2026012623242806011141825007d122461258.jpg&nmt=18)

![Tesla's Humanoid Rival Has Arrived — Boston Dynamics Eyes $70 Billion Valuation [K-Humanoid Wars, Part 1]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=110&h=79&m=5&simg=2026022010243207659141825007d12411124362.jpg&nmt=18)

!['Samsung's Bet on the Future' — Rainbow Robotics, Korea's Humanoid Pioneer [K-Humanoid Wars, Part 2]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=110&h=79&m=5&simg=2026022413501808272141825007d12411124362.jpg&nmt=18)

!['From Heavy Industry to Humanoids' — Doosan Robotics Charts a New Future in Physical AI [K-Humanoid Wars, Part 3]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=110&h=79&m=5&simg=2026030310061306979141825007d12411124362.jpg&nmt=18)