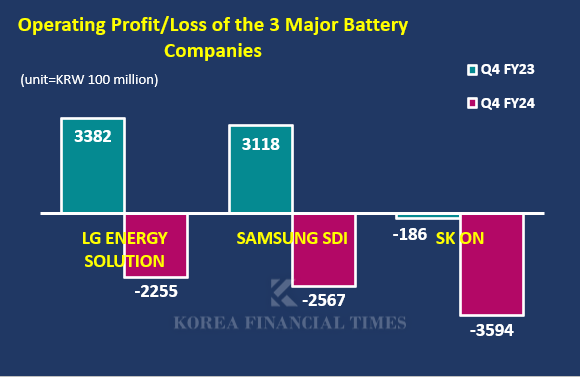

On the 6th, SK Innovation announced that its battery subsidiary, SK On, posted an operating loss of KRW 359.4 billion in Q4 2024. This represents a KRW 340 billion increase in losses compared to the KRW 18.6 billion deficit recorded in the same period of 2023. The company’s total annual losses for 2024 reached KRW 1.127 trillion.

이미지 확대보기

이미지 확대보기Market Conditions Show No Signs of Recovery in 2025

Hopes for a dramatic market rebound this year remain slim. The second administration of U.S. President Donald Trump, who is known for his skepticism toward EVs, has now taken office. Upon inauguration last month, President Trump immediately repealed an executive order from the Biden administration that mandated EV adoption. He is also considering cutting EV subsidies, raising concerns across the industry.Battery companies, which had previously dismissed the "Trump risk" as having a low chance of materializing, are now growing increasingly uneasy.

During an earnings conference call on January 24, LG Energy Solution stated, "Policy uncertainty in North America is quite high." While the company believes there is little likelihood of changes to battery production subsidies under the Advanced Manufacturing Production Credit (AMPC), it sees a risk of EV purchase subsidies being reduced or eliminated. This uncertainty is leading automakers to adopt a more conservative approach to their EV plans, which in turn is affecting battery production rates.

Samsung SDI, which is set to begin full-scale operations at its first U.S. plant this year, acknowledged the challenges, stating, "Given the fluctuating market conditions and uncertainty, we are in discussions with our customer, Stellantis, regarding annual production volumes."

SK On noted that while some customers managed stable sales despite not qualifying for subsidies last year, this was mainly due to Hyundai and Kia, which boosted their U.S. EV sales through self-imposed discounts. The impact of subsidies on pricing remains significant. Additionally, SK On announced that the launch of its Tennessee plant, originally scheduled to begin production this year for its customer Ford, has been postponed to next year.

In Q4 2024, the financial benefits from the AMPC program amounted to KRW 377.3 billion for LG Energy Solution, KRW 81.3 billion for SK On, and KRW 24.9 billion for Samsung SDI. With an increasing portion of their earnings now tied to U.S. policies, any drastic changes could deal a severe blow to their financial performance.

Battery Companies to Cut Investments Amid Industry Slump

To cope with the prolonged downturn, all three companies plan to reduce capital expenditures this year.LG Energy Solution announced that it will cut its investment budget by 20–30% compared to last year’s KRW 13 trillion, meaning it will likely spend around KRW 10 trillion in 2025. SK On plans to slash its investments from KRW 7.5 trillion to KRW 3.5 trillion—roughly half. While Samsung SDI did not disclose a specific investment figure, it confirmed that spending will decrease compared to last year’s KRW 6.6 trillion.

Gwak Horyung (horr@fntimes.com)

[관련기사]

- LG Energy Solution, Forecasts Q4 loss..."Worst since spin-off”

- 'Semiconductor Variables Pour In'—Samsung Confident in Responding with Global Supply Chain Management Capabilities

- Chairman Chey Tae-won of SK Group gives 'high praise at CES'... Who is he praising?

- 'Full of uncertainty' batteries seek turnaround opportunities in Europe

- "Why SK On Pins Its Hopes on Hyundai and Kia's Performance in the U.S."

가장 핫한 경제 소식! 한국금융신문의 ‘추천뉴스’를 받아보세요~

데일리 금융경제뉴스 Copyright ⓒ 한국금융신문 & FNTIMES.com

저작권법에 의거 상업적 목적의 무단 전재, 복사, 배포 금지

![Samsung Electronics and SK Hynix Engage in High-Stakes AI Chip War [KFT Topic]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=284&h=214&m=5&simg=2026013013432407964141825007d12411124362.jpg&nmt=18)

![Hyundai Mobis Posts Record Results, Pivots to Robotics and Electrification [KFT Topic]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=284&h=214&m=5&simg=2026012911595100522141825007d12411124362.jpg&nmt=18)

![One Year In: CEO Hyun Shin-kyun Transforms LG CNS into KRW 6 Trillion AI Powerhouse [KFT Topic]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=284&h=214&m=5&simg=2026012807381208149141825007d12411124362.jpg&nmt=18)

!['Chung Eui-sun Declares Robot Management Era'... Hyundai Motor Group to Lead Robotics Age with 'Physical AI' [KFT Topic]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=284&h=214&m=5&simg=20260106111449071567492587736121125197123.jpg&nmt=18)

![Lee Jae-yong and Chey Tae-won, Korea's 'Semiconductor Duo,' Head to China... What's the Status of Local Operations? [KFT Topic]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=284&h=214&m=5&simg=2026010608232205705141825007d12411124362.jpg&nmt=18)

!['Beyond Mobile to Robotics': LG Innotek Continues Portfolio Expansion [KFT Topic]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=284&h=214&m=5&simg=2026010508201109906141825007d12411124362.jpg&nmt=18)

![Doosan Enerbility Eyes Return to 'A' Credit Rating After 9 Years on Nuclear Power and Gas Turbine Boom [KFT Topic]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=284&h=214&m=5&simg=2026010208511504157141825007d12411124362.jpg&nmt=18)

!["Samsung Is Back," Chip Chief Declares, Eyeing Record Profit on HBM Recovery [KFT Topic]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=110&h=79&m=5&simg=2026011408580109459141825007d12411124362.jpg&nmt=18)

!['Expansion' S-OIL vs. 'Caution' GS Caltex [KFT Topic]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=110&h=79&m=5&simg=2026012010260905723141825007d12411124362.jpg&nmt=18)

![Koo Kwang-mo's Vision for AI and Robotics Drives LG Group's Transformation [KFT Topic]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=110&h=79&m=5&simg=2026012123034202714141825007d122461258.jpg&nmt=18)

![One Year In: CEO Hyun Shin-kyun Transforms LG CNS into KRW 6 Trillion AI Powerhouse [KFT Topic]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=110&h=79&m=5&simg=2026012807381208149141825007d12411124362.jpg&nmt=18)

![Samsung's 'Last Chance': Lee Jae-yong Pushes HBM4 as Make-or-Break Moment [KFT Topic]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=110&h=79&m=5&simg=2026012623242806011141825007d122461258.jpg&nmt=18)