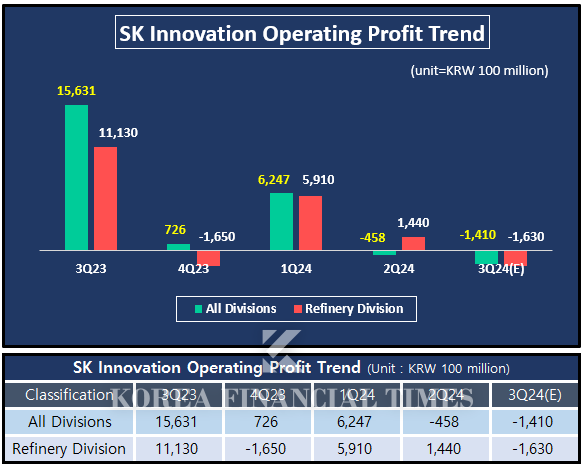

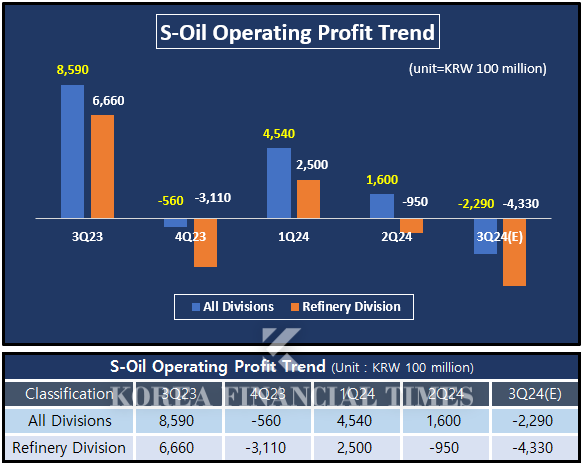

SK Innovation's operating profit forecast for the 3rd quarter, compiled by FnGuide on the 11th, is KRW 310 billion. In the case of S-Oil, the operating loss is expected to be around KRW 50 billion.

Choi Go-woon, a researcher at Korea Investment & Securities Co., said in a corporate analysis report by SK Innovation that it will post a loss of KRW 141 billion in the 3rd quarter. Even though battery subsidiary SK On narrowed its loss from KRW 460 billion in the 2nd quarter to late KRW 200 billion range in the 3rd quarter, he estimated that the refinery division would have posted a loss of KRW 160 billion. SK Innovation's refining division posted an operating profit of KRW 144 billion in the 2nd quarter and KRW 1.13 trillion in the 3rd quarter of last year.

이미지 확대보기

이미지 확대보기Jeon Woo-je, a researcher at KB Securities, predicted in a report on S-Oil analysis on the 4th that the company will turn into a deficit to KRW 229 billion in operating losses in the 3rd quarter. In particular, the operating loss of the refinery business is expected to reach KRW 430 billion. The refining division of S-Oil lost KRW 100 billion range in the 2nd quarter, as the price of Dubai crude oil fell from 83.6 dollars per barrel at the end of the 2nd quarter to 75.7 dollars per barrel at the end of the 3rd quarter. Jeon said, "The refinery sector is estimated to lose KRW 266.8 billion more compared to the previous quarter due to exchange rates and oil prices."

이미지 확대보기

이미지 확대보기The industry expects the oil refining industry to bottom out in the 3rd quarter and recover from the 4th quarter. This is because industrial demand is expected to recover as the Chinese government recently hinted at implementing large-scale economic stimulus measures, and international oil prices are also on the rise due to concerns over the Iran-Israel conflict and he impact of Hurricane 'Milton' in the U.S.

However, there is a question mark as to whether the boom of the past, which made hundreds of billions of won to trillions of won every quarter,will come again. “The valuation of the refining industry is becoming more conservative,” Choi said, adding, ”The fact that oil prices are not rising more despite the escalating conflict in the Middle East shows that the market mechanism is not as distorted as it used to be.

[관련기사]

가장 핫한 경제 소식! 한국금융신문의 ‘추천뉴스’를 받아보세요~

데일리 금융경제뉴스 Copyright ⓒ 한국금융신문 & FNTIMES.com

저작권법에 의거 상업적 목적의 무단 전재, 복사, 배포 금지

![테슬라 대항마 ‘우뚝'…몸값 100조 ‘훌쩍' [K-휴머노이드 대전] ① ‘정의선의 베팅’ 보스턴다이나믹스](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=284&h=214&m=5&simg=2026021603064404252dd55077bc221924192196.jpg&nmt=18)

![테슬라 대항마 ‘우뚝'…몸값 100조 ‘훌쩍' [K-휴머노이드 대전] ① ‘정의선의 베팅’ 보스턴다이나믹스](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=110&h=79&m=5&simg=2026021603064404252dd55077bc221924192196.jpg&nmt=18)