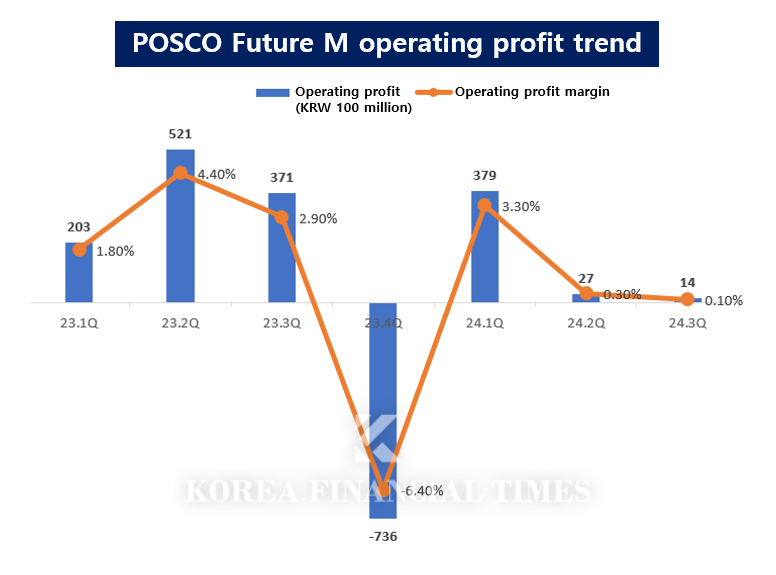

POSCO FutureM is recording operating profit of KRW 42 billion in the first to third quarters of 2024. This is a 61.6% decrease from the first to third quarters of 2023. It is only a quarter of the first to third quarters of 2022 (KRW 162.5 billion), which were on a roll. The profitability of the anode and cathode materials business deteriorated significantly due to the electric vehicle chasm and the plunge in raw materials.

이미지 확대보기

이미지 확대보기As large-scale investments were made while cash flow generation was low, the financial burden also increased. The company's debt ratio soared to ▲60.9% at the end of 2021, ▲75% at the end of 2022, ▲142.6% at the end of 2023, and ▲192.3% at the end of the third quarter of 2024.

Due to poor performance and deteriorating financial stability, pressure to lower the credit rating (AA-, stable) is also increasing. Korea Ratings presents 'Net debt/EBITDA (operating profit before interest, taxes, depreciation, and amortization) exceeding 4 times' as a factor for reviewing POSCO Future M's credit rating. POSCO Future M had already exceeded the standard at the end of last year. In addition, it has also surpassed 'debt ratio of 150% or more', a factor for downward consideration presented by Korea Ratings.

Expectations for an improved electric vehicle market outlook next year are also low, but POSCO Future M is still supported by the POSCO Group.

Last month, POSCO Future M announced that it will issue a new type of bond-type capital security (perpetual bond) worth KRW 600 billion on the 18th. Of this, KRW 500 billion will be acquired by the holding company POSCO Holdings. Perpetual bonds are recognized as capital in accounting, which has the effect of improving the financial structure. Accordingly, POSCO Future M’s debt ratio is also expected to drop to around 150%. The group's emergency transfusion of funds will put out the fire.

It has decided to adjust its own speed by reducing or postponing planned investments. The company has decided to reduce its target production of negaitive electrode materials, which are currently in deficit, to 113,000 tons in 2026, half the previous level. It has also reduced its target production of positive electrode materials for the same period by about 13% to 395,000 tons.

Gwak Horyung (horr@fntimes.com)

[관련기사]

- POSCO-Hyundai Steel, when will the industry rebound? China's stimulus package is the only answer

- [ECM] SK On ∙ Lotte Chemical, Unstable PRS Contract… Concerns Over Increased Losses

- 'Full of uncertainty' batteries seek turnaround opportunities in Europe

- LG Energy Solution 'surpassed expectations', proved competitive, but is there a risk?

가장 핫한 경제 소식! 한국금융신문의 ‘추천뉴스’를 받아보세요~

데일리 금융경제뉴스 Copyright ⓒ 한국금융신문 & FNTIMES.com

저작권법에 의거 상업적 목적의 무단 전재, 복사, 배포 금지

!['From Heavy Industry to Humanoids' — Doosan Robotics Charts a New Future in Physical AI [K-Humanoid Wars, Part 3]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=284&h=214&m=5&simg=2026030310061306979141825007d12411124362.jpg&nmt=18)

!['Samsung's Bet on the Future' — Rainbow Robotics, Korea's Humanoid Pioneer [K-Humanoid Wars, Part 2]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=284&h=214&m=5&simg=2026022413501808272141825007d12411124362.jpg&nmt=18)

![Tesla's Humanoid Rival Has Arrived — Boston Dynamics Eyes $70 Billion Valuation [K-Humanoid Wars, Part 1]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=284&h=214&m=5&simg=2026022010243207659141825007d12411124362.jpg&nmt=18)

![Samsung's 'Last Chance': Lee Jae-yong Pushes HBM4 as Make-or-Break Moment [KFT Topic]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=284&h=214&m=5&simg=2026012623242806011141825007d122461258.jpg&nmt=18)

![Tesla's Humanoid Rival Has Arrived — Boston Dynamics Eyes $70 Billion Valuation [K-Humanoid Wars, Part 1]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=110&h=79&m=5&simg=2026022010243207659141825007d12411124362.jpg&nmt=18)

!['Samsung's Bet on the Future' — Rainbow Robotics, Korea's Humanoid Pioneer [K-Humanoid Wars, Part 2]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=110&h=79&m=5&simg=2026022413501808272141825007d12411124362.jpg&nmt=18)

!['From Heavy Industry to Humanoids' — Doosan Robotics Charts a New Future in Physical AI [K-Humanoid Wars, Part 3]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=110&h=79&m=5&simg=2026030310061306979141825007d12411124362.jpg&nmt=18)