이미지 확대보기

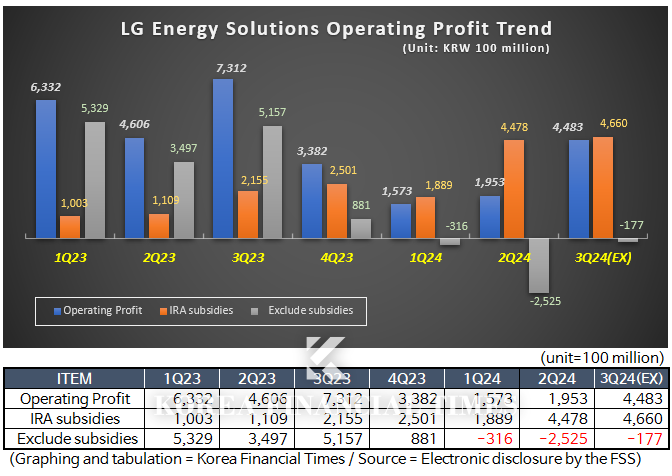

이미지 확대보기LG Energy Solution announced on the 8th that its sales for the 3rd quarter of 2024 were preliminarily calculated at KRW 6.88 trillion and operating profit at KRW 448.3 billion. Compared to the 3rd quarter of 2023, sales were down 16.3% and operating profit was down 38.7%.

이미지 확대보기

이미지 확대보기There was also some positive news. The company announced on the 8th that it had signed a battery supply agreement with a Mercedes-Benz affiliate, focusing on North America. According to industry sources, it is a large-scale contract to supply 50.5 GWh of its next-generation cylindrical battery, '46Pi', for 10 years. LG Energy Solution said, “We cannot confirm any further details due to confidentiality agreements with our customers.”

Mercedes-Benz is a representative company that has preferred Chinese batteries such as CATL. In Korea, the company has been embroiled in controversy for installing cheaper Parasys batteries in its cars after a fire in a parking lot in Incheon.

In the first half of the year, LG Energy Solution won a trillion-scale ESS project in the U.S. ESS market. The U.S. ESS market is already dominated by Chinese companies with competitive prices. It is significant that LG Energy Solution is seeing a counterproductive effect as developed countries such as the U.S. and Europe are building tariff barriers against Chinese products.

이미지 확대보기

이미지 확대보기Of course, there are also worries. The company's 3rd-quarter results reflected KRW 466 billion in subsidies under the Advanced Manufacturing Production Credit (AMPC) of the U.S. IRA (Inflation Reduction Act). Excluding this, the profit from actual operating activities was a negative KRW 17.7 billion. While this is down from the 2nd quarter of this year (a loss of KRW 252.5 billion), it is the third consecutive quarter of substantial losses.

LG Energy Solution President Kim Dong-myung indirectly expressed this concern when he declared at the vision declaration ceremony the previous day that the company would be recognized for its corporate value by creating a stable EBITDA profitability of mid-10% excluding IRA within five years. Mr. Kim said he aims to expand the company's portfolio, which is skewed toward lithium-ion batteries for electric vehicles, to include dry process LFP, battery solutions, and ESS.

Gwak Horyung (horr@fntimes.com)

가장 핫한 경제 소식! 한국금융신문의 ‘추천뉴스’를 받아보세요~

데일리 금융경제뉴스 Copyright ⓒ 한국금융신문 & FNTIMES.com

저작권법에 의거 상업적 목적의 무단 전재, 복사, 배포 금지

![[DQN] ‘김동선 체제 4년’ 한화갤러리아, 사업확장 했지만 돈은 못 벌었다 [Z스코어 기업가치 바로보기]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=284&h=214&m=5&simg=2026030120193900218dd55077bc212411124362.jpg&nmt=18)

![박인원의 ‘휴머노이드 선언’...두산 ‘3차 대변신’ 이끌까 [K-휴머노이드 대전] ③ ‘오너 4세’ 주도 두산로보틱스](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=284&h=214&m=5&simg=2026030120284507035dd55077bc212411124362.jpg&nmt=18)

![이재용 회장 ‘삼성의 미래ʼ PICK “올해 일 낸다” [K-휴머노이드 대전] ② 휴머노이드 원조 레인보우로보틱스](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=284&h=214&m=5&simg=2026022214532407407dd55077bc221924192196.jpg&nmt=18)

![SK㈜, 자회사 무배당에도 '고배당' 지키는 속사정 [지주사 벚꽃배당]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=110&h=79&m=5&simg=20260306183031066137de3572ddd12517950139.jpg&nmt=18)