이미지 확대보기

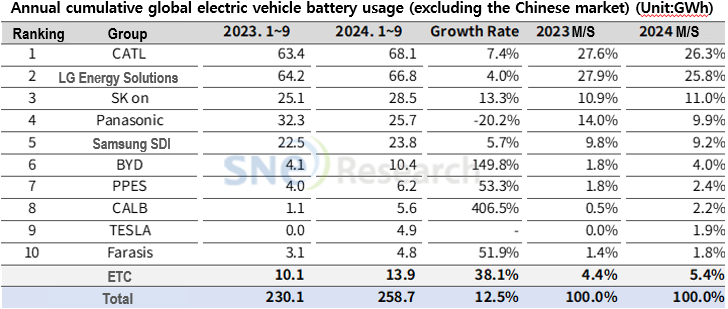

이미지 확대보기Recently, domestic battery companies are struggling with the Chinese battery offensive. According to SNE Research, China's CATL (36.7% market share) and BYD (16.4%) took first place in the global electric vehicle battery market in the first to third quarters of this year. LG Energy Solution, which ranked first in the 2022 survey, fell to third place with a market share of 12.1%. China's CALB (4.9%) took fourth place, ahead of SK On (4.8%, 5th place) and Samsung SDI (4.0%, 7th place).

You might ask whether Chinese battery makers have grown on the back of domestic demand, but that's only half the story. In the same period, CATL (26.3%) topped the EV battery market share excluding China. BYD came in sixth place behind Samsung SDI (9.2%) with a 4.0 per cent market share, up 2.2 percentage points from 1.8% last year.

The global growth of Chinese batteries has been achieved in a situation where direct entry into the U.S. is virtually blocked. SNE Research predicted that “CATL supplies batteries to many finished automobiles, including Tesla, BMW, Mercedes, Volkswagen, and Hyundai Motor,” and that “in the future, due to oversupply in the Chinese domestic market, it will rapidly expand its global market share through exports to Brazil, Thailand, Israel, and Australia.”

이미지 확대보기

이미지 확대보기The good news for domestic companies is that Europe is also putting the brakes on Chinese electric vehicles. The European Union (EU) executive committee announced late last month that it would impose tariffs on Chinese electric vehicles from the existing 10% to 18-45% for five years depending on the company.

Add to that the tightening of EU carbon dioxide emissions regulations starting next year. Automakers doing business in Europe will have to increase sales of electric vehicles that do not emit carbon dioxide while driving to respond to the regulations. The industry predicts that European electric vehicle sales will increase by at least 20% to 70% next year. While there are concerns about increased competition in emerging markets, this could mean more opportunities for domestic battery companies in Europe.

이미지 확대보기

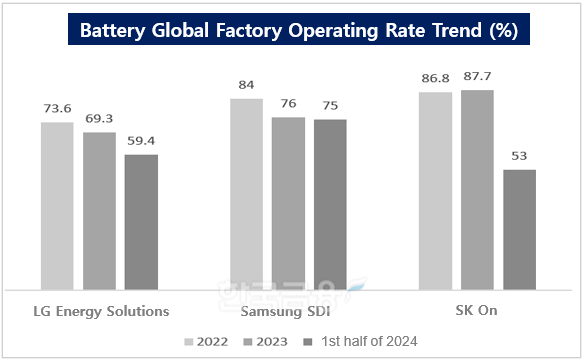

이미지 확대보기Europe is the place that has been hit hard by the electric vehicle chasm. Due to the decrease in demand for electric vehicles, battery companies have seen fixed costs increase and profitability plummet due to the decrease in factory operating rates. The three domestic battery companies do not separately announce the operating rates of their factories by region.

The industry estimates that it will be around 50-60% in the first half of the year.

Domestic companies are also cautiously predicting a recovery in demand in Europe. LG Energy Solution is looking forward to the European launch of its mass-market electric vehicle, the Kia EV3. In a conference call announcing its third-quarter performance, LG Energy Solution CFO Lee Chang-sil said, “It is quite difficult to accurately predict next year,” but added, “There are various factors that will improve demand, such as European carbon dioxide emission regulations and the expansion of mass-market electric vehicles by global automakers.” Son Michael, head of Samsung SDI’s medium- and large-sized battery strategy marketing division, said, “European countries are starting to expand their policy support again,” adding, ’In particular, Germany, which has the largest market, is again pushing for electric vehicle tax incentives for corporate vehicles.’

Gwak Horyung (horr@fntimes.com)

[관련기사]

- LG Energy Solution 'surpassed expectations', proved competitive, but is there a risk?

- Lee Dong-chae, founder of EcoPro, returns to management after a year... Will he repeat the 'success myth'?

- SK Hynix surpasses Samsung Electronics... AI-oriented semiconductors accelerate pace of growth

- "Crisis Surrounding Samsung... Will Lee Jae-yong Return as a Registered Director in His Second Year as Chairman?"

- SK Innovation KRW -160 billion, S-Oil KRW -430 billion... Earnings shock predicted for refinery business

가장 핫한 경제 소식! 한국금융신문의 ‘추천뉴스’를 받아보세요~

데일리 금융경제뉴스 Copyright ⓒ 한국금융신문 & FNTIMES.com

저작권법에 의거 상업적 목적의 무단 전재, 복사, 배포 금지

![‘리니지 제국'의 부진? 엔씨의 저력을 보여주마 [Z-스코어 기업가치 바로보기]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=284&h=214&m=5&simg=2026020123095403419dd55077bc211821821443.jpg&nmt=18)

![‘리니지 제국'의 부진? 엔씨의 저력을 보여주마 [Z-스코어 기업가치 바로보기]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=110&h=79&m=5&simg=2026020123095403419dd55077bc211821821443.jpg&nmt=18)