이미지 확대보기

이미지 확대보기However, the aramid effect is expected to begin in earnest after the fourth quarter. This is because there is no problem with the operation of the new plant in the third quarter, but regular maintenance of existing production facilities is underway.

이미지 확대보기

이미지 확대보기Aramid is a new material that is five times stronger than steel and can withstand high temperatures of 500 degrees Celsius. It is attracting attention as an alternative material in high-tech industries such as electric vehicles, optical cables, and aerospace. Aramid pulp is a product made by cutting aramid yarns into shavings, which are used to reinforce automobile parts.

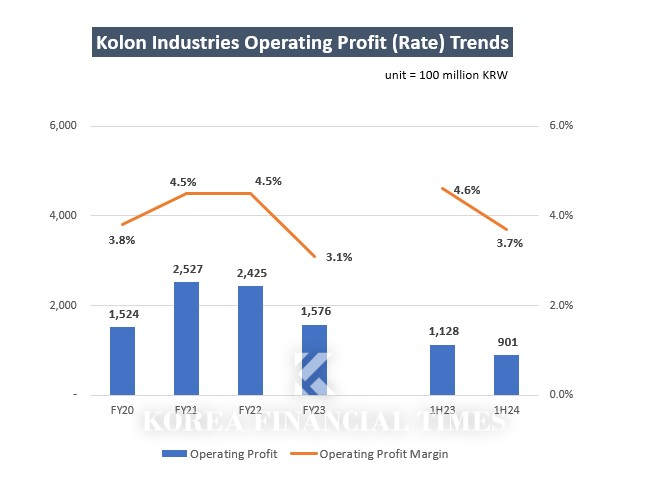

Kolon Industries focuses on tire cord, petroleum resin, and fashion. Last year, sales and operating profit fell 6 percent and 35 percent, respectively, from the previous year due to the sluggish industry. Its operating profit in the first half of this year was only KRW 90 billion, down 20 percent from last year. Aramid's contribution to the company's earnings is urgently needed to turn things around.

이미지 확대보기

이미지 확대보기The restructuring of underperforming businesses is also expected. The company began a full-scale restructuring of its unprofitable PET film business earlier this month. Kolon Industries plans to organize its business by establishing a joint venture with SK Microworks, which was acquired from SKC by private equity fund Hahn & Company. Kolon Industries will hold an 18 percent stake in the joint venture in exchange for an in-kind contribution of its Gimcheon PET film plant.

The film and electronic materials division, which includes Kolon Industries' film division, has posted an operating loss of KRW 15 billion in the first half of this year, following losses of about KRW 157 billion in 2022 and 2023. As Kolon Industries has a small stake in the joint venture, its results will not be reflected in the future.

Gwak Horyung (horr@fntimes.com)

가장 핫한 경제 소식! 한국금융신문의 ‘추천뉴스’를 받아보세요~

데일리 금융경제뉴스 Copyright ⓒ 한국금융신문 & FNTIMES.com

저작권법에 의거 상업적 목적의 무단 전재, 복사, 배포 금지

![‘24년 회계 한우물' 정세의, KCC 릴레이 수술 ‘착착' [나는 CFO다]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=284&h=214&m=5&simg=2025072722494905104dd55077bc25812315206.jpg&nmt=18)

![삼성물산 주가 급등에 KCC 주주들 애매한 표정 [저PBR 숨은그림찾기]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=284&h=214&m=5&simg=2025072008345405903dd55077bc25812315206.jpg&nmt=18)

![현대차 여성 관리자 5년후엔 2배 ‘쑥’ [여기 어때?]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=284&h=214&m=5&simg=2025071322255509402dd55077bc25812315225.jpg&nmt=18)

![태광산업 자사주 전략, ‘판도라의 상자' 될까 [2025 이사회 톺아보기]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=284&h=214&m=5&simg=2025071322214700495dd55077bc25812315225.jpg&nmt=18)

![‘느리지만 꾸준한 개선’ 코오롱…대표이사·이사회 의장 겸직 ‘고수’ [기업 지배구조 보고서]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=284&h=214&m=5&simg=2025072515503604208dd55077bc212411124362.jpg&nmt=18)

![“풀스택 AI 트로이카”…어차피 우승은 ‘네이버·LG·SKT’? [K-AI 선발전 ①]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=110&h=79&m=5&simg=20250723133953006867fd637f543591615728.jpg&nmt=18)

![“우리도 있다”…AI 다크호스 ‘스타트업’ 누구? [K-AI 선발전 ③]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=110&h=79&m=5&simg=20250725143320001637fd637f543591615728.jpg&nmt=18)

![‘국내 최고 수준 어린이집 보유한’ 판교 그 회사 [여기 어때?]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=110&h=79&m=5&simg=20250722152945093777fd637f543211212237130.jpg&nmt=18)