이미지 확대보기

이미지 확대보기 이미지 확대보기

이미지 확대보기The global smartphone market has been in a prolonged slump for eight years. According to market research firm Counterpoint Research, global smartphone shipments peaked at 1.57 billion units in 2017 and dropped to 1.28 billion units by 2024. With smartphone penetration in major global markets nearing saturation and technology reaching maturity, replacement cycles continue to lengthen.

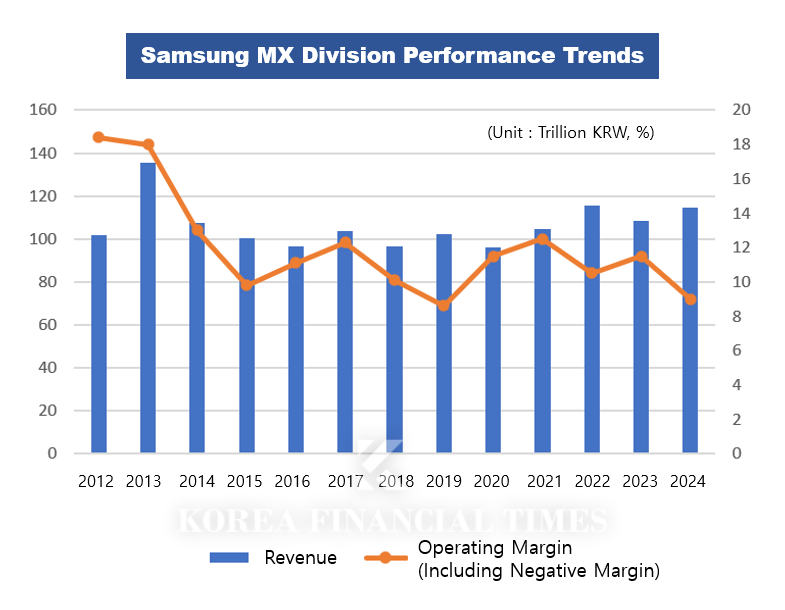

The performance of Samsung Electronics’ MX Division has also plateaued. Last year, sales stood at KRW 114 trillion, nearly unchanged from KRW 107 trillion in 2014—ten years ago.

Operating profit margins (including the Network Business Division) reached 18% during the global success of the Galaxy S2, S3, and S4 from 2011 to 2013, but dropped to 9% last year. It is the first time in five years that the margin has fallen to single digits, since the large-scale restructuring (personnel realignment) in 2019, when it was 8.6%.

이미지 확대보기

이미지 확대보기Roh Tae-moon, who has led the MX Division since 2020, has emphasized “the best of the best, the ultimate premium.” The strategy is to boost profitability by focusing on the premium segment, rather than competing in the mid- to low-end market where Chinese rivals are strong.

On the hardware front, Samsung attempted to expand form factors with foldable phones, launching the Galaxy Fold (unfolds horizontally) in 2019 and the Galaxy Flip (folds vertically) in 2020. However, these have not replaced conventional smartphones. When folded, the devices are thick and less portable, and durability issues have arisen. Samsung Electronics aims for a turnaround with the launch of the Fold and Flip 7 on July 9, which are expected to be the thinnest foldable phones in the company’s history.

Software remains a key challenge. In particular, the level of collaboration with other companies on AI services is emerging as a critical issue. Building in-house AI can help reduce costs, but such a strategy risks limiting functionality compared to external innovations—potentially compromising the user experience.

In addition, Samsung has adopted a hybrid approach, allowing access only to external AI services that the company has specifically approved. This leaves the door open for potential collaboration with “AI giants.”

Even Apple Inc., which prefers a closed proprietary ecosystem from the operating system (OS) level, appears to be feeling the pressure. Recent foreign media reports indicate that Apple is considering integrating OpenAI’s GPT and Anthropic’s Claude models into Siri.

Previously, Apple announced at the Worldwide Developers Conference (WWDC 2025) last month that upgrades to Siri would be postponed until next year.

An industry official commented, “Apple’s delay in unveiling Siri AI appears to be due to the model’s performance not meeting standards. Samsung Electronics will also inevitably have to consider external partnerships.”

Gwak Horyung (horr@fntimes.com)

[관련기사]

- Samsung Electronics Enters Strategy Meetings Without Lee Jae-yong... Will There Be a Semiconductor Solution?

- ‘Galaxy Z Launch in July’ Roh Tae-moon…Unstable ‘Exynos’ Remains a Concern

- Hope for LG Display's Rebound vs. Dilemma for Samsung Electronics

- Samsung Electronics Loses D-RAM Top Spot After 33 Years... Will It Struggle All Year?

- "Samsung Electronics Bets Big on HBM: Completed Sample Supply of Improved HBM3E, to Be Reflected in Q2 Earnings"

가장 핫한 경제 소식! 한국금융신문의 ‘추천뉴스’를 받아보세요~

데일리 금융경제뉴스 Copyright ⓒ 한국금융신문 & FNTIMES.com

저작권법에 의거 상업적 목적의 무단 전재, 복사, 배포 금지