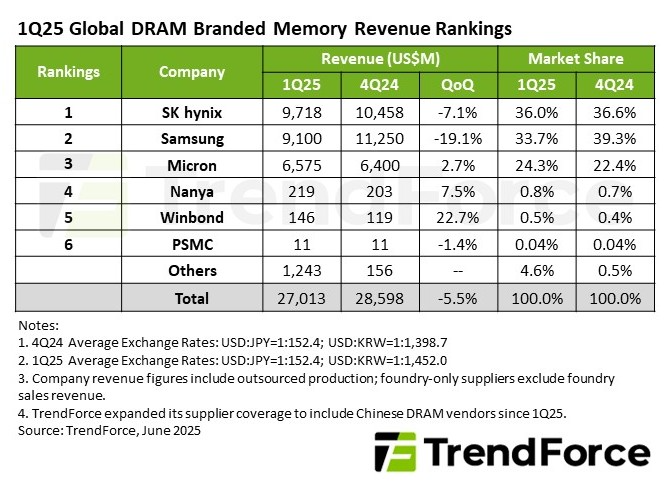

According to market research firm TrendForce, SK hynix recorded a 36% share of the global DRAM market (based on revenue) in the first quarter of this year, surpassing Samsung Electronics, which posted a 33.7% share.

SK hynix’s DRAM sales in Q1 this year amounted to USD 9.718 billion, a 7.1% decrease from the previous quarter. However, Samsung Electronics saw an even larger decline, with sales dropping 19.1% to USD 9.1 billion during the same period.

The difference in performance between the two companies was driven by high bandwidth memory (HBM), a semiconductor for artificial intelligence (AI). TrendForce analyzed, “SK hynix managed to defend its average selling price (ASP) thanks to increased shipments of 5th-generation HBM3e.”

IIn contrast, Samsung Electronics saw a significant decline in shipments of its HBM3e products following a redesign. It is reported that Samsung Electronics undertook a redesign of its HBM3E 12-layer product in March to pass quality verification (qualification test) for supply to NVIDIA, which has been delayed for over a year.

There are projections that SK hynix will maintain its No. 1 position in the DRAM market for the entire year. Since SK hynix’s HBM, where the company dominates, is supplied to customers under annual contracts, it is largely unaffected by external variables such as market conditions. Even if Samsung Electronics ramps up HBM3E supply in the second half of the year, SK hynix is expected to post stable results based on existing contracts.

To turn the tables, Samsung Electronics must prepare for the upcoming competition in 6th-generation HBM4, which will enter full-scale mass production next year. According to industry sources, Samsung Electronics is considering expanding its 6th-generation (1c) DRAM production capacity at facilities such as the Pyeongtaek Plant 4 (P4). The company plans to apply this to HBM4. SK hynix is reportedly planning to use its 5th-generation (1b) DRAM for both HBM3e and HBM4. Samsung Electronics’ strategy appears to be to apply more advanced generation microfabrication technology and aim for a swift reversal.

Gwak Horyung (horr@fntimes.com)

[관련기사]

- Previewing the Future of Financial AI : '2025 Korea Financial Future Forum' Concludes Successfully

- "Samsung Electronics Bets Big on HBM: Completed Sample Supply of Improved HBM3E, to Be Reflected in Q2 Earnings"

- SK Group Doubles Cash Generation on Semiconductor Gains... Energy Sector Increases Borrowing

- SK hynix Posts Over KRW 7 Trillion in Q1 Operating Profit… “Strong Demand for HBM to Persist”

- Samsung Electronics 'Trapped in the KRW 50,000 Swamp'... "Vows to Secure Competitiveness in AI and Robotics"

- 'Semiconductor Variables Pour In'—Samsung Confident in Responding with Global Supply Chain Management Capabilities

가장 핫한 경제 소식! 한국금융신문의 ‘추천뉴스’를 받아보세요~

데일리 금융경제뉴스 Copyright ⓒ 한국금융신문 & FNTIMES.com

저작권법에 의거 상업적 목적의 무단 전재, 복사, 배포 금지

!['From Heavy Industry to Humanoids' — Doosan Robotics Charts a New Future in Physical AI [K-Humanoid Wars, Part 3]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=284&h=214&m=5&simg=2026030310061306979141825007d12411124362.jpg&nmt=18)

!['Samsung's Bet on the Future' — Rainbow Robotics, Korea's Humanoid Pioneer [K-Humanoid Wars, Part 2]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=284&h=214&m=5&simg=2026022413501808272141825007d12411124362.jpg&nmt=18)

![Tesla's Humanoid Rival Has Arrived — Boston Dynamics Eyes $70 Billion Valuation [K-Humanoid Wars, Part 1]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=284&h=214&m=5&simg=2026022010243207659141825007d12411124362.jpg&nmt=18)

![Samsung's 'Last Chance': Lee Jae-yong Pushes HBM4 as Make-or-Break Moment [KFT Topic]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=284&h=214&m=5&simg=2026012623242806011141825007d122461258.jpg&nmt=18)

![Tesla's Humanoid Rival Has Arrived — Boston Dynamics Eyes $70 Billion Valuation [K-Humanoid Wars, Part 1]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=110&h=79&m=5&simg=2026022010243207659141825007d12411124362.jpg&nmt=18)

!['Samsung's Bet on the Future' — Rainbow Robotics, Korea's Humanoid Pioneer [K-Humanoid Wars, Part 2]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=110&h=79&m=5&simg=2026022413501808272141825007d12411124362.jpg&nmt=18)

!['From Heavy Industry to Humanoids' — Doosan Robotics Charts a New Future in Physical AI [K-Humanoid Wars, Part 3]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=110&h=79&m=5&simg=2026030310061306979141825007d12411124362.jpg&nmt=18)