이미지 확대보기

이미지 확대보기Additionally, Samsung Electronics emphasized that mass production plans for its latest products, including HBM4 (6th generation), are proceeding smoothly in line with customer production schedules.

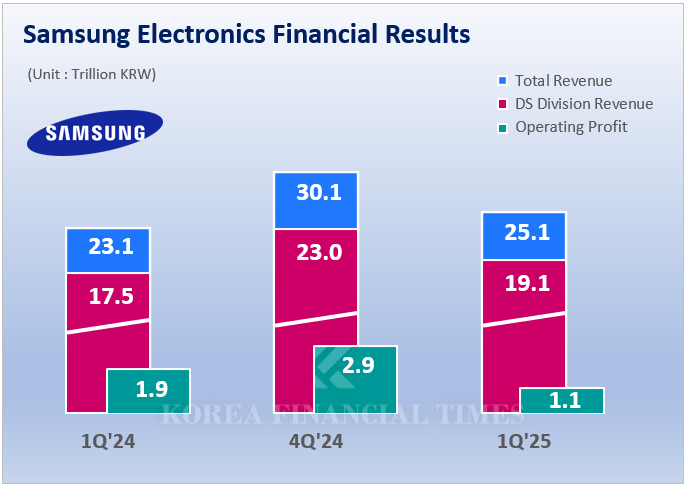

However, the semiconductor division, including HBM, saw its performance decline despite expanded sales of server DRAM, primarily due to decreased HBM sales. The Device Solutions (DS) division, responsible for the semiconductor business, recorded first-quarter sales of KRW 25.1 trillion and operating profit of KRW 1.1 trillion. While sales rose by about KRW 2 trillion year-on-year, operating profit fell by approximately KRW 800 billion.

The DX division, buoyed by strong sales of the Galaxy S25, offset the DS division’s sluggish performance. The DX division posted first-quarter sales of KRW 51.7 trillion and operating profit of KRW 4.7 trillion.

Nevertheless, profitability in the second quarter is uncertain as the Galaxy S25 effect wanes and the smartphone market enters a seasonal downturn. This makes a rebound in the DS division, the other pillar of Samsung Electronics’ business, all the more urgent.

The key to the DS division’s recovery is undoubtedly securing competitiveness in HBM. In the first quarter, Samsung Electronics focused on redesigning the 12-layer HBM3E in response to customer demands. Kim Jae-joon, Executive Vice President and Head of the Memory Business at Samsung Electronics, explained during the earnings conference call, “There was some impact from delayed supply due to the HBM3E redesign and other factors”.

이미지 확대보기

이미지 확대보기Samsung Electronics anticipates that supply of the redesigned products to customers will gradually increase in the second quarter. Kim Jae-joon stated, “We have completed the supply of improved HBM3E samples to our major customers, and we expect the number of purchasing firms to increase from the second quarter. HBM sales hit a trough in the first quarter, but as deliveries of enhanced products ramp up in Q2, we expect a stepwise recovery each quarter”.

The company also revealed its mass production plans for the latest HBM4 product line. Samsung Electronics aims to begin mass production of standard HBM4 and HBM4E, as well as custom HBMs tailored to customer needs, in the second half of this year as scheduled.

Kim Jae-joon said, “The sixth-generation HBM4 is on track for mass production in the second half of the year, in line with customers’ project timelines. We are also preparing for mass production of custom HBM products based on HBM4 and HBM4E, collaborating with multiple customers”.

He added, “As sales of this HBM4 product lineup are expected to ramp up in 2026, volatility in memory earnings will be very high going forward.”

Furthermore, Kim Jae-joon stated, “Despite concerns over global trade disputes and economic slowdown, demand for memory in the mobile and PC markets is expected to improve due to the spread of AI servers and on-device AI. We will actively respond to demand for HBM and other high-capacity products, and focus on enhancing competitiveness around high-value-added products”.

Kim JaeHun (rlqm93@fntimes.com)

[관련기사]

- 'Humanoid Pioneer' Oh Jun-ho Tasked with Nurturing Samsung Electronics' Future Robot Business

- Samsung Electronics' New CFO Park Soon-chul...Breaking through uncertainty 'special assignment'

- Lee Jae-yong’s 3 Picks Transforming Samsung Electronics : 'Automotive Electronics, Displays, and Robotics'

- Will Samsung Electronics Unlock Its Treasury After 8 Years? Potential for Mega M&A

- Samsung Electronics 'Trapped in the KRW 50,000 Swamp'... "Vows to Secure Competitiveness in AI and Robotics"

가장 핫한 경제 소식! 한국금융신문의 ‘추천뉴스’를 받아보세요~

데일리 금융경제뉴스 Copyright ⓒ 한국금융신문 & FNTIMES.com

저작권법에 의거 상업적 목적의 무단 전재, 복사, 배포 금지

!['From Heavy Industry to Humanoids' — Doosan Robotics Charts a New Future in Physical AI [K-Humanoid Wars, Part 3]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=284&h=214&m=5&simg=2026030310061306979141825007d12411124362.jpg&nmt=18)

!['Samsung's Bet on the Future' — Rainbow Robotics, Korea's Humanoid Pioneer [K-Humanoid Wars, Part 2]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=284&h=214&m=5&simg=2026022413501808272141825007d12411124362.jpg&nmt=18)

![Tesla's Humanoid Rival Has Arrived — Boston Dynamics Eyes $70 Billion Valuation [K-Humanoid Wars, Part 1]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=284&h=214&m=5&simg=2026022010243207659141825007d12411124362.jpg&nmt=18)

![Samsung's 'Last Chance': Lee Jae-yong Pushes HBM4 as Make-or-Break Moment [KFT Topic]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=284&h=214&m=5&simg=2026012623242806011141825007d122461258.jpg&nmt=18)

![Tesla's Humanoid Rival Has Arrived — Boston Dynamics Eyes $70 Billion Valuation [K-Humanoid Wars, Part 1]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=110&h=79&m=5&simg=2026022010243207659141825007d12411124362.jpg&nmt=18)

!['Samsung's Bet on the Future' — Rainbow Robotics, Korea's Humanoid Pioneer [K-Humanoid Wars, Part 2]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=110&h=79&m=5&simg=2026022413501808272141825007d12411124362.jpg&nmt=18)

!['From Heavy Industry to Humanoids' — Doosan Robotics Charts a New Future in Physical AI [K-Humanoid Wars, Part 3]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=110&h=79&m=5&simg=2026030310061306979141825007d12411124362.jpg&nmt=18)