이미지 확대보기

이미지 확대보기According to financial data provider FnGuide, as of the 23rd, the consensus for LG Electronics’ Q2 results is sales of KRW 21.6688 trillion and operating profit of KRW 927.1 billion (operating margin 4.3%).

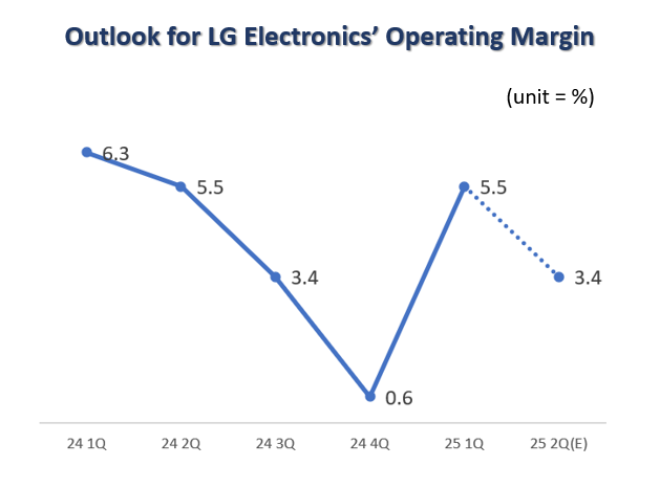

On the 19th, Daishin Securities analyst Park Kang-ho lowered his estimate for LG Electronics’ operating profit from KRW 952 billion to KRW 870 billion, a roughly 9% cut. The sales estimate is similar to consensus. This would result in an operating margin around 4.0%.

Park noted, “Global TV sales are underperforming expectations, and rising global prices and increased tariff impacts are weighing on the home appliance division. While LG Electronics preemptively built up inventory in Q1 to prepare for tariffs, that effect will diminish from Q2 onward.”

이미지 확대보기

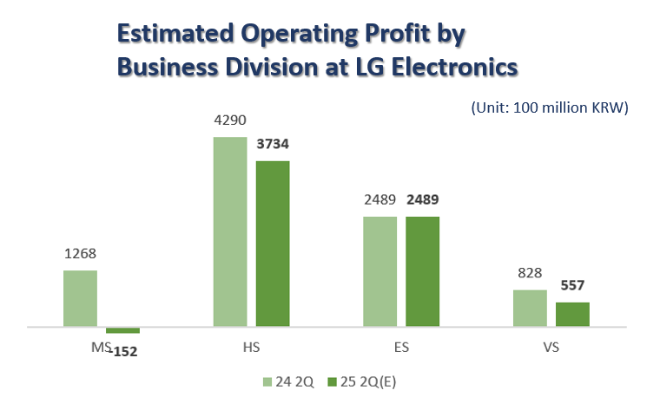

이미지 확대보기In a report released on the 23rd, Mirae Asset Securities analyst Park Joon-seo projected operating profit at KRW 735 billion, more than 20% below consensus, suggesting a possible earnings shock. The operating margin is forecast at 3.5%, about half the level of a year ago.

The MS Division, which handles TVs and monitors, is expected to swing to an operating loss of KRW 15.2 billion. This division recorded operating profit of KRW 127 billion in Q2 last year, but has posted sub-1% margins for three consecutive quarters since then.

The HS (Home Appliance & Air Solution) Division, which has supported earnings so far, is also expected to see operating profit fall 13% year-on-year to KRW 373.4 billion.

LG Electronics is expanding its washing machine plant in Tennessee to respond to tariffs, but there are limits to how quickly export volumes can be shifted.

The ES Division, newly established at the end of last year to expand the HVAC (Heating, Ventilation, and Air Conditioning) business, is expected to post operating profit of KRW 248.9 billion, similar to a year earlier. However, as a B2B-focused business, profit is expected to fall sharply from Q1 (KRW 406.7 billion), when infrastructure project spending peaked.

However, there are also expectations for a recovery in performance in the second half of the year and beyond.

This is because logistics costs, which have been the main drag on earnings since last year, are now clearly trending downward. According to the Korea Customs Logistics Association, the Shanghai Containerized Freight Index (SCFI) stayed between 1,200 and 1,900 points through May this year. Although it rose to 2,200 points this month due to the Israel-Iran conflict, it is still well below the 3,700-point level of late last year.

The effects of these reduced logistics costs are expected to be reflected in the company’s performance starting from the third quarter, with a time lag.

Gwak Horyung (horr@fntimes.com)

[관련기사]

- Hope for LG Display's Rebound vs. Dilemma for Samsung Electronics

- Koo Kwang-mo, Chairman of LG Group: A Keen Eye for Technology Nurtured in Engineering School

- LG Group, 'Electronics' Defensive Power Draws Attention Amid 'Chemical' Crisis

- Cho Joo-wan’s Second Term at LG Electronics: Can It Overcome the Limits as a ‘Home Appliance Powerhouse’ and Achieve Growth?

- Solid Performance in Home Appliances... LG Electronics Reports All-Time High Q1 Revenue, Slight Drop in Profit

가장 핫한 경제 소식! 한국금융신문의 ‘추천뉴스’를 받아보세요~

데일리 금융경제뉴스 Copyright ⓒ 한국금융신문 & FNTIMES.com

저작권법에 의거 상업적 목적의 무단 전재, 복사, 배포 금지

!['From Heavy Industry to Humanoids' — Doosan Robotics Charts a New Future in Physical AI [K-Humanoid Wars, Part 3]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=284&h=214&m=5&simg=2026030310061306979141825007d12411124362.jpg&nmt=18)

!['Samsung's Bet on the Future' — Rainbow Robotics, Korea's Humanoid Pioneer [K-Humanoid Wars, Part 2]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=284&h=214&m=5&simg=2026022413501808272141825007d12411124362.jpg&nmt=18)

![Tesla's Humanoid Rival Has Arrived — Boston Dynamics Eyes $70 Billion Valuation [K-Humanoid Wars, Part 1]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=284&h=214&m=5&simg=2026022010243207659141825007d12411124362.jpg&nmt=18)

![Samsung's 'Last Chance': Lee Jae-yong Pushes HBM4 as Make-or-Break Moment [KFT Topic]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=284&h=214&m=5&simg=2026012623242806011141825007d122461258.jpg&nmt=18)

![Tesla's Humanoid Rival Has Arrived — Boston Dynamics Eyes $70 Billion Valuation [K-Humanoid Wars, Part 1]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=110&h=79&m=5&simg=2026022010243207659141825007d12411124362.jpg&nmt=18)

!['Samsung's Bet on the Future' — Rainbow Robotics, Korea's Humanoid Pioneer [K-Humanoid Wars, Part 2]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=110&h=79&m=5&simg=2026022413501808272141825007d12411124362.jpg&nmt=18)

!['From Heavy Industry to Humanoids' — Doosan Robotics Charts a New Future in Physical AI [K-Humanoid Wars, Part 3]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=110&h=79&m=5&simg=2026030310061306979141825007d12411124362.jpg&nmt=18)