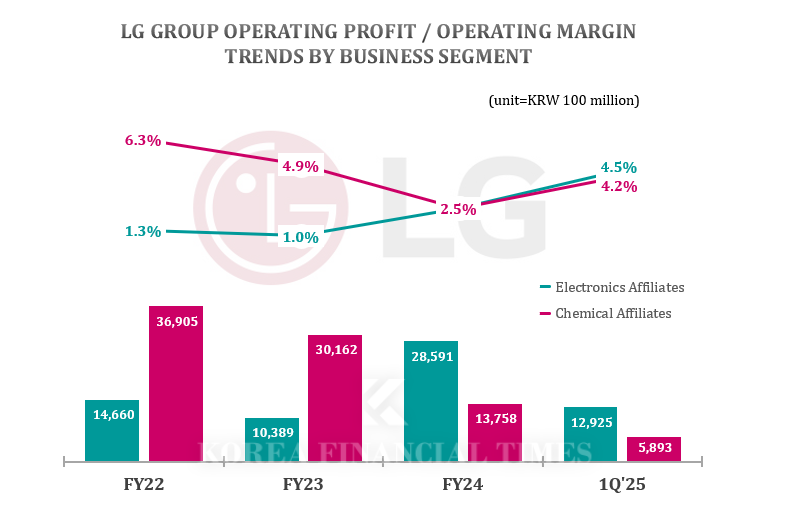

In particular, the profitability defense of the electronics affiliates stands out compared to the struggling chemical sector.

The reason for the rebound in operating margin is the turnaround to profitability by LG Display. LG Display swung from an operating loss of KRW 469.4 billion in Q1 last year to an operating profit of KRW 33.5 billion in Q1 this year. This is the first quarterly profit for the company in three years.

이미지 확대보기

이미지 확대보기Chemical affiliates such as LG Chem, LG Household & Health Care, and LG Energy Solution posted a combined revenue of KRW 13.8689 trillion and operating profit of KRW 589.3 billion. The operating margin was 4.2%, lagging 0.3 percentage points behind the electronics affiliates. It is positive that they succeeded in rebounding their profitability. The annual operating margins for chemical affiliates were 6.3% in 2022, 4.9% in 2023, and 2.5% in 2024, showing a downward trend.

This was largely due to the operating profit of LG Energy Solution, which increased 138% from KRW 157.3 billion in Q1 last year to KRW 374.7 billion in Q1 this year.

However, the operating profit of LG Energy Solution includes a KRW 457.7 billion tax credit from the U.S. IRA. Excluding the subsidy, the company actually posted an operating loss of KRW 83 billion, which remains a concern.

LG Chem also saw its core petrochemical division's operating loss widen to KRW 56 billion, about double from a year earlier. Despite cost-cutting efforts, factors such as rising electricity rates contributed to the deterioration in profitability.

Meanwhile, LG Group has decided not to hold its annual strategy briefing, usually chaired by Chairman Koo Kwang-mo in the first half of the year to review future strategies. It is assessed that this decision reflects Chairman Koo's judgment that, amid growing global uncertainties, it is more necessary to swiftly execute existing strategies rather than discuss new ones.

LG Chem also saw its core petrochemical division's operating loss widen to KRW 56 billion, about double from a year earlier. Although cost-saving efforts were made, the company explained that factors such as rising electricity prices contributed to the deterioration in profitability.

Meanwhile, LG Group has decided not to hold its annual strategy briefing, usually chaired by Chairman Koo Kwang-mo in the first half of the year to review future strategies. It is assessed that this decision reflects Chairman Koo's judgment that, amid growing global uncertainties, it is more necessary to swiftly execute existing strategies rather than discuss new ones.

Gwak Horyung (horr@fntimes.com)

[관련기사]

- Cho Joo-wan’s Second Term at LG Electronics: Can It Overcome the Limits as a ‘Home Appliance Powerhouse’ and Achieve Growth?

- Solid Performance in Home Appliances... LG Electronics Reports All-Time High Q1 Revenue, Slight Drop in Profit

- LG Energy Solution, Samsung SDI and SK-on Aim for 'K-Battery Comeback'

- Koo Kwang-mo Invests in Canadian Lithium Extraction Company, Accelerating 'Cleantech' Growth

- Vice Chairman Shin Hak-cheol of LG Chem to Extend Term by Two More Years... Expectations for a CEO Approaching His 70s

가장 핫한 경제 소식! 한국금융신문의 ‘추천뉴스’를 받아보세요~

데일리 금융경제뉴스 Copyright ⓒ 한국금융신문 & FNTIMES.com

저작권법에 의거 상업적 목적의 무단 전재, 복사, 배포 금지

!['From Heavy Industry to Humanoids' — Doosan Robotics Charts a New Future in Physical AI [K-Humanoid Wars, Part 3]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=284&h=214&m=5&simg=2026030310061306979141825007d12411124362.jpg&nmt=18)

!['Samsung's Bet on the Future' — Rainbow Robotics, Korea's Humanoid Pioneer [K-Humanoid Wars, Part 2]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=284&h=214&m=5&simg=2026022413501808272141825007d12411124362.jpg&nmt=18)

![Tesla's Humanoid Rival Has Arrived — Boston Dynamics Eyes $70 Billion Valuation [K-Humanoid Wars, Part 1]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=284&h=214&m=5&simg=2026022010243207659141825007d12411124362.jpg&nmt=18)

![Samsung's 'Last Chance': Lee Jae-yong Pushes HBM4 as Make-or-Break Moment [KFT Topic]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=284&h=214&m=5&simg=2026012623242806011141825007d122461258.jpg&nmt=18)

![Tesla's Humanoid Rival Has Arrived — Boston Dynamics Eyes $70 Billion Valuation [K-Humanoid Wars, Part 1]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=110&h=79&m=5&simg=2026022010243207659141825007d12411124362.jpg&nmt=18)

!['Samsung's Bet on the Future' — Rainbow Robotics, Korea's Humanoid Pioneer [K-Humanoid Wars, Part 2]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=110&h=79&m=5&simg=2026022413501808272141825007d12411124362.jpg&nmt=18)