이미지 확대보기

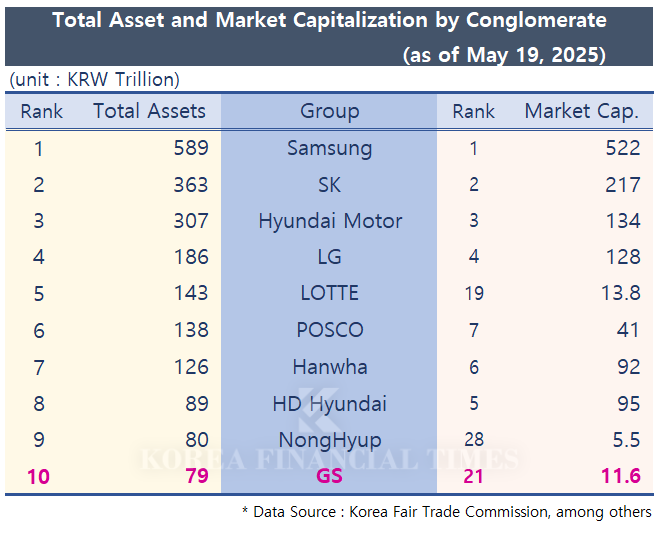

이미지 확대보기According to the '2025 Designation Status of Publicly Announced Business Groups' released by the Korea Fair Trade Commission (KFTC) on May 1, GS is now ranked 10th among business groups based on total fair assets. This year, GS ceded its 9th place position to NongHyup. In the previous 2024 survey, GS had already lost ground to HD Hyundai, marking a two-year consecutive decline in rankings.

As of the end of last year, GS’s total fair assets stood at KRW 79.317 trillion, a 1.9% decrease from the previous year. Among the top 10 groups, GS was the only one to see a decline in total assets. The KFTC explained, “GS’s ranking fell as the assets of related affiliates decreased due to falling oil prices.”

The recent downward trend at GS can be traced to its business structure. GS is built on three main pillars: energy, construction, and distribution-traditional industries with high fixed costs and strong sensitivity to economic cycles. Compared to other conglomerates that have diversified into ICT and bio sectors, GS is seen as lacking in high-profit new business drivers.

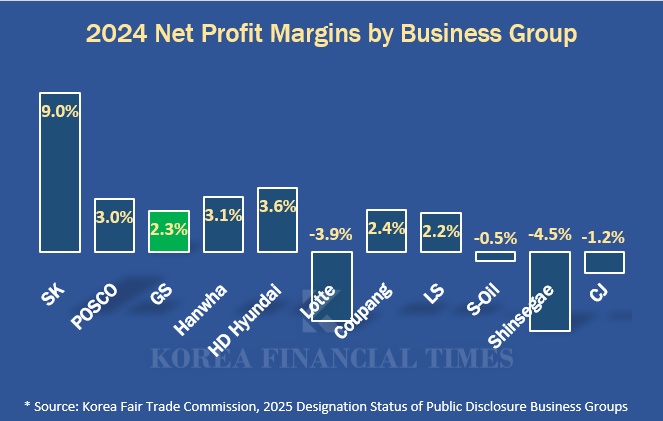

In fact, while GS ranked 6th in sales last year with KRW 81.816 trillion, its net profit was only KRW 1.9 trillion, placing it 12th. The net profit margin was 2.3%. This is lower than Samsung (10.4%), SK (9.0%), Hyundai Motor (8.1%), as well as HD Hyundai (3.6%) and Hanwha (3.1%), both of which have smaller sales volumes.

Nevertheless, some argue that GS performed relatively well given the sluggish business environment. Other energy and distribution groups recorded negative net profit margins: S-OIL at -0.5%, Lotte at -3.9%, and Shinsegae at -4.5%.

In summary, while GS may lack business expansion for future growth, it is interpreted as having stable management capabilities in its main businesses. This characteristic stems from its unique family management system. The holding company GS’s shares are divided among 53 members of the Heo family, the controlling shareholders. One of its key affiliates, GS Engineering & Construction, is directly owned in large part by the family of Chairman Heo Chang-soo, independent of the holding company.

An industry insider commented, “Given GS’s business structure, there is little strategic need to attract external capital, and the group likely views such moves as exposing itself to risk.”

이미지 확대보기

이미지 확대보기Even so, a wind of change is being detected at GS as it enters a fourth-generation leadership transition. In particular, Heo Seo-hong, who was appointed CEO of GS Retail at the end of last year, has charted a course distinct from other fourth-generation owners. After starting his career as an analyst in the Corporate Finance Division at Samjong KPMG, he worked in the new business team at GS Home Shopping, served as head of management support at GS Energy, and led the Future Business Team at GS. He is known to have spearheaded the acquisition of Hugel during his tenure as head of the Future Business Team. This is considered a very rare M&A case that diverges from GS Group’s typically conservative investment stance.

Gwak Horyung (horr@fntimes.com)

[관련기사]

가장 핫한 경제 소식! 한국금융신문의 ‘추천뉴스’를 받아보세요~

데일리 금융경제뉴스 Copyright ⓒ 한국금융신문 & FNTIMES.com

저작권법에 의거 상업적 목적의 무단 전재, 복사, 배포 금지

!['From Heavy Industry to Humanoids' — Doosan Robotics Charts a New Future in Physical AI [K-Humanoid Wars, Part 3]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=284&h=214&m=5&simg=2026030310061306979141825007d12411124362.jpg&nmt=18)

!['Samsung's Bet on the Future' — Rainbow Robotics, Korea's Humanoid Pioneer [K-Humanoid Wars, Part 2]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=284&h=214&m=5&simg=2026022413501808272141825007d12411124362.jpg&nmt=18)

![Tesla's Humanoid Rival Has Arrived — Boston Dynamics Eyes $70 Billion Valuation [K-Humanoid Wars, Part 1]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=284&h=214&m=5&simg=2026022010243207659141825007d12411124362.jpg&nmt=18)

![Samsung's 'Last Chance': Lee Jae-yong Pushes HBM4 as Make-or-Break Moment [KFT Topic]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=284&h=214&m=5&simg=2026012623242806011141825007d122461258.jpg&nmt=18)

![Tesla's Humanoid Rival Has Arrived — Boston Dynamics Eyes $70 Billion Valuation [K-Humanoid Wars, Part 1]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=110&h=79&m=5&simg=2026022010243207659141825007d12411124362.jpg&nmt=18)

!['Samsung's Bet on the Future' — Rainbow Robotics, Korea's Humanoid Pioneer [K-Humanoid Wars, Part 2]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=110&h=79&m=5&simg=2026022413501808272141825007d12411124362.jpg&nmt=18)

!['From Heavy Industry to Humanoids' — Doosan Robotics Charts a New Future in Physical AI [K-Humanoid Wars, Part 3]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=110&h=79&m=5&simg=2026030310061306979141825007d12411124362.jpg&nmt=18)