이미지 확대보기

이미지 확대보기In particular, expectations are high for Samsung Electronics’ success in three key areas that Chairman Lee Jae-yong has identified: automotive electronics (EV components and electronic devices), displays, and robotics. The company is also restructuring its organization to support subsidiaries involved in these sectors, prioritizing its future business ventures.

Harman: From Struggles to a New Cash Cow

According to Samsung Electronics' business report, its automotive electronics subsidiary Harman recorded an annual revenue of KRW 14.2749 trillion and an operating profit of KRW 1.3076 trillion last year. This marks the highest performance since Samsung Electronics acquired the company in 2017. The achievement is particularly significant given the struggles faced by Samsung’s core businesses, such as semiconductors and home appliances.Harman, the global leader in automotive audio and digital cockpits (automated digital driving spaces), was acquired by Samsung Electronics in 2017 for approximately KRW 9.2 trillion. At the time, it was the largest overseas M&A project by a Korean company, garnering widespread attention.

However, the acquisition initially faced challenges. In its first year under Samsung, Harman’s operating profit was only KRW 57.4 billion in 2017, increasing to KRW 161.7 billion in 2018 and KRW 3.22 billion in 2019. These figures still fell short of its pre-acquisition profit of KRW 680.9 trillion in 2016. The situation worsened in 2020 when the global automotive industry was severely impacted by COVID-19, causing Harman’s profit to plummet to KRW 50 billion.

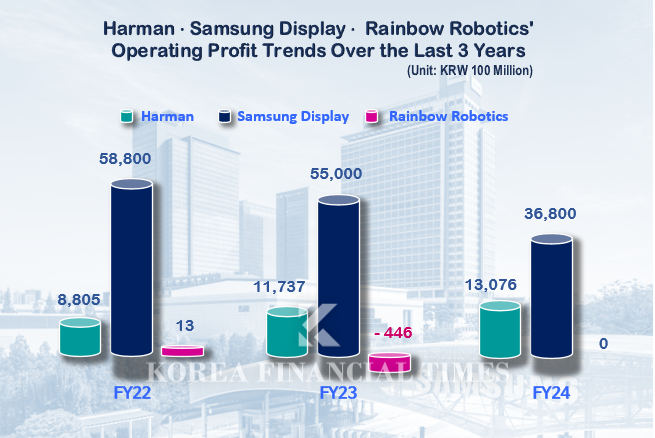

Things took a turn in 2021 with the growth of the electric vehicle market and expansion into vehicle software businesses, such as Head-Up Displays (HUD). Harman’s operating profit surged to KRW 599.1 billion in 2021, surpassing KRW 1 trillion for the first time in 2023 at KRW 1.1737 trillion. For two consecutive years, Harman has maintained over KRW 1 trillion in operating profit, solidifying itself as Samsung’s new cash cow.

이미지 확대보기

이미지 확대보기This year, Harman faces a new challenge: fending off the rapidly growing Chinese automotive electronics companies. Despite achieving record earnings, its global market share in digital cockpits has been declining for four consecutive years due to the electric vehicle market slowdown and competition from Chinese firms.

To counter this, Harman is focusing on expanding partnerships to regain market share. Chairman Lee Jae-yong has also been actively involved, recently visiting Xiaomi’s EV factory in China and meeting with CEO Lei Jun to discuss potential collaborations.

Samsung Electronics is also bolstering Harman’s competitiveness by restructuring its organization. At the end of last year, it transformed the ‘Automotive Electronics Business Team’ into the ‘Harman Support Team’ under the CEO’s direct supervision. Additionally, Harman appointed Christian Sobottka, a vehicle software expert, as its new president, signaling its ambition to dominate not just EV technology but also future Software-Defined Vehicles (SDVs).

Samsung Display: A KRW 4 Trillion Investment to Maintain OLED Leadership

Samsung Display, another focus of Chairman Lee’s attention, is also expected to make significant moves this year. Lee has been personally involved in the business since his time as an executive director, overseeing the development of QD (Quantum Dot)-OLED technology, which is now used in Samsung’s premium TV lineup.After completing its transition to OLED in 2020, Samsung Display achieved a record revenue of KRW 34.3 trillion, operating profit of KRW 5.88 trillion, and net profit of KRW 6.61 trillion in 2022. However, its performance slightly declined in 2023 and 2024 due to weak global IT device demand.

This year, Samsung Display is focusing on maintaining its technological edge in the mid-to-small-sized OLED market while recovering profitability. To this end, the company recently announced a KRW 4 trillion investment to enhance its competitiveness in next-generation 8.6-generation OLED and QD-OLED technologies.

A key focus is securing leadership in 8.6-generation OLED technology, which is optimized for IT devices. Samsung Display supplies OLED panels not only for Samsung’s tablets, laptops, and smartphones but also for major clients such as Apple, Razer, and Intel. With the OLED transition in tablets and laptops accelerating this year, securing 8.6-generation OLED leadership is expected to be a turning point for profitability.

To strengthen its competitiveness in mid-to-small-sized OLEDs, Samsung Display recently appointed Lee Chung as its new CEO. Lee, who previously led the Small-Sized Business Division and IT Business Team, spearheaded the investment in 8.6-generation OLED production lines in 2023.

“This year marks a major turning point for business expansion, requiring us to perfect foldable technology, secure 8.6-generation IT OLED mass-production capabilities, and expand our IT and automotive display business,” Lee said. “We will establish barriers to entry that competitors cannot easily overcome through differentiated performance and manufacturing competitiveness.”

Robotics: Samsung’s Next Big Bet with Rainbow Robotics

While automotive electronics and Samsung Display have been key focuses for Chairman Lee even before his official appointment, robotics is a new frontier he has been pursuing since becoming chairman in 2022. At the time of his appointment, Lee identified AI, biotechnology, telecommunications, and robotics as the core future industries for Samsung Electronics.Samsung’s ultimate goal in robotics is the development of humanoid robots. Unlike LG Electronics and Hyundai Motor Group, which focus on auxiliary robots, Samsung envisions a robotics ecosystem where humanoids integrate seamlessly into everyday life, similar to home appliances.

이미지 확대보기

이미지 확대보기A key player in this vision is Rainbow Robotics, founded by KAIST professor Oh Jun-ho, who developed the world’s first bipedal humanoid robot, HUBO, in 2004. In January 2023, Samsung Electronics invested KRW 59 billion to acquire a 10.22% stake in Rainbow Robotics through a rights issue. In March of the same year, Samsung Electronics spent KRW 27.8 billion to expand its stake to 14.7% through an over-the-counter purchase and signed a call option agreement. On December 31 of last year, it exercised the call option, increasing its stake to 35.0%, becoming the largest shareholder, and effectively incorporating Rainbow Robotics as a subsidiary.

To maximize synergies, Samsung Electronics established the Future Robotics Initiative under the CEO’s direct supervision, appointing Oh Jun-ho, who stepped down as Rainbow Robotics’ CEO, as its head.

The humanoid robot market is heating up, with global giants such as NVIDIA and Tesla unveiling their models. Samsung plans to integrate its AI and software technologies with Rainbow Robotics’ expertise to accelerate the development of intelligent humanoid robots.

The two companies recently launched their first joint commercial project: security robots. These quadruped robots are seen as a solution to future labor shortages caused by declining birth rates. By developing this new business line before full humanoid commercialization, Samsung aims to gradually build its robotics capabilities.

Rainbow Robotics has designated security quadruped robots as a key research project, focusing on enhancing their performance. Samsung Electronics is equipping these robots with PTZ (pan-tilt-zoom) cameras to enable 24/7 surveillance and security operations.

A Samsung Electronics official stated, “At the shareholder meeting on March 19, we introduced the quadruped security robot ‘RBQ-10’ and shared our robotics strategy. The RBQ-10 is currently under development and is set to launch later this year.”

Kim JaeHun (rlqm93@fntimes.com)

[관련기사]

- Will Samsung Electronics Unlock Its Treasury After 8 Years? Potential for Mega M&A

- Samsung Electronics 'Trapped in the KRW 50,000 Swamp'... "Vows to Secure Competitiveness in AI and Robotics"

- Samsung Biologics Replaces CFO and R&D Head... Will It Find New Momentum This Year?

- 'Semiconductor Variables Pour In'—Samsung Confident in Responding with Global Supply Chain Management Capabilities

- 'Humanoid Pioneer' Oh Jun-ho Tasked with Nurturing Samsung Electronics' Future Robot Business

- "Crisis Surrounding Samsung... Will Lee Jae-yong Return as a Registered Director in His Second Year as Chairman?"

가장 핫한 경제 소식! 한국금융신문의 ‘추천뉴스’를 받아보세요~

데일리 금융경제뉴스 Copyright ⓒ 한국금융신문 & FNTIMES.com

저작권법에 의거 상업적 목적의 무단 전재, 복사, 배포 금지

!['From Heavy Industry to Humanoids' — Doosan Robotics Charts a New Future in Physical AI [K-Humanoid Wars, Part 3]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=284&h=214&m=5&simg=2026030310061306979141825007d12411124362.jpg&nmt=18)

!['Samsung's Bet on the Future' — Rainbow Robotics, Korea's Humanoid Pioneer [K-Humanoid Wars, Part 2]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=284&h=214&m=5&simg=2026022413501808272141825007d12411124362.jpg&nmt=18)

![Tesla's Humanoid Rival Has Arrived — Boston Dynamics Eyes $70 Billion Valuation [K-Humanoid Wars, Part 1]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=284&h=214&m=5&simg=2026022010243207659141825007d12411124362.jpg&nmt=18)

![Samsung's 'Last Chance': Lee Jae-yong Pushes HBM4 as Make-or-Break Moment [KFT Topic]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=284&h=214&m=5&simg=2026012623242806011141825007d122461258.jpg&nmt=18)

![Tesla's Humanoid Rival Has Arrived — Boston Dynamics Eyes $70 Billion Valuation [K-Humanoid Wars, Part 1]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=110&h=79&m=5&simg=2026022010243207659141825007d12411124362.jpg&nmt=18)

!['Samsung's Bet on the Future' — Rainbow Robotics, Korea's Humanoid Pioneer [K-Humanoid Wars, Part 2]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=110&h=79&m=5&simg=2026022413501808272141825007d12411124362.jpg&nmt=18)