이미지 확대보기

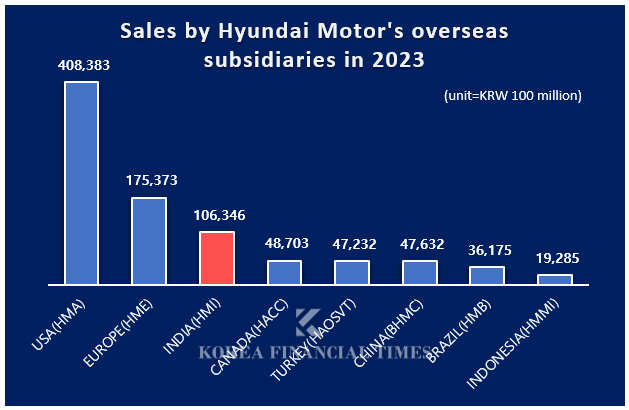

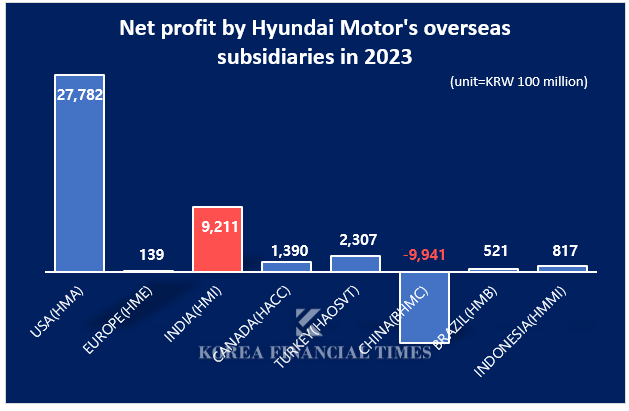

이미지 확대보기India is Hyundai's second largest overseas market after the United States. It has become even more important since China's slowing growth and Russia's withdrawal. Hyundai Motor India (HMI) had sales of KRW 10.63 trillion last year. It is the third largest after the United States (HMA, KRW 40.82 trillion) and Europe (HME, KRW 17.66 trillion). HMI's net profit was KRW 921.1 billion, second only to the United States (KRW 2.78 trillion), and more than the combined net profit of its five overseas subsidiaries, excluding China (KRW 517 billion).

이미지 확대보기

이미지 확대보기 이미지 확대보기

이미지 확대보기Hyundai broke its annual sales record last year, selling 602,111 vehicles. Its market share was 14.6 %, ranking it second in the industry. The top spot went to Maruti Suzuki, an Indo-Japanese joint venture that first listed on the Indian stock market in 2003. Hyundai is the second automaker to list on the Indian stock market.

Hyundai aims to establish an annual production system of 1 million vehicles in India in the second half of next year. In addition to its existing Chennai plant (824,000 units), it will start up its Pune plant, which it acquired from GM last year.

In addition, the company has a blueprint to take the lead in the industry transition by introducing five EV models by 2030, including the strategic EV Creta EV. The strategy is not only to sell electric vehicles but also to lead the construction of an electrification ecosystem by expanding electric vehicle charging stations and collaborating with an Indian battery company (Exide Energy).

Hyundai Motor India's IPO last week was a success and is expected to raise around KRW 4.5 trillion. It is the largest IPO in the history of the Indian stock market. Hyundai Motor conducted the IPO by publicly selling 17.5% of its 100% stake in Indian subsidiaries, not issuing new shares. It prioritized raising cash that it could get its hands on immediately.

Some say that Hyundai Motor's preemptive entry into the Indian stock market is an adventurer. Despite India's growth potential, local political and labor risks are also a reason why global companies are reluctant to enter the country directly. GM's withdrawal from India was ostensibly due to poor profitability, but local policy uncertainty also played a role.

[관련기사]

가장 핫한 경제 소식! 한국금융신문의 ‘추천뉴스’를 받아보세요~

데일리 금융경제뉴스 Copyright ⓒ 한국금융신문 & FNTIMES.com

저작권법에 의거 상업적 목적의 무단 전재, 복사, 배포 금지

![Samsung Electronics and SK Hynix Engage in High-Stakes AI Chip War [KFT Topic]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=284&h=214&m=5&simg=2026013013432407964141825007d12411124362.jpg&nmt=18)

![Hyundai Mobis Posts Record Results, Pivots to Robotics and Electrification [KFT Topic]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=284&h=214&m=5&simg=2026012911595100522141825007d12411124362.jpg&nmt=18)

![One Year In: CEO Hyun Shin-kyun Transforms LG CNS into KRW 6 Trillion AI Powerhouse [KFT Topic]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=284&h=214&m=5&simg=2026012807381208149141825007d12411124362.jpg&nmt=18)

!['Chung Eui-sun Declares Robot Management Era'... Hyundai Motor Group to Lead Robotics Age with 'Physical AI' [KFT Topic]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=284&h=214&m=5&simg=20260106111449071567492587736121125197123.jpg&nmt=18)

![Lee Jae-yong and Chey Tae-won, Korea's 'Semiconductor Duo,' Head to China... What's the Status of Local Operations? [KFT Topic]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=284&h=214&m=5&simg=2026010608232205705141825007d12411124362.jpg&nmt=18)

!['Beyond Mobile to Robotics': LG Innotek Continues Portfolio Expansion [KFT Topic]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=284&h=214&m=5&simg=2026010508201109906141825007d12411124362.jpg&nmt=18)

![Doosan Enerbility Eyes Return to 'A' Credit Rating After 9 Years on Nuclear Power and Gas Turbine Boom [KFT Topic]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=284&h=214&m=5&simg=2026010208511504157141825007d12411124362.jpg&nmt=18)

!["Samsung Is Back," Chip Chief Declares, Eyeing Record Profit on HBM Recovery [KFT Topic]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=110&h=79&m=5&simg=2026011408580109459141825007d12411124362.jpg&nmt=18)

![Koo Kwang-mo's Vision for AI and Robotics Drives LG Group's Transformation [KFT Topic]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=110&h=79&m=5&simg=2026012123034202714141825007d122461258.jpg&nmt=18)

!['Expansion' S-OIL vs. 'Caution' GS Caltex [KFT Topic]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=110&h=79&m=5&simg=2026012010260905723141825007d12411124362.jpg&nmt=18)

![One Year In: CEO Hyun Shin-kyun Transforms LG CNS into KRW 6 Trillion AI Powerhouse [KFT Topic]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=110&h=79&m=5&simg=2026012807381208149141825007d12411124362.jpg&nmt=18)

![Samsung's 'Last Chance': Lee Jae-yong Pushes HBM4 as Make-or-Break Moment [KFT Topic]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=110&h=79&m=5&simg=2026012623242806011141825007d122461258.jpg&nmt=18)