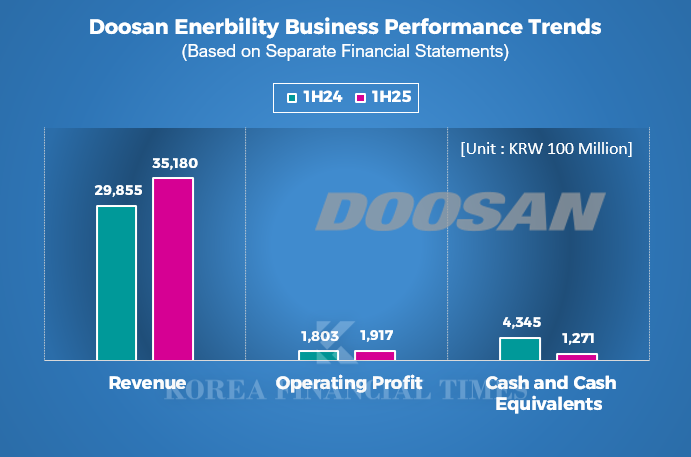

Doosan Enerbility achieved solid performance in the first half of this year. It secured orders totaling KRW 3.7573 trillion, a 98.4% increase from a year ago. On a separate financial statement basis, it recorded revenues of KRW 3.5180 trillion and operating profit of KRW 191.7 billion. These figures represent increases of 17.8% and 6.4% year-on-year, respectively.

Consequently, while the company reduced investments and expanded borrowings, these efforts were insufficient to boost cash reserves. As of the end of June, Doosan Enerbility's cash on hand was KRW 127.1 billion, a 70% decrease compared to the same period last year.

Cash flow from investing activities shrank by more than six times year-on-year to negative KRW 36.1 billion, while cash flow from financing activities surged by 238.8% to KRW 472.0 billion. Net borrowings increased by 41.7% year-on-year to KRW 3.5796 trillion, and the debt-to-equity ratio rose by 3.8 percentage points to 135.5% compared to the previous year.

이미지 확대보기

이미지 확대보기Amidst this situation, uncertainties regarding the profitability of the two-unit Dukovany nuclear power plant project in the Czech Republic, identified as Doosan Enerbility's largest source of revenue in the second half, are also being raised.

Recently, the terms of an agreement signed between Korea Hydro & Nuclear Power (KHNP) and U.S. nuclear firm Westinghouse have been disclosed. This agreement was made as KHNP secured the KRW 26 trillion Czech new nuclear power plant construction project in June.

According to the agreement, KHNP will purchase Westinghouse equipment worth KRW 900 billion and pay KRW 240 billion in royalties for every nuclear reactor exported over the next 50 years.

The agreement is also reported to include clauses requiring technical verification for exporting South Korea's independently developed Small Modular Reactors (SMRs) and prohibiting KHNP from securing new nuclear power plant orders in Europe (excluding the Czech Republic), North America, Japan, the UK, and Ukraine.

Doosan Enerbility is currently in contract negotiations with KHNP regarding the supply of equipment and construction for the Czech nuclear power plant. The company anticipates securing contracts worth KRW 3.8 trillion in the second half of the year through these negotiations. This amount is equivalent to the total value of all projects Doosan Enerbility secured in the first half.

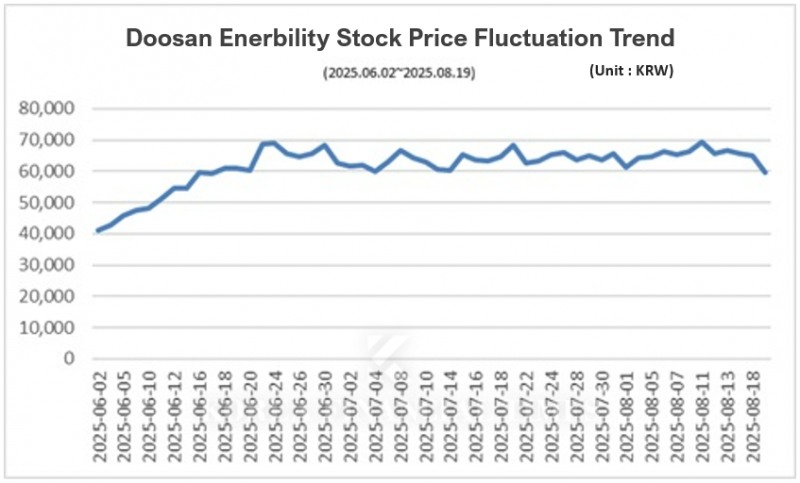

Meanwhile, as these facts became known, Doosan Enerbility's stock price plummeted by 8.6% on the 19th. On the 20th, its stock price briefly fell to KRW 51,100 in early trading, hitting its lowest point in the last three months.

Shin Haeju (hjs0509@fntimes.com)

[관련기사]

- HD Hyundai Raises KRW 150 Billion… How Much Synergy Will the Merger of Construction Equipment · InfraCore Bring?

- Doosan Enerbility, Rebuts Recommendation Against ISS Split-off Merger

- Why Doosan Enerbility wants to spin off Doosan Bobcat, its 'cash cow'

- 'Governance Issue' Doosan Enerbility, Variables to issue bonds next month?

가장 핫한 경제 소식! 한국금융신문의 ‘추천뉴스’를 받아보세요~

데일리 금융경제뉴스 Copyright ⓒ 한국금융신문 & FNTIMES.com

저작권법에 의거 상업적 목적의 무단 전재, 복사, 배포 금지

!['Chung Eui-sun Declares Robot Management Era'... Hyundai Motor Group to Lead Robotics Age with 'Physical AI' [KFT Topic]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=284&h=214&m=5&simg=20260106111449071567492587736121125197123.jpg&nmt=18)

![Lee Jae-yong and Chey Tae-won, Korea's 'Semiconductor Duo,' Head to China... What's the Status of Local Operations? [KFT Topic]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=284&h=214&m=5&simg=2026010608232205705141825007d12411124362.jpg&nmt=18)

!['Beyond Mobile to Robotics': LG Innotek Continues Portfolio Expansion [KFT Topic]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=284&h=214&m=5&simg=2026010508201109906141825007d12411124362.jpg&nmt=18)

![Doosan Enerbility Eyes Return to 'A' Credit Rating After 9 Years on Nuclear Power and Gas Turbine Boom [KFT Topic]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=284&h=214&m=5&simg=2026010208511504157141825007d12411124362.jpg&nmt=18)

![Hyundai Mobis Posts Record Results, Pivots to Robotics and Electrification [KFT Topic]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=110&h=79&m=5&simg=2026012911595100522141825007d12411124362.jpg&nmt=18)