이미지 확대보기

이미지 확대보기Additionally, despite slowing electric vehicle demand, the company plans to enhance its responsiveness to customer and market needs and technology, while accelerating expansion of its future battery portfolio into robotics and aerospace.

Defending Performance with ESS Amid Slowing EV Demand

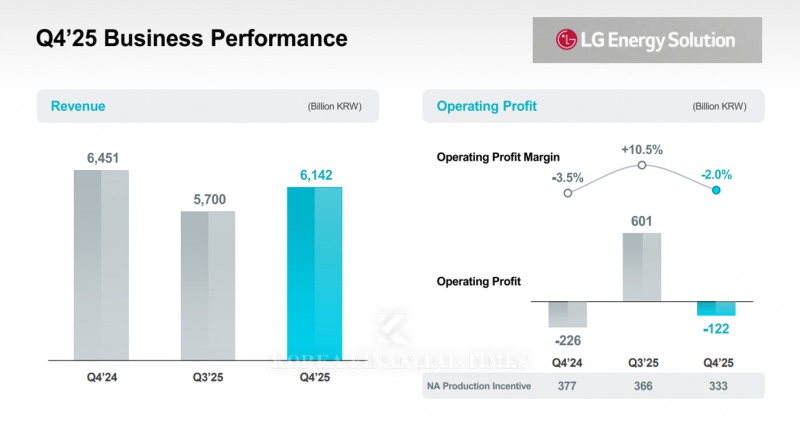

LG Energy Solution held its annual and fourth-quarter 2025 earnings conference on the 29th of last month, announcing consolidated revenue of KRW 23.6718 trillion and operating profit of KRW 1.3461 trillion for last year. Revenue decreased 7.6% year-over-year, while operating profit increased 133.9%.However, fourth-quarter revenue fell 4.8% year-over-year to KRW 6.1415 trillion, with an operating loss of KRW 122 billion. North American production subsidies reflected in the fourth quarter amounted to KRW 332.8 billion. Excluding North American production subsidies, the fourth-quarter operating loss stood at KRW 454.8 billion.

LG Energy Solution's operating profit increase this year was primarily driven by the effects of transitioning to ESS amid slowing EV demand.

"Last year, various policy changes affecting EV electrification pace led to overall demand contraction, resulting in a 7.6% year-over-year decrease in company-wide revenue," explained Lee Chang-sil, CFO of LG Energy Solution, at the earnings conference. "Operating profit increased 133.9% year-over-year through a sales strategy focused on high-margin products and full-scale North American ESS production."

이미지 확대보기

이미지 확대보기Notably, LG Energy Solution terminated a battery supply contract worth approximately KRW 11 trillion late last year due to reduced EV production by GM, a major customer.

'ESS Confidence': LGES to "Expand New Orders Through Enhanced Production Capacity"

With slowing EV market demand expected to continue this year, ESS remains the reliable anchor. LG Energy Solution also forecasts that the ESS market will enter a "structural growth" phase this year, while the EV battery market will continue modest growth in the 10% range.Particularly in the key strategic North American market, EVs appear likely to experience negative growth due to the expiration of purchase subsidies, but the ESS market is expected to show growth exceeding the global average, driven by big tech companies' expanded data center investments and policy support.

LG Energy Solution presented expanded ESS production capacity and securing new orders as key objectives for this year.

First, the company set its new ESS order target for this year to exceed 90GWh, last year's record high. The company also plans to nearly double its global ESS battery production capacity to secure over 60GWh by year-end.

A significant portion of production capacity will be concentrated in North America, where steep growth is expected. The company plans to secure ESS production capacity without significant cost burden by utilizing the Michigan Holland and Lansing standalone plants, as well as portions of JV plants.

"We improved production line utilization by adjusting our North American ESS production base to the Michigan Holland plant to accelerate mass production timing, and converting EV idle lines at the Poland plant and North American JVs to ESS production," explained CFO Lee Chang-sil. "In Europe, we began producing mid-to-low-priced products such as high-voltage mid-nickel and LFP, with shipments to customers starting in the fourth quarter of last year."

He emphasized, "Based on ESS order guidance, we aim for annual revenue growth in the mid-teens to 20% compared to last year. Despite declining EV pouch-type sales, we plan to achieve company-wide revenue growth through high growth in small batteries including the 46 series and the ESS business."

Advancing EV Batteries... Pursuing Future Portfolio Expansion

LG Energy Solution is strengthening its ESS business while enhancing product responsiveness to increasingly segmented customer and market needs in the electric vehicle sector.First, the company will expand its presence in the mid-to-low-priced market by fully commercializing LFP and high-voltage mid-nickel production, and prepare for 2028 mass production of LMR prismatic batteries by starting sample production at Ochang in the first half of the year.

이미지 확대보기

이미지 확대보기New business and future technology preparations are also accelerating. Regarding the robotics market, which has recently garnered high market expectations, LG Energy Solution stated, "Our cylindrical battery technology has been recognized, and we are not only supplying products to six companies with leading global technology but also discussing specifications and mass production timing for next-generation models."

The company also plans to expand battery applications to maritime, urban air mobility, and aerospace sectors, while proceeding without delay on next-generation materials and processes including dry processes, all-solid-state batteries, and sodium batteries.

"The global battery market has entered a 'Value Shift' period where value is being reorganized beyond electric vehicles into various industries including ESS," said Kim Dong-myeong, CEO (President) of LG Energy Solution. "This year, we will materialize our efforts in portfolio rebalancing and operational efficiency into tangible results, and turn opportunities into achievements through intense focus."

Kim JaeHun (rlqm93@fntimes.com)

[관련기사]

- Koo Kwang-mo's Vision for AI and Robotics Drives LG Group's Transformation [KFT Topic]

- LG Energy Solution's Global Ambitions Hit by Credit Rating Downgrades

- LG Electronics' Two Robot Companies Show Polar Opposite Results...Robostar vs ROBOTIS '10-Fold Return Gap'

- SK On Faces Uphill Battle in Second ESS Bid After Shutout in First Round

- Tit-for-Tat in US ESS Market: LG EnSol Debuts Prismatic Cells as Samsung SDI Unveils First LFP Batteries

가장 핫한 경제 소식! 한국금융신문의 ‘추천뉴스’를 받아보세요~

데일리 금융경제뉴스 Copyright ⓒ 한국금융신문 & FNTIMES.com

저작권법에 의거 상업적 목적의 무단 전재, 복사, 배포 금지

![Samsung Electronics and SK Hynix Engage in High-Stakes AI Chip War [KFT Topic]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=284&h=214&m=5&simg=2026013013432407964141825007d12411124362.jpg&nmt=18)

![Hyundai Mobis Posts Record Results, Pivots to Robotics and Electrification [KFT Topic]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=284&h=214&m=5&simg=2026012911595100522141825007d12411124362.jpg&nmt=18)

![One Year In: CEO Hyun Shin-kyun Transforms LG CNS into KRW 6 Trillion AI Powerhouse [KFT Topic]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=284&h=214&m=5&simg=2026012807381208149141825007d12411124362.jpg&nmt=18)

!['Chung Eui-sun Declares Robot Management Era'... Hyundai Motor Group to Lead Robotics Age with 'Physical AI' [KFT Topic]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=284&h=214&m=5&simg=20260106111449071567492587736121125197123.jpg&nmt=18)

![Lee Jae-yong and Chey Tae-won, Korea's 'Semiconductor Duo,' Head to China... What's the Status of Local Operations? [KFT Topic]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=284&h=214&m=5&simg=2026010608232205705141825007d12411124362.jpg&nmt=18)

!['Beyond Mobile to Robotics': LG Innotek Continues Portfolio Expansion [KFT Topic]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=284&h=214&m=5&simg=2026010508201109906141825007d12411124362.jpg&nmt=18)

![Doosan Enerbility Eyes Return to 'A' Credit Rating After 9 Years on Nuclear Power and Gas Turbine Boom [KFT Topic]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=284&h=214&m=5&simg=2026010208511504157141825007d12411124362.jpg&nmt=18)

!["Samsung Is Back," Chip Chief Declares, Eyeing Record Profit on HBM Recovery [KFT Topic]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=110&h=79&m=5&simg=2026011408580109459141825007d12411124362.jpg&nmt=18)

![Koo Kwang-mo's Vision for AI and Robotics Drives LG Group's Transformation [KFT Topic]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=110&h=79&m=5&simg=2026012123034202714141825007d122461258.jpg&nmt=18)

!['Expansion' S-OIL vs. 'Caution' GS Caltex [KFT Topic]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=110&h=79&m=5&simg=2026012010260905723141825007d12411124362.jpg&nmt=18)

![One Year In: CEO Hyun Shin-kyun Transforms LG CNS into KRW 6 Trillion AI Powerhouse [KFT Topic]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=110&h=79&m=5&simg=2026012807381208149141825007d12411124362.jpg&nmt=18)

![Samsung's 'Last Chance': Lee Jae-yong Pushes HBM4 as Make-or-Break Moment [KFT Topic]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=110&h=79&m=5&simg=2026012623242806011141825007d122461258.jpg&nmt=18)