이미지 확대보기

이미지 확대보기Through this strategy, both companies aim to aggressively secure orders, capitalizing on the weakened influence of Chinese ESS manufacturers in the U.S. due to tariffs and regulations.

The highlight products showcased by Samsung SDI at this event are the next-generation Solid Battery Blocks (SBBs), namely 'SBB 1.7' and 'SBB 2.0'. These products, revealed for the first time at the exhibition, are slated for local production in the U.S. starting next year.

Among these, SBB 2.0 marks Samsung SDI's debut LFP battery product. Until now, Samsung SDI had primarily focused on ternary NCA (Nickel-Cobalt-Aluminum) batteries, unlike its competitors. While NCA batteries offer higher energy density and larger capacity than LFP, their higher manufacturing cost has posed challenges in price competitiveness.

SBB 2.0 features Samsung SDI's proprietary prismatic form factor, incorporating differentiated materials and electrode plate technology. This innovation overcomes the low energy density, a common drawback of existing LFP batteries, while maximizing advantages such as safety and cost-effectiveness. Samsung SDI plans to offer customized solutions to customers by leveraging both SBB 2.0 and SBB 1.7, which is equipped with ternary NCA batteries.

While Samsung SDI unveiled its first LFP battery product, LG Energy Solution introduced prismatic batteries, a segment where Samsung SDI has traditionally excelled. This marks LG Energy Solution's first presentation of prismatic ESS batteries.

이미지 확대보기

이미지 확대보기LG Energy Solution's prismatic batteries include the JF2 and JF3 battery cell and pack products. These products boast ultra-high energy density exceeding 500 Wh, while also being resistant to external impacts and offering lower production costs. LG Energy Solution's prismatic batteries are scheduled for production in North America, a first for the industry.

To achieve this, LG Energy Solution began the full-scale local mass production of LFP batteries for ESS at its Michigan plant in the second quarter of this year, an industry first in the U.S. This initiative has established a 'Made-in-USA' foundation, ensuring stable supply to local customers and enabling customers to benefit from IRA (Inflation Reduction Act) incentives for ESS installations manufactured in North America.

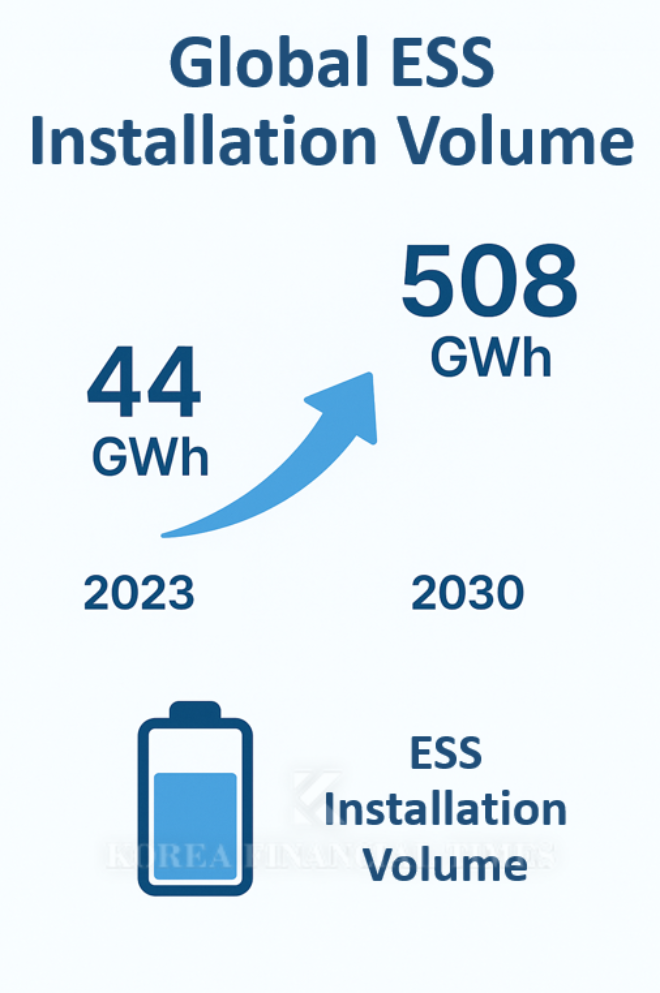

The primary reason both companies are publicly showcasing new battery products and technologies in the U.S. is the intense competition for orders. The Korea Energy Economics Institute projects that the global ESS installation capacity, which stood at only 44 gigawatt-hours (GWh) in 2023, will expand to 508 GWh by 2030. In particular, the U.S. ESS market is growing rapidly due to increasing electricity demand driven by the surging AI boom.

Furthermore, the diminished influence of Chinese ESS manufacturers in the U.S. market, due to tariff policies and regulations imposed by the Trump administration, presents an opportunity for Korean companies. Currently, the U.S. imposes a 40.9% tariff on Chinese-made ESS batteries, which is expected to increase to 58.4% next year.

Another factor driving Korean battery companies' vigorous pursuit of ESS orders is the accelerated discontinuation of electric vehicle subsidies in the U.S. Starting late this month, the maximum USD 7,500 electric vehicle tax credit will be abolished. The original scheduled date for the subsidy repeal was 2032, meaning it has been brought forward by approximately seven years.

Kim JaeHun (rlqm93@fntimes.com)

[관련기사]

- SK, LG, LOTTE: 'Secure Cash!' — Restructuring, Liquidity Drive 'All-In'

- LG Chem’s Shin Hak-cheol Issues KRW 1.4T in Exchangeable Bonds Alongside Push to Sell Non-Core Assets

- LG Energy Solution, Samsung SDI and SK-on Aim for 'K-Battery Comeback'

- LG Energy Solution, Samsung SDI, SK On Brace for Prolonged EV Battery Slump

- Koo Kwang-mo, Chairman of LG Group: A Keen Eye for Technology Nurtured in Engineering School

가장 핫한 경제 소식! 한국금융신문의 ‘추천뉴스’를 받아보세요~

데일리 금융경제뉴스 Copyright ⓒ 한국금융신문 & FNTIMES.com

저작권법에 의거 상업적 목적의 무단 전재, 복사, 배포 금지

![Samsung Electronics and SK Hynix Engage in High-Stakes AI Chip War [KFT Topic]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=284&h=214&m=5&simg=2026013013432407964141825007d12411124362.jpg&nmt=18)

![Hyundai Mobis Posts Record Results, Pivots to Robotics and Electrification [KFT Topic]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=284&h=214&m=5&simg=2026012911595100522141825007d12411124362.jpg&nmt=18)

![One Year In: CEO Hyun Shin-kyun Transforms LG CNS into KRW 6 Trillion AI Powerhouse [KFT Topic]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=284&h=214&m=5&simg=2026012807381208149141825007d12411124362.jpg&nmt=18)

!['Chung Eui-sun Declares Robot Management Era'... Hyundai Motor Group to Lead Robotics Age with 'Physical AI' [KFT Topic]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=284&h=214&m=5&simg=20260106111449071567492587736121125197123.jpg&nmt=18)

![Lee Jae-yong and Chey Tae-won, Korea's 'Semiconductor Duo,' Head to China... What's the Status of Local Operations? [KFT Topic]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=284&h=214&m=5&simg=2026010608232205705141825007d12411124362.jpg&nmt=18)

!['Beyond Mobile to Robotics': LG Innotek Continues Portfolio Expansion [KFT Topic]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=284&h=214&m=5&simg=2026010508201109906141825007d12411124362.jpg&nmt=18)

![Doosan Enerbility Eyes Return to 'A' Credit Rating After 9 Years on Nuclear Power and Gas Turbine Boom [KFT Topic]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=284&h=214&m=5&simg=2026010208511504157141825007d12411124362.jpg&nmt=18)

!["Samsung Is Back," Chip Chief Declares, Eyeing Record Profit on HBM Recovery [KFT Topic]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=110&h=79&m=5&simg=2026011408580109459141825007d12411124362.jpg&nmt=18)

![Koo Kwang-mo's Vision for AI and Robotics Drives LG Group's Transformation [KFT Topic]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=110&h=79&m=5&simg=2026012123034202714141825007d122461258.jpg&nmt=18)

!['Expansion' S-OIL vs. 'Caution' GS Caltex [KFT Topic]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=110&h=79&m=5&simg=2026012010260905723141825007d12411124362.jpg&nmt=18)

![One Year In: CEO Hyun Shin-kyun Transforms LG CNS into KRW 6 Trillion AI Powerhouse [KFT Topic]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=110&h=79&m=5&simg=2026012807381208149141825007d12411124362.jpg&nmt=18)

![Samsung's 'Last Chance': Lee Jae-yong Pushes HBM4 as Make-or-Break Moment [KFT Topic]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=110&h=79&m=5&simg=2026012623242806011141825007d122461258.jpg&nmt=18)