Similar Business Structures

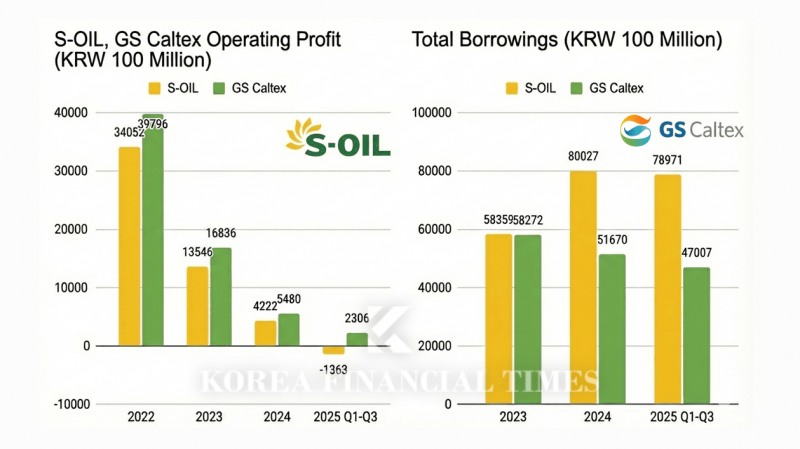

GS Caltex and S-OIL, both in the refining industry, show similar earnings trends. GS Caltex's operating profit recorded ▲KRW 3,979.6 billion in 2022 ▲KRW 1,683.8 billion in 2023 ▲KRW 548 billion in 2024 ▲KRW 230.6 billion in Q1-Q3 2025. S-OIL also showed a declining trend with ▲KRW 3,405.2 billion in 2022 ▲KRW 1,354.6 billion in 2023 ▲KRW 422.2 billion in 2024 ▲an operating loss of KRW 136.3 billion in Q1-Q3 2025.As of 2024, revenue stands at KRW 48 trillion for GS Caltex and KRW 37 trillion for S-OIL. Both companies maintain a high 79% share in their core refining business.

이미지 확대보기

이미지 확대보기Rising Debt vs. Falling Debt

However, the two companies have pursued different investment strategies since 2023. S-OIL has invested approximately KRW 9 trillion in the Shaheen Project, a large-scale petrochemical complex construction project in Ulsan. GS Caltex, after completing its olefin production facility (MFC) in 2022 with an investment of KRW 2.7 trillion, has continued a cautious approach rather than aggressive investment.This is also evident in the companies' annual total borrowings trends.

According to Korea Ratings and disclosure data, S-OIL's total borrowings increased from KRW 5,835.9 billion in 2023 to over KRW 8,002.7 billion in 2024. Although it decreased to the KRW 7,900 billion range in Q3 2025 due to reduced short-term borrowings, net debt continues to rise due to expanded Shaheen-related investments.

In contrast, GS Caltex's total borrowings, which surged to KRW 5,827.2 billion in 2023, decreased to KRW 4,700.7 billion in Q3 2025. The company is managing to maintain a stable financial structure despite reduced cash flow.

'Shaheen': Banking on Aramco

S-OIL faces warning signs in its financial condition due to deteriorating profitability and the burden of Shaheen investment.NICE Investors Service and Korea Ratings cite "net debt/EBITDA (earnings before interest, taxes, depreciation and amortization) of 2.5-3 times or higher" as a factor for considering a downgrade of S-OIL's credit rating outlook. This indicator soared from 1.8 times in 2023 to 5 times in 2024 and 10.3 times in Q3 2025. Despite exceeding the downgrade threshold by more than three times, the credit rating remains at 'AA (Positive)'. This is based on the assessment that financial burdens are controllable with support from Saudi Aramco, the largest shareholder.

Indeed, the Shaheen Project would have been impossible without Aramco's backing. S-OIL announced it would finance 71% of the KRW 9 trillion investment through internal sources (including Aramco trade payables) and 29% through external borrowing (Aramco, corporate bonds, etc.). The original plan was to finance about half of the internal funding through Aramco trade payables and cover the rest with its own cash. However, as financial burdens surged due to massive losses in the first half of last year, Aramco's support continued by increasing the scale of trade payables and extending repayment periods.

이미지 확대보기

이미지 확대보기Ultimately, the company's financial condition is expected to be reassessed based on the actual performance of the Shaheen Project. The project will produce 1.8 million tons annually of ethylene and other products in Ulsan, the largest single facility of its kind. Commercial operations are set to begin at the end of this year, with results to be fully reflected in earnings from early next year.

Ethylene is a basic raw material currently facing oversupply from China and large-scale reductions in domestic petrochemicals, raising some concerns. Nevertheless, S-OIL is confident it will maximize profitability by applying Aramco's 'TC2C' (thermal crude to chemicals) process technology, which converts crude oil directly into ethylene. At last quarter's earnings briefing, S-OIL projected "an internal rate of return (IRR) in the double digits."

GS Caltex Guards Cash with Conservative Management

Reasons for GS Caltex's more cautious stance compared to competitors include the GS Group's conservative management approach and its joint major shareholder governance structure with Chevron. Insufficient results from its most recent large-scale investment is also cited as one of the reasons.When GS Caltex decided to invest in the MFC in Yeosu, South Jeolla Province, it expected to generate KRW 400 billion in annual operating profit. MFC is a process that produces basic raw materials such as ethylene and propylene. It touted differentiation by being able to input not only existing naphtha but also other refining process by-products such as ethane and LPG.

However, GS Caltex, like other domestic petrochemical companies, could not escape China's oversupply. The company's entire petrochemical division operating profit was KRW 82.1 billion, not significantly different from the past, and posted cumulative losses of KRW 100 billion through Q3 last year.

At the end of last year, GS Caltex joined LG Chem in a domestic petrochemical restructuring plan that is currently under government review. While specific measures have not been disclosed, it is expected to involve integrated operation of facilities within the Yeosu industrial complex and reduction of some facilities. Ethylene production capacity in Yeosu stands at 2 million tons for LG Chem and 900,000 tons for GS Caltex.

Industry observers expect GS Caltex will have no choice but to actively pursue not only efficiency improvements in existing businesses but also new business investments. The company has also been promoting carbon reduction, bio-feedstock, and gas station-based service businesses under the banner of 'green transformation' for several years.

Gwak Horyung (horr@fntimes.com)

[관련기사]

가장 핫한 경제 소식! 한국금융신문의 ‘추천뉴스’를 받아보세요~

데일리 금융경제뉴스 Copyright ⓒ 한국금융신문 & FNTIMES.com

저작권법에 의거 상업적 목적의 무단 전재, 복사, 배포 금지

!['From Heavy Industry to Humanoids' — Doosan Robotics Charts a New Future in Physical AI [K-Humanoid Wars, Part 3]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=284&h=214&m=5&simg=2026030310061306979141825007d12411124362.jpg&nmt=18)

!['Samsung's Bet on the Future' — Rainbow Robotics, Korea's Humanoid Pioneer [K-Humanoid Wars, Part 2]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=284&h=214&m=5&simg=2026022413501808272141825007d12411124362.jpg&nmt=18)

![Tesla's Humanoid Rival Has Arrived — Boston Dynamics Eyes $70 Billion Valuation [K-Humanoid Wars, Part 1]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=284&h=214&m=5&simg=2026022010243207659141825007d12411124362.jpg&nmt=18)

![Samsung's 'Last Chance': Lee Jae-yong Pushes HBM4 as Make-or-Break Moment [KFT Topic]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=284&h=214&m=5&simg=2026012623242806011141825007d122461258.jpg&nmt=18)

![Tesla's Humanoid Rival Has Arrived — Boston Dynamics Eyes $70 Billion Valuation [K-Humanoid Wars, Part 1]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=110&h=79&m=5&simg=2026022010243207659141825007d12411124362.jpg&nmt=18)

!['Samsung's Bet on the Future' — Rainbow Robotics, Korea's Humanoid Pioneer [K-Humanoid Wars, Part 2]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=110&h=79&m=5&simg=2026022413501808272141825007d12411124362.jpg&nmt=18)

!['From Heavy Industry to Humanoids' — Doosan Robotics Charts a New Future in Physical AI [K-Humanoid Wars, Part 3]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=110&h=79&m=5&simg=2026030310061306979141825007d12411124362.jpg&nmt=18)