SK "HBM First" vs Samsung "Flexible Approach"

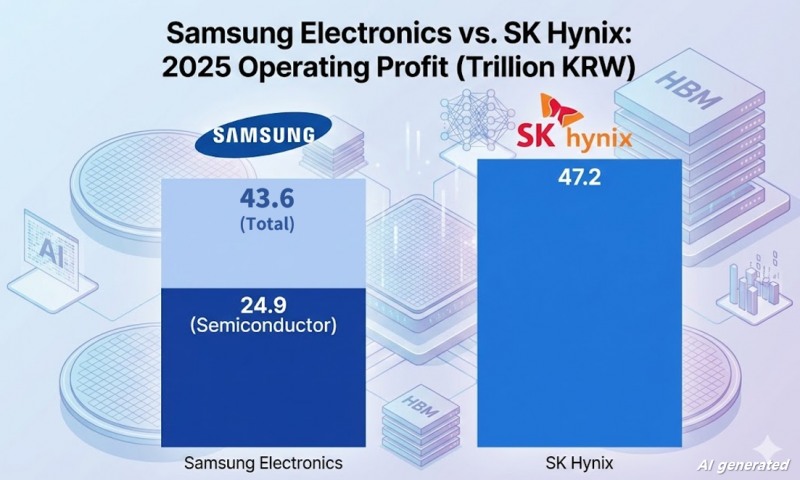

SK Hynix achieved KRW 97.1467 trillion in revenue and KRW 47.2063 trillion in operating profit last year. For the first time, it surpassed Samsung Electronics' profitability, which recorded KRW 333.6059 trillion in revenue and KRW 43.6011 trillion in operating profit during the same period. Samsung Electronics' DS (semiconductor) division posted an operating profit of KRW 24.9 trillion, approximately half that of SK Hynix. This is attributed to Samsung's late entry into the relevant market after losing HBM leadership in the first half of last year. 이미지 확대보기

이미지 확대보기Samsung Electronics is forecasting a major counteroffensive this year. This is because the AI-driven memory shortage has created a phenomenon where the profitability of commodity DRAM surpasses that of HBM. Samsung Electronics holds an advantageous position in commodity DRAM with its overwhelming mass production capability and flexibility.

The two companies' business strategies for this year also differ subtly. SK Hynix emphasized stable HBM supply, stating that "customer trust is more important than short-term results."

In contrast, Samsung Electronics stated, "From a profitability perspective, we need to operate our product portfolio with a focus on servers rather than HBM," while adding, "We will operate flexibly and in a balanced manner rather than with concentrated supply."

Samsung Electronics also said, "For application markets other than servers, we will respond with a focus on high value-added products." Accordingly, memory supply shortages are expected to intensify in the small IT device market, including smartphones, tablets, and laptops, for budget models excluding AI-enabled flagship devices.

Competition to Secure HBM4

During this earnings conference call, attention focused on the status of the 6th-generation High Bandwidth Memory "HBM4" business, which can gauge memory technology competitiveness. This was because speculation emerged that Samsung Electronics would begin supplying HBM4 for the first time next month, leading some to interpret that SK Hynix, the No. 1 player in the HBM market, might be losing its leadership.SK Hynix, which started its event one hour before Samsung Electronics, received questions about HBM4 competitiveness first and responded, "We are the pioneer who has collaborated with partners to develop the market since the HBM2E era," adding, "Customer trust in our mass production experience and quality, which goes beyond simply leading in technology, is a capability that cannot be surpassed in a short period." Then, seemingly conscious of Samsung Electronics, which preemptively applied 1c (6th-generation 10-nanometer class) DRAM technology, SK Hynix stated, "It's a major achievement that we satisfied customer performance requirements even with our 1b (5th-generation 10-nanometer class) process-based technology," and "We plan to secure yield rates at the HBM3E level." The company also stated, "We are targeting an overwhelming market share in HBM4 as well," and "Although some competitor entry is expected, our leadership and dominant supplier position will continue."

Samsung Electronics explained, "HBM4 is scheduled to ship starting in February," and "Despite heightened performance requirements from major customers, we are smoothly proceeding with customer evaluation without redesign and are currently at the qual (quality test) completion stage." First, it confirmed the rumors were true through a specific shipment schedule. Mentioning "redesign," which SK Hynix is known to have experienced, is also interpreted as a remark targeting its competitor. Samsung Electronics went on to emphasize its technological competitiveness, stating, "We will supply HBM4E samples to customers in the middle of this year," and "We have already delivered HBM4E samples with hybrid bonding applied, and some are being planned for commercialization."

"Expanding Capital Expenditure"

Regarding this year's capital expenditure (CAPEX), both companies stated "we will invest more than last year" but refrained from mentioning specific figures. This is interpreted as reluctance to expose their strategies based on capital expenditure scale.

However, SK Hynix mentioned that even this year, when a surge in revenue is expected, it would be able to maintain "capital expenditure in the mid-30% range as a percentage of revenue."

Samsung Electronics stated it would continue its shell-first strategy of preemptively constructing clean rooms and flexibly proceeding with capital expenditure according to market conditions. Most of this year's capital expenditure will also be executed on equipment to be installed in pre-secured new fab clean rooms.

Special Dividends on Record-Breaking Performance

Following last year's record-breaking performance that exceeded expectations, both companies decided to implement additional shareholder returns.SK Hynix plans to pay KRW 1,875 per share, adding KRW 1,500 in additional dividends to the existing fourth-quarter dividend of KRW 375 per share. The 2025 dividend per share is KRW 3,000, totaling approximately KRW 2.1 trillion. In addition, the company decided to cancel 2.1% of its existing treasury shares valued at over KRW 12 trillion to enhance existing shareholder value.

Samsung Electronics decided to pay KRW 566 per share by implementing an additional dividend of KRW 196 on top of the existing dividend of KRW 370 per common share. This also has the significance of meeting the government's "dividend tax separate taxation" requirement that shareholders of high-dividend companies can receive.

The company is also proceeding with its share buyback and cancellation plan, which applies through this year. Accordingly, the shareholder return scale for 2025 includes KRW 9.8 trillion in regular dividends, KRW 1.3 trillion in additional dividends, and KRW 6.6 trillion in treasury share buybacks and cancellations.

Gwak Horyung (horr@fntimes.com)

[관련기사]

- Samsung's 'Last Chance': Lee Jae-yong Pushes HBM4 as Make-or-Break Moment [KFT Topic]

- "Samsung Is Back," Chip Chief Declares, Eyeing Record Profit on HBM Recovery [KFT Topic]

- Lee Jae-yong and Chey Tae-won, Korea's 'Semiconductor Duo,' Head to China... What's the Status of Local Operations? [KFT Topic]

- SK Hynix's Five-President Team Set to Usher in KRW 100 Trillion Profit Era

- 'AI Core' HBM4 Competition Strategy Poles Apart: Samsung Electronics 'Solo' vs SK Hynix 'Alliance'

- Samsung Electronics and SK Hynix Eye KRW 150 Trillion Operating Profit Era

가장 핫한 경제 소식! 한국금융신문의 ‘추천뉴스’를 받아보세요~

데일리 금융경제뉴스 Copyright ⓒ 한국금융신문 & FNTIMES.com

저작권법에 의거 상업적 목적의 무단 전재, 복사, 배포 금지

![Samsung Electronics and SK Hynix Engage in High-Stakes AI Chip War [KFT Topic]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=284&h=214&m=5&simg=2026013013432407964141825007d12411124362.jpg&nmt=18)

![Hyundai Mobis Posts Record Results, Pivots to Robotics and Electrification [KFT Topic]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=284&h=214&m=5&simg=2026012911595100522141825007d12411124362.jpg&nmt=18)

![One Year In: CEO Hyun Shin-kyun Transforms LG CNS into KRW 6 Trillion AI Powerhouse [KFT Topic]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=284&h=214&m=5&simg=2026012807381208149141825007d12411124362.jpg&nmt=18)

![Samsung's 'Last Chance': Lee Jae-yong Pushes HBM4 as Make-or-Break Moment [KFT Topic]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=284&h=214&m=5&simg=2026012623242806011141825007d122461258.jpg&nmt=18)

!['Chung Eui-sun Declares Robot Management Era'... Hyundai Motor Group to Lead Robotics Age with 'Physical AI' [KFT Topic]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=284&h=214&m=5&simg=20260106111449071567492587736121125197123.jpg&nmt=18)

![Lee Jae-yong and Chey Tae-won, Korea's 'Semiconductor Duo,' Head to China... What's the Status of Local Operations? [KFT Topic]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=284&h=214&m=5&simg=2026010608232205705141825007d12411124362.jpg&nmt=18)

!['Beyond Mobile to Robotics': LG Innotek Continues Portfolio Expansion [KFT Topic]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=284&h=214&m=5&simg=2026010508201109906141825007d12411124362.jpg&nmt=18)

![Doosan Enerbility Eyes Return to 'A' Credit Rating After 9 Years on Nuclear Power and Gas Turbine Boom [KFT Topic]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=284&h=214&m=5&simg=2026010208511504157141825007d12411124362.jpg&nmt=18)

![Three Generations of Hyundai's American Challenge: From Budget Cars to Premium EVs [KFT Topic]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=110&h=79&m=5&simg=2026011209372904936141825007d12411124362.jpg&nmt=18)

![Naver hits KRW 10 trillion revenue but premium valuation in doubt [KFT Topic]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=110&h=79&m=5&simg=2026011308484406594141825007d12411124362.jpg&nmt=18)

!['Expansion' S-OIL vs. 'Caution' GS Caltex [KFT Topic]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=110&h=79&m=5&simg=2026012010260905723141825007d12411124362.jpg&nmt=18)

![Koo Kwang-mo's Vision for AI and Robotics Drives LG Group's Transformation [KFT Topic]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=110&h=79&m=5&simg=2026012123034202714141825007d122461258.jpg&nmt=18)

!["Samsung Is Back," Chip Chief Declares, Eyeing Record Profit on HBM Recovery [KFT Topic]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=110&h=79&m=5&simg=2026011408580109459141825007d12411124362.jpg&nmt=18)