이미지 확대보기

이미지 확대보기Chung Eui-sun, Chairman of Hyundai Motor Group, marks his fifth anniversary of appointment on the 14th. However, the management environment facing Chairman Chung remains a series of uncertainties. US tariff policy, a longer-than-expected electric vehicle chasm (temporary demand slowdown), and competition in future mobility commercialisation cannot be overlooked.

According to Hyundai Motor and Kia, the two companies plan to invest approximately KRW 112 trillion over the next five years to solidify their position as global tier-one mobility companies. Hyundai Motor will allocate approximately KRW 77.3 trillion, while Kia will invest approximately KRW 42 trillion respectively.

Both companies plan to strengthen business competitiveness in electrification, software, robotics, AI, and AAM (advanced air mobility) through research and development (R&D) investment, capital expenditure (CAPEX), and strategic investment.

The most critical challenge is responding to US tariffs. The US has imposed 25 percent tariffs on automotive exports to the US since April. Though the Korean government agreed to a 15 percent tariff reduction, the specific implementation timeline remains unclear. Japanese and EU automakers are already receiving 15 percent tariff treatment, pressuring Hyundai Motor Group.

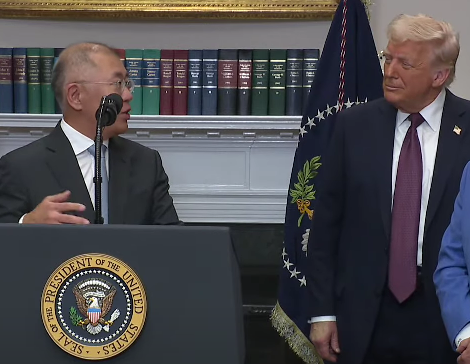

Chairman Chung's answer involves expanding local production and strengthening hybrid lineups. To this end, he announced in August plans to invest approximately USD 26 billion in the US market over the next four years to enhance local production and business competitiveness. This adds USD 5 billion to the USD 21 billion investment plan announced jointly with US President Trump in March.

이미지 확대보기

이미지 확대보기First, the company will accelerate operations at its two US production facilities: the Alabama plant and HMGMA (Hyundai Motor Group Metaplan America). Particularly, HMGMA will expand production capacity from the current 300,000 units to 500,000 units by 2028, enabling mixed production of not only electric vehicles but also hybrid vehicles.

Additionally, the company will expand hybrid offerings to over 18 models covering entry, mid-size, full-size, and luxury segments by 2030, capitalising on rebound benefits concentrated in hybrid amid the electric vehicle chasm, actively responding to market demand changes. This means establishing more than double the current hybrid lineup.

GENESIS, showing strong growth potential in the US market, will launch Hyundai Motor Group's first rear-wheel-drive (RWD) based and the brand's first luxury hybrid vehicle next year. Subsequently, the company plans to develop an entry-level hybrid with reasonable pricing.

European market strategy, emerging as an alternative to the US market, will also strengthen. Hyundai Motor will launch 'IONIQ 3' next year in the European market to lead recovery and popularisation of electric vehicle demand. IONIQ 3 is an entirely new electric vehicle featuring next-generation infotainment systems.

Kia will expand its electrification lineup next year with the compact electric SUV 'EV2'. This year, Kia demonstrated results by boosting sales in the European market with EV3 and EV4 leading the charge. Alongside this, the company will strengthen global commercial vehicle market strategy with PBV (purpose-built vehicle) 'PV5' and others.

Chairman Chung will also begin full-scale acceleration of three future businesses he has prioritised: robotics, autonomous driving, and AAM. Currently, these businesses are handled by Boston Dynamics (robotics), Podi2dot, Motional (autonomous driving), and Supernal (AAM) respectively. Chairman Chung has invested trillions of won in establishing foundations for these three new ventures since his appointment.

이미지 확대보기

이미지 확대보기First, Chairman Chung plans to establish a new robot production facility with annual capacity of 30,000 units to serve as a hub for the robotics ecosystem within the US. Through this plan, local subsidiaries such as Boston Dynamics and Motional, which handle robotics and autonomous driving, will accelerate commercialisation.

Supernal unveiled its electric vertical take-off and landing aircraft (eVTOL) 'S-A2' in early last year and is conducting test operations. Supernal plans to formally launch the S-A2 at the Los Angeles Olympics in summer 2028 and produce 100 to 200 units annually.

Meanwhile, Chairman Chung is executing large-scale investments domestically as well. Hyundai Motor Group will invest record KRW 24.3 trillion this year to strengthen future competitiveness centred on Korea as a mobility innovation hub. This represents a more than 19 percent increase compared to KRW 20.4 trillion in 2024.

Specifically, the company will execute research and development (R&D) investment of KRW 11.5 trillion, operating investment of KRW 12 trillion, and strategic investment of KRW 800 billion respectively.

Particularly, large-scale investment will be made in constructing dedicated EV factories. Kia's Hwaseong EVO Plant will be completed in the second half of this year, beginning full-scale production of customer-customised PBV electric vehicles. At Hyundai Motor's Ulsan dedicated EV factory, targeted for operations in the first half of 2026, the company plans to mass-produce various vehicle types beginning with large-size SUV electric models.

Kim JaeHun (rlqm93@fntimes.com)

[관련기사]

- Hyundai Motor Group 'Chung Eui-sun era' 5 years ①: 'Disruptive innovation leadership' powers global Big3

- Chung Eui-sun's 10 Years of Passion for Hyundai N : High-Performance Brand Eyes the Electric Vehicle Era

- Inheritance Tax for Chung Mong-koo Totals KRW 2.3 Trillion… Chung Eui-sun Takes It Head-On in His Own Way

- "Investing Despite Trillion-KRW Losses"... Chung Eui-sun's New Business '3 Picks'

- Hyundai Motor Group Chairman Chung Eui-sun to Receive Salary from Kia Starting This Year

가장 핫한 경제 소식! 한국금융신문의 ‘추천뉴스’를 받아보세요~

데일리 금융경제뉴스 Copyright ⓒ 한국금융신문 & FNTIMES.com

저작권법에 의거 상업적 목적의 무단 전재, 복사, 배포 금지

![Robot Joints, 80%-a-Year Growth: Hyundai Mobis, Samsung Electro-Mechanics Lead Korea's Actuator Rush [K-Humanoid Wars ④]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=284&h=214&m=5&simg=2026030908365902517141825007d12411124362.jpg&nmt=18)

!['From Heavy Industry to Humanoids' — Doosan Robotics Charts a New Future in Physical AI [K-Humanoid Wars, Part 3]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=284&h=214&m=5&simg=2026030310061306979141825007d12411124362.jpg&nmt=18)

!['Samsung's Bet on the Future' — Rainbow Robotics, Korea's Humanoid Pioneer [K-Humanoid Wars, Part 2]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=284&h=214&m=5&simg=2026022413501808272141825007d12411124362.jpg&nmt=18)

![Tesla's Humanoid Rival Has Arrived — Boston Dynamics Eyes $70 Billion Valuation [K-Humanoid Wars, Part 1]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=284&h=214&m=5&simg=2026022010243207659141825007d12411124362.jpg&nmt=18)

![Tesla's Humanoid Rival Has Arrived — Boston Dynamics Eyes $70 Billion Valuation [K-Humanoid Wars, Part 1]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=110&h=79&m=5&simg=2026022010243207659141825007d12411124362.jpg&nmt=18)

!['Samsung's Bet on the Future' — Rainbow Robotics, Korea's Humanoid Pioneer [K-Humanoid Wars, Part 2]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=110&h=79&m=5&simg=2026022413501808272141825007d12411124362.jpg&nmt=18)

!['From Heavy Industry to Humanoids' — Doosan Robotics Charts a New Future in Physical AI [K-Humanoid Wars, Part 3]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=110&h=79&m=5&simg=2026030310061306979141825007d12411124362.jpg&nmt=18)