이미지 확대보기

이미지 확대보기On August 12, LS declared it would retire 1 million treasury shares, representing 3.1% of its total outstanding stock. The shares will be retired in two phases : 500,000 shares on August 21, with the remaining 500,000 to be retired by the first quarter of 2026. LS currently holds 5,852,462 treasury shares, representing 15.1% of its issued stock.

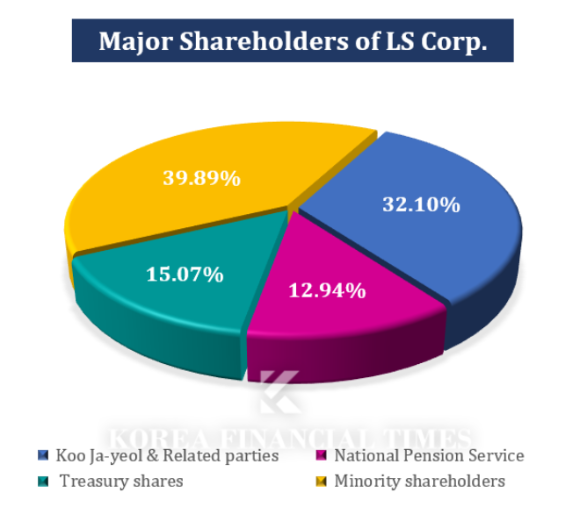

Some industry observers speculate that LS’s decision to retire treasury shares is ultimately aimed at defending its management rights against Hoban Group. The two conglomerates are engaged in a shareholding battle, with Hoban acquiring over a 2% stake in LS this March. Although Hoban has yet to surpass the critical 3% threshold—which would grant it rights such as inspecting LS’s accounting books and challenging director misconduct—LS remains on alert.

In particular, Taihan Cable, an affiliate of Hoban Group, and LS Cable are long-standing rivals. In April, LS Cable won a final court ruling against Taihan Cable in a lawsuit over the alleged misappropriation of bus duct technology. More recently, the two companies have been vying for contracts in the “West Coast Energy Highway” national power grid project promoted by the Lee Jae-myung administration.

This forms the basis for analysis that LS’s share retirement move is aimed at boosting its stock price to make it more difficult for Hoban Group to increase its stake. A reduction in the number of shares in circulation typically lifts earnings per share and dividends per share, increasing the likelihood of a higher stock price. This, in turn, can raise the cost for outside players to acquire additional stakes.

Despite this, LS’s share price moved in the opposite direction, closing down 0.58% at KRW 170,200 on August 12. On August 13, the price dipped further to around KRW 167,200 within two hours of market open.

An industry insider commented, “Discussions around amendments to the Commercial Act have been ongoing since the Lee Jae-myung administration took office, so expectations around treasury share retirement for holding companies might have been priced into the shares already.”

이미지 확대보기

이미지 확대보기Earlier in May, LS issued KRW 65 billion worth of exchangeable bonds (EBs) backed by 387,365 treasury shares—equivalent to 1.2% of total shares—subscribed by Korean Air.

This move was widely interpreted as a defensive tactic against Hoban Group’s managerial challenge. Because treasury shares lack voting rights and cannot be used in shareholder meetings, issuing EBs linked to these shares enables LS to establish a friendly controlling interest.

Once Korean Air converts these bonds into shares, it will acquire voting rights, potentially tipping future votes in favor of LS management during proxy battles.

Shin Haeju (hjs0509@fntimes.com)

[관련기사]

가장 핫한 경제 소식! 한국금융신문의 ‘추천뉴스’를 받아보세요~

데일리 금융경제뉴스 Copyright ⓒ 한국금융신문 & FNTIMES.com

저작권법에 의거 상업적 목적의 무단 전재, 복사, 배포 금지

![Samsung Biologics Hits Industry-First KRW 2 Trillion Operating Profit, Eyes KRW 3 Trillion Next [KFT Topic]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=284&h=214&m=5&simg=2026012308315609061141825007d12411124362.jpg&nmt=18)

![Koo Kwang-mo's Vision for AI and Robotics Drives LG Group's Transformation [KFT Topic]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=284&h=214&m=5&simg=2026012123034202714141825007d122461258.jpg&nmt=18)

![Kakao CEO Chung Shina Rebuilds C-Level Leadership for AI OS Transformation [KFT Topic]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=284&h=214&m=5&simg=2026012109141504933141825007d12411124362.jpg&nmt=18)

!['Expansion' S-OIL vs. 'Caution' GS Caltex [KFT Topic]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=284&h=214&m=5&simg=2026012010260905723141825007d12411124362.jpg&nmt=18)

!['Chung Eui-sun Declares Robot Management Era'... Hyundai Motor Group to Lead Robotics Age with 'Physical AI' [KFT Topic]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=284&h=214&m=5&simg=20260106111449071567492587736121125197123.jpg&nmt=18)

![Lee Jae-yong and Chey Tae-won, Korea's 'Semiconductor Duo,' Head to China... What's the Status of Local Operations? [KFT Topic]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=284&h=214&m=5&simg=2026010608232205705141825007d12411124362.jpg&nmt=18)

!['Beyond Mobile to Robotics': LG Innotek Continues Portfolio Expansion [KFT Topic]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=284&h=214&m=5&simg=2026010508201109906141825007d12411124362.jpg&nmt=18)

![Doosan Enerbility Eyes Return to 'A' Credit Rating After 9 Years on Nuclear Power and Gas Turbine Boom [KFT Topic]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=284&h=214&m=5&simg=2026010208511504157141825007d12411124362.jpg&nmt=18)

!['Chung Eui-sun Declares Robot Management Era'... Hyundai Motor Group to Lead Robotics Age with 'Physical AI' [KFT Topic]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=110&h=79&m=5&simg=20260106111449071567492587736121125197123.jpg&nmt=18)

![Three Generations of Hyundai's American Challenge: From Budget Cars to Premium EVs [KFT Topic]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=110&h=79&m=5&simg=2026011209372904936141825007d12411124362.jpg&nmt=18)

![Naver hits KRW 10 trillion revenue but premium valuation in doubt [KFT Topic]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=110&h=79&m=5&simg=2026011308484406594141825007d12411124362.jpg&nmt=18)

!["Samsung Is Back," Chip Chief Declares, Eyeing Record Profit on HBM Recovery [KFT Topic]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=110&h=79&m=5&simg=2026011408580109459141825007d12411124362.jpg&nmt=18)

!['Expansion' S-OIL vs. 'Caution' GS Caltex [KFT Topic]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=110&h=79&m=5&simg=2026012010260905723141825007d12411124362.jpg&nmt=18)