이미지 확대보기

이미지 확대보기HD Hyundai plans to issue a total of KRW 150 billion in corporate bonds on the 16th. The bonds will consist of KRW 70 billion with a three-year maturity, KRW 70 billion with a five-year maturity, and KRW 10 billion with a seven-year maturity. All proceeds will be used for debt repayment. If the demand forecast on the day is successful, the issuance can be increased up to KRW 180 billion.

At that time, the company issued bonds with a spread of about 27 basis points (bp) over government bonds, allowing it to raise funds at a relatively low interest rate.

Currently, HD Hyundai’s corporate bond credit rating is ‘A+ (Stable)’. It received A+ ratings from the three major domestic credit rating agencies: Korea Ratings, Korea Investors Service, and NICE Investors Service. All maintained the regular evaluation rating received in February this year.

HD Hyundai is the pure holding company of the group, generating revenue through dividend income from affiliates, rental income from the Global Research and Development Center (GRC), and trademark income. As of the first quarter, on an individual basis, cash and cash equivalents amounted to KRW 38.3 billion, and short-term borrowings stood at KRW 1.1649 trillion.

Park Hyun-jun, chief researcher at NICE Investors Service, stated, “It is expected that the company can smoothly respond to ordinary funding needs by utilizing rental and trademark income,” and assessed that “the company’s short-term liquidity risk is very low.”

Recently, HD Hyundai announced plans to merge HD Hyundai Construction Equipment and HD Hyundai InfraCore to launch ‘HD Construction Equipment,’ which is likely to have a positive impact on HD Hyundai’s profitability improvement.

Through an integrated corporation worth KRW 8 trillion, the company can resolve business overlaps and simplify the governance structure, leading to strengthened competitiveness in the construction equipment sector and cost reduction effects.

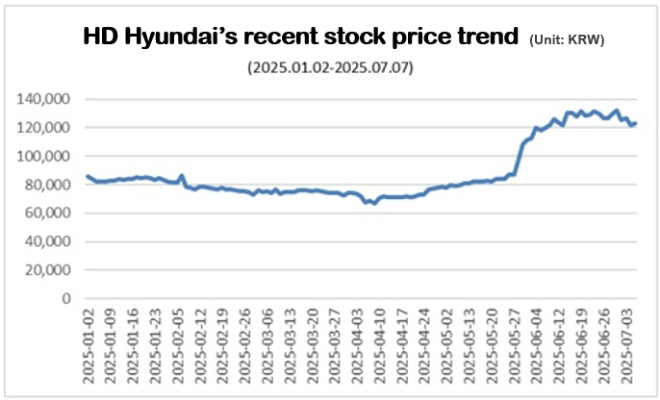

Recently, NICE Investors Service forecasted that the impact of this merger on the credit ratings of both companies would be limited and that business stability would improve. Following the announcement of the merger plan on the 1st, HD Hyundai’s stock price reached a new high for the year at KRW 132,400, and closed at KRW 134,300 on the 8th.

이미지 확대보기

이미지 확대보기Shin Haeju (hjs0509@fntimes.com)

[관련기사]

- 'From Shipbuilding to Solar'... HD Hyundai’s Chung Ki-sun vs. Hanwha’s Kim Dong-kwan in a Winner-Takes-All Showdown

- HD Hyundai, LIG, and KAI Team Up for 'Futuristic Unmanned Vessel Project' — Hanwha Left Out?

- HD Hyundai’s Two Construction Equipment Affiliates: "Even with Poor Performance, It’s for the Shareholders"

가장 핫한 경제 소식! 한국금융신문의 ‘추천뉴스’를 받아보세요~

데일리 금융경제뉴스 Copyright ⓒ 한국금융신문 & FNTIMES.com

저작권법에 의거 상업적 목적의 무단 전재, 복사, 배포 금지

![Samsung Electronics and SK Hynix Engage in High-Stakes AI Chip War [KFT Topic]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=284&h=214&m=5&simg=2026013013432407964141825007d12411124362.jpg&nmt=18)

![Hyundai Mobis Posts Record Results, Pivots to Robotics and Electrification [KFT Topic]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=284&h=214&m=5&simg=2026012911595100522141825007d12411124362.jpg&nmt=18)

![One Year In: CEO Hyun Shin-kyun Transforms LG CNS into KRW 6 Trillion AI Powerhouse [KFT Topic]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=284&h=214&m=5&simg=2026012807381208149141825007d12411124362.jpg&nmt=18)

![Samsung's 'Last Chance': Lee Jae-yong Pushes HBM4 as Make-or-Break Moment [KFT Topic]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=284&h=214&m=5&simg=2026012623242806011141825007d122461258.jpg&nmt=18)

!['Chung Eui-sun Declares Robot Management Era'... Hyundai Motor Group to Lead Robotics Age with 'Physical AI' [KFT Topic]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=284&h=214&m=5&simg=20260106111449071567492587736121125197123.jpg&nmt=18)

![Lee Jae-yong and Chey Tae-won, Korea's 'Semiconductor Duo,' Head to China... What's the Status of Local Operations? [KFT Topic]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=284&h=214&m=5&simg=2026010608232205705141825007d12411124362.jpg&nmt=18)

!['Beyond Mobile to Robotics': LG Innotek Continues Portfolio Expansion [KFT Topic]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=284&h=214&m=5&simg=2026010508201109906141825007d12411124362.jpg&nmt=18)

![Doosan Enerbility Eyes Return to 'A' Credit Rating After 9 Years on Nuclear Power and Gas Turbine Boom [KFT Topic]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=284&h=214&m=5&simg=2026010208511504157141825007d12411124362.jpg&nmt=18)

![Naver hits KRW 10 trillion revenue but premium valuation in doubt [KFT Topic]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=110&h=79&m=5&simg=2026011308484406594141825007d12411124362.jpg&nmt=18)

!["Samsung Is Back," Chip Chief Declares, Eyeing Record Profit on HBM Recovery [KFT Topic]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=110&h=79&m=5&simg=2026011408580109459141825007d12411124362.jpg&nmt=18)

![Koo Kwang-mo's Vision for AI and Robotics Drives LG Group's Transformation [KFT Topic]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=110&h=79&m=5&simg=2026012123034202714141825007d122461258.jpg&nmt=18)

!['Expansion' S-OIL vs. 'Caution' GS Caltex [KFT Topic]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=110&h=79&m=5&simg=2026012010260905723141825007d12411124362.jpg&nmt=18)

![One Year In: CEO Hyun Shin-kyun Transforms LG CNS into KRW 6 Trillion AI Powerhouse [KFT Topic]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=110&h=79&m=5&simg=2026012807381208149141825007d12411124362.jpg&nmt=18)