이미지 확대보기

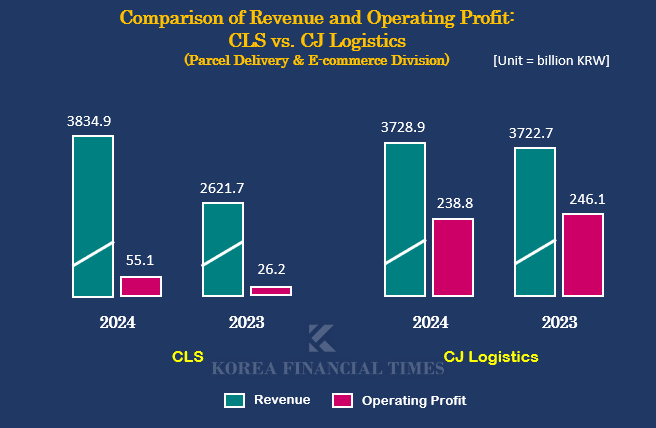

이미지 확대보기According to CLS’s audit report released on April 21, the company posted revenue of KRW3.8349 trillion last year, a 46.3% increase from the previous year. Operating profit rose by 110.1% to KRW 55.1 billion.

이미지 확대보기

이미지 확대보기During the same period, CJ Logistics’ parcel and e-commerce division recorded revenue of KRW 3.7289 trillion, a modest 0.2% year-on-year increase. However, CLS outpaced it by approximately KRW 100 billion. CJ Logistics' operating profit fell by 3% to KRW 238.8 billion.

CLS’s growth mirrors Coupang’s overall performance. Coupang reported revenue of KRW 41.2901 trillion in 2024, a 29% year-on-year increase. Notably, the commerce division closely linked to CLS—which includes Rocket Delivery, Rocket Fresh, Rocket Growth, and Marketplace—recorded KRW 36.4093 trillion in revenue, an 18% rise.

A key driver of CLS’s growth was the surge in small business partners joining Coupang’s platform. The number of registered small merchants rose from about 47,000 in 2018 to over 200,000 in 2023—more than a fourfold increase.

Significant growth in “Rocket Growth”—Coupang’s service for small merchants that handles warehousing, packaging, shipping, and returns once products are stocked—has also drawn attention. In 2023, the service facilitated transactions worth several trillion KRW, with around 1 million different small business products available. CLS’s ability to absorb the rapidly increasing delivery volume contributed to its revenue growth.

The growth rate has been striking. According to the Korea Integrated Logistics Association, CLS’s market share jumped from 12.7% at the end of 2022 to 24.1% as of August last year—almost doubling within a year. CLS surpassed Lotte Global Logistics and Hanjin Express to become the industry’s second-largest player. Meanwhile, CJ Logistics, which had maintained around 50.1% market share since 2020, saw its share drop from 40% in 2022 to 33.6% by the end of September 2024 as CLS statistics were officially included.

In the midst of fierce competition in parcel delivery, CLS’s performance is drawing heightened attention, particularly as logistics competitiveness becomes crucial in retail.

The next battleground is expected to be the “3PL” (third-party logistics) market. Since last year, CJ Logistics has been aggressively expanding its reach by forming partnerships with major retailers including Shinsegae Group, Naver, and Kurly, and by launching “7-day-a-week delivery” services.

CLS, too, is ramping up its 3PL capabilities, continuing to rely on small businesses with competitive pricing. The company’s strategy is to secure logistics volume by investing in logistics infrastructure across the country, thereby attracting more small merchants.

In 2024 alone, Coupang began construction on logistics centers in Gimcheon (North Gyeongsang Province), Gangseo (Busan), and Icheon (Gyeonggi Province), while new facilities in Cheonan, Nam Daejeon, and the Gwangju Advanced Logistics Center became operational. A sub-hub in Chilgok (North Gyeongsang Province) began operations at the end of last year, and another in Ulsan is slated for completion this year. Additionally, the company has broken ground on a state-of-the-art AI-powered logistics center in Jecheon (North Chungcheong Province) with up to KRW 100 billion in planned investment.

If product inflows from small businesses and regional farms across the country continue to grow, CLS’s upward trajectory is likely to accelerate.

An industry insider remarked, “Coupang’s dominance built on 7-day delivery has been formidable. CJ Logistics’ counterattack with its own 7-day delivery system will be a major storyline to watch this year,” adding, “As logistics competition intensifies, the key differentiator will shift to the quality of delivery services.”

Park seulgi (seulgi@fntimes.com)

[관련기사]

가장 핫한 경제 소식! 한국금융신문의 ‘추천뉴스’를 받아보세요~

데일리 금융경제뉴스 Copyright ⓒ 한국금융신문 & FNTIMES.com

저작권법에 의거 상업적 목적의 무단 전재, 복사, 배포 금지

![Tesla's Humanoid Rival Has Arrived — Boston Dynamics Eyes $70 Billion Valuation [K-Humanoid Wars, Part 1]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=284&h=214&m=5&simg=2026022010243207659141825007d12411124362.jpg&nmt=18)

![Samsung's 'Last Chance': Lee Jae-yong Pushes HBM4 as Make-or-Break Moment [KFT Topic]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=284&h=214&m=5&simg=2026012623242806011141825007d122461258.jpg&nmt=18)

![Hanwha Aerospace Stock Surges 3,500% in Six Years on 'Extraordinary Strength' [KFT Topic]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=284&h=214&m=5&simg=2026012609443900770141825007d12411124362.jpg&nmt=18)

![Tesla's Humanoid Rival Has Arrived — Boston Dynamics Eyes $70 Billion Valuation [K-Humanoid Wars, Part 1]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=110&h=79&m=5&simg=2026022010243207659141825007d12411124362.jpg&nmt=18)

!['Samsung's Bet on the Future' — Rainbow Robotics, Korea's Humanoid Pioneer [K-Humanoid Wars, Part 2]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=110&h=79&m=5&simg=2026022413501808272141825007d12411124362.jpg&nmt=18)