Naver and Daiso Strengthen Their E-commerce Strategies

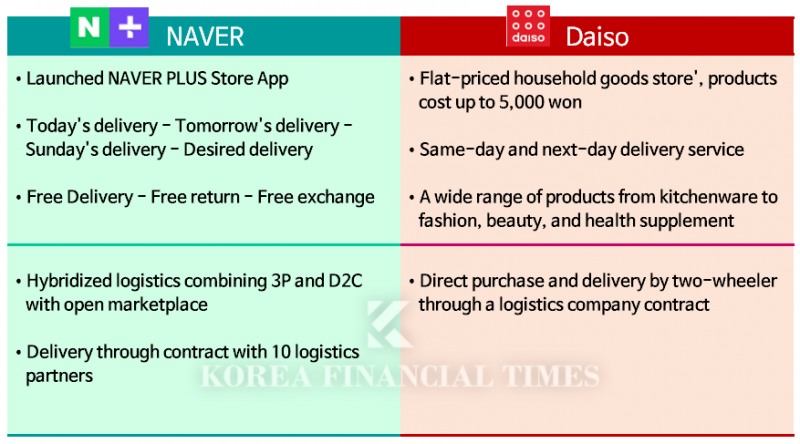

According to industry sources on the 17th, Naver and Daiso are aggressively expanding their e-commerce businesses. On March 12, Naver officially launched its "Naver Plus Store" app, while Daiso introduced its "Today Delivery" service through its online Daiso Mall.From the user's perspective, this AI-powered recommendation system enables quick and easy discovery of desired or interesting products. For sellers, it provides targeted marketing opportunities, increasing the likelihood of attracting loyal customers. Naver plans to continuously enhance its AI-based recommendation and matching capabilities.

To further strengthen its competitive edge, Naver has upgraded its "Naver Arrival Guarantee" service to "Naver Delivery (N Delivery)", improving the quality of its logistics. The service now includes categories such as same-day delivery, next-day delivery, Sunday delivery, and scheduled delivery.

Additionally, Naver has integrated the core benefits of Coupang’s WOW Membership—free shipping, free returns, and free exchanges—into the Naver Plus Store app. Naver membership holders who spend over 10,000 won can enjoy these "three free benefits."

Can Naver Become a True Rival to Coupang?

The retail industry has been closely watching Naver’s entry into the e-commerce app market, as it is considered Coupang’s strongest potential competitor. Naver, with 10 million paid subscribers, stands as a formidable platform alongside Coupang, which has 14 million paid subscribers. In terms of annual transaction volume, Naver is nearly on par with Coupang—while Coupang recorded 60 trillion won in annual transactions, Naver Commerce surpassed 50 trillion won for the first time last year.However, when it comes to revenue, Coupang remains significantly ahead. Coupang set a record in the retail industry by exceeding 41 trillion won in revenue last year, whereas Naver's commerce division generated just over 2 trillion won, nearly 20 times less than Coupang. Despite this gap, industry experts believe that the Naver Plus Store app could be a game-changer, as it now offers membership benefits and delivery services comparable to Coupang's.

The Rise of Daiso: The “Offline Coupang” Goes Online

Daiso, often referred to as the “Offline Coupang,” is also making major strides in e-commerce. While traditionally strong in brick-and-mortar retail, the company has been expanding its online presence aggressively since last year.Recently, Daiso has introduced same-day and next-day delivery services, further enhancing its competitiveness in e-commerce.

Daiso has launched a "Today Delivery" pilot program in certain districts of Gangnam, Seocho, and Songpa in Seoul. Customers who order through the Daiso Mall app before 5 PM can receive their items on the same day, with orders prepared at nearby stores. The service operates year-round, with a delivery fee of 5,500 won. Orders placed after 5 PM are delivered by 3 PM the next day via contracted logistics partners using motorcycles.

Daiso Strengthens Logistics for Greater E-commerce Impact

Daiso’s investment in logistics is expected to create greater synergy with its expanded product categories, which now include beauty, fashion, and health supplements. Beauty products, in particular, have seen overwhelming demand, frequently selling out. In an era of rising living costs, affordable yet high-quality products (priced at a maximum of 5,000 won) have resonated with consumers seeking value-for-money options.Daiso’s e-commerce growth is already visible. According to app and retail analytics firm WiseApp·Retail·Goods, Daiso Mall’s monthly active users (MAU) reached 3.35 million last year—an 81.1% increase compared to the previous year, marking an all-time high since the app's launch.

To support this expansion, Daiso is also reinforcing its logistics infrastructure. The company is constructing the Sejong Hub Center, set to be completed in January 2027, which will handle logistics for 800 Daiso stores in central South Korea. Once operational, it will distribute goods to the Chungcheong region and southern Seoul, while existing hubs in Namyangju and Busan will serve the northern Seoul, Gangwon, and Yeongnam-Honam regions.

Currently, Daiso’s logistics centers process up to 700,000 orders per day (Busan: 300,000, Namyangju: 220,000, Anseong: 180,000). Once the Sejong Hub Center is operational, it will add an additional 300,000 orders per day, ensuring stable logistics capacity.

Despite the challenges faced by traditional offline retailers, Daiso has stood out as an exception. Now, by expanding into online markets, it is emerging as an unexpected dark horse in e-commerce.

An industry expert noted, "Coupang still dominates the market with its 41-trillion-won revenue, but economic conditions and consumer behavior are shifting rapidly. It remains to be seen how Naver and Daiso will reshape the e-commerce landscape."

Park seulgi (seulgi@fntimes.com)

[관련기사]

- Naver Focuses on 'AI Enhancement,' Kakao on 'Stabilization'... Contrasting Atmospheres in Board Restructuring

- Naver's Stock on the Rise, AI Momentum Begins with Commerce

- Naver’s Lee Hae-jin Returns as Chairman of the Board After 7 Years of Seclusion… ‘AI Business Drive’

- "A Spectacular Comeback"—CJ CheilJedang’s Kang Shin-ho Expands K-Food Influence Overseas

- MBK Forced into a Corner as Homeplus Faces Corporate Rehabilitation Fallout

- 'Traders' at the Forefront, Leading E-Mart’s Performance Amid Recession

- Baemin Bum Seok Austin Kim vs. Coupang Kim Bom-Suk: A Name-dropping Delivery Competition

- [2024 Retail Review - Hypermarkets] 'Shaken' by Consumption Recession & Strength of SSM... E-Mart did Well Through Main Business Reinforcement

가장 핫한 경제 소식! 한국금융신문의 ‘추천뉴스’를 받아보세요~

데일리 금융경제뉴스 Copyright ⓒ 한국금융신문 & FNTIMES.com

저작권법에 의거 상업적 목적의 무단 전재, 복사, 배포 금지

![Tesla's Humanoid Rival Has Arrived — Boston Dynamics Eyes $70 Billion Valuation [K-Humanoid Wars, Part 1]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=284&h=214&m=5&simg=2026022010243207659141825007d12411124362.jpg&nmt=18)

![Samsung's 'Last Chance': Lee Jae-yong Pushes HBM4 as Make-or-Break Moment [KFT Topic]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=284&h=214&m=5&simg=2026012623242806011141825007d122461258.jpg&nmt=18)

![Hanwha Aerospace Stock Surges 3,500% in Six Years on 'Extraordinary Strength' [KFT Topic]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=284&h=214&m=5&simg=2026012609443900770141825007d12411124362.jpg&nmt=18)

![Tesla's Humanoid Rival Has Arrived — Boston Dynamics Eyes $70 Billion Valuation [K-Humanoid Wars, Part 1]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=110&h=79&m=5&simg=2026022010243207659141825007d12411124362.jpg&nmt=18)

!['Samsung's Bet on the Future' — Rainbow Robotics, Korea's Humanoid Pioneer [K-Humanoid Wars, Part 2]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=110&h=79&m=5&simg=2026022413501808272141825007d12411124362.jpg&nmt=18)