이미지 확대보기

이미지 확대보기On April 4, José Muñoz, President and CEO of Hyundai Motor America (HMA), and Song Ho Sung, President and CEO of Kia Corporation, stated, "We currently have no plans to raise prices in the U.S." This announcement came a day after former U.S. President Donald Trump implemented a 25% tariff on imported vehicles, signaling that the companies would not immediately respond with price hikes.

However, this does not mean that the company will fully bear the increased costs caused by the tariffs. The following day, HMA clarified through a press release that it would not raise the Manufacturer's Suggested Retail Price (MSRP) for new or leased vehicles until June 2, leaving open the possibility of price increases after that date.

Hyundai and Kia are not alone in temporarily freezing prices. Other automakers with local production facilities in the U.S., such as General Motors (GM), Toyota, and Honda, have made similar announcements. This approach appears to reflect their strategy to rely on locally produced vehicles while observing how the situation unfolds, especially since President Trump is leveraging tariffs as a negotiation tool.

In contrast, automakers with relatively lower stakes in the U.S. market have responded with immediate price hikes. Ferrari raised its vehicle prices in the U.S. by 10%, while Jaguar Land Rover announced it would suspend exports to the U.S. starting in April. Volkswagen and BMW have also informed that they will add dealer fees to export models subject to tariffs starting next month.

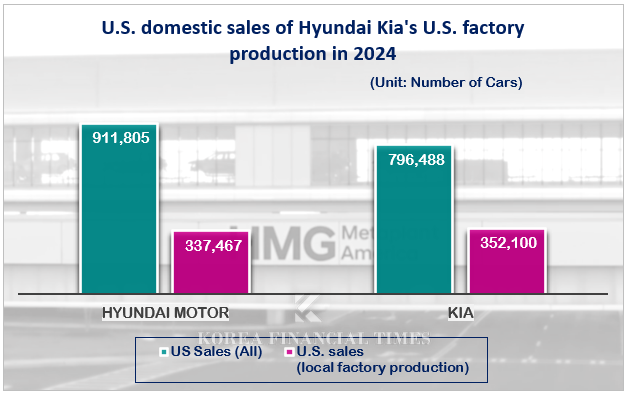

Despite their local production efforts, Hyundai and Kia face limitations in meeting U.S. demand solely with domestically produced vehicles.

At Hyundai's Alabama plant, models such as the Tucson, Santa Fe, and Genesis GV70 are manufactured. Last year, this plant produced 337,467 units for domestic sales. Given Hyundai's total U.S. sales of 911,805 units last year, only 37% of its vehicles were locally produced. Key sedan models like the Elantra (Avante) and Sonata are manufactured at Hyundai's Ulsan plant in South Korea for export. Some Tucson units are also produced at Kia's Mexico plant.

Kia's Georgia plant accounted for 352,100 units (44%) of its total U.S. sales of 796,488 units last year. Models like the Sportage, Sorento, and Telluride are produced there. Additionally, Kia's Mexico plant contributed significantly with sales of 274,490 units last year, producing key models like the K4 for the U.S. market.

이미지 확대보기

이미지 확대보기Given Hyundai and Kia's high reliance on the U.S. market, their financial performance is expected to take a hit.

According to Lee Ji-soo, an analyst at Korea Investment & Securities Co., Ltd., who analyzed various scenarios involving tariffs on Korean automakers on April 3, Hyundai is estimated to face an annual cost increase of KRW 5.145 trillion if it absorbs a 25% tariff on its exported volume of 570,000 units from South Korea. Similarly, Kia's burden is projected at KRW 3.82 trillion under the same conditions. Combined, this amounts to KRW 8.9 trillion—equivalent to 33% of both companies' combined operating profit of KRW 26.9 trillion last year.

To mitigate tariff-related costs, there is speculation that Hyundai and Kia may consider producing internal combustion engine vehicles at their recently completed eco-friendly Meta Plant America (HMGMA) in Georgia. However, Lee noted that relocating production from South Korea would require union negotiations and limit the range of models that can be produced overseas.

The industry is closely watching Hyundai and Kia's first-quarter earnings conference call scheduled for later this month. An industry insider commented, "Even if they reiterate their commitment to freezing prices until May during this call, it will likely be difficult to exclude tariff impacts from their second-quarter earnings guidance."

이미지 확대보기

이미지 확대보기Gwak Horyung (horr@fntimes.com)

[관련기사]

- "Investing Despite Trillion-KRW Losses"... Chung Eui-sun's New Business '3 Picks'

- Hyundai Motor Suffers KRW 700 Billion Loss in China, While Kia Achieves Profit Turnaround

- Hyundai Motor Group Chairman Chung Eui-sun to Receive Salary from Kia Starting This Year

- Kia also Trump Risk? What to do with the Mexican-made ‘K4’ that just started selling?

가장 핫한 경제 소식! 한국금융신문의 ‘추천뉴스’를 받아보세요~

데일리 금융경제뉴스 Copyright ⓒ 한국금융신문 & FNTIMES.com

저작권법에 의거 상업적 목적의 무단 전재, 복사, 배포 금지

!['Chung Eui-sun Declares Robot Management Era'... Hyundai Motor Group to Lead Robotics Age with 'Physical AI' [KFT Topic]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=284&h=214&m=5&simg=20260106111449071567492587736121125197123.jpg&nmt=18)

![Lee Jae-yong and Chey Tae-won, Korea's 'Semiconductor Duo,' Head to China... What's the Status of Local Operations? [KFT Topic]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=284&h=214&m=5&simg=2026010608232205705141825007d12411124362.jpg&nmt=18)

!['Beyond Mobile to Robotics': LG Innotek Continues Portfolio Expansion [KFT Topic]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=284&h=214&m=5&simg=2026010508201109906141825007d12411124362.jpg&nmt=18)

![Doosan Enerbility Eyes Return to 'A' Credit Rating After 9 Years on Nuclear Power and Gas Turbine Boom [KFT Topic]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=284&h=214&m=5&simg=2026010208511504157141825007d12411124362.jpg&nmt=18)

!['Expansion' S-OIL vs. 'Caution' GS Caltex [KFT Topic]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=110&h=79&m=5&simg=2026012010260905723141825007d12411124362.jpg&nmt=18)

![Koo Kwang-mo's Vision for AI and Robotics Drives LG Group's Transformation [KFT Topic]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=110&h=79&m=5&simg=2026012123034202714141825007d122461258.jpg&nmt=18)

![One Year In: CEO Hyun Shin-kyun Transforms LG CNS into KRW 6 Trillion AI Powerhouse [KFT Topic]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=110&h=79&m=5&simg=2026012807381208149141825007d12411124362.jpg&nmt=18)

![Samsung's 'Last Chance': Lee Jae-yong Pushes HBM4 as Make-or-Break Moment [KFT Topic]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=110&h=79&m=5&simg=2026012623242806011141825007d122461258.jpg&nmt=18)

![Kia's U.S. EV Sales Plunge 39%... What's Happening? [KFT Topic]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=110&h=79&m=5&simg=2026011909411301855141825007d12411124362.jpg&nmt=18)