이미지 확대보기

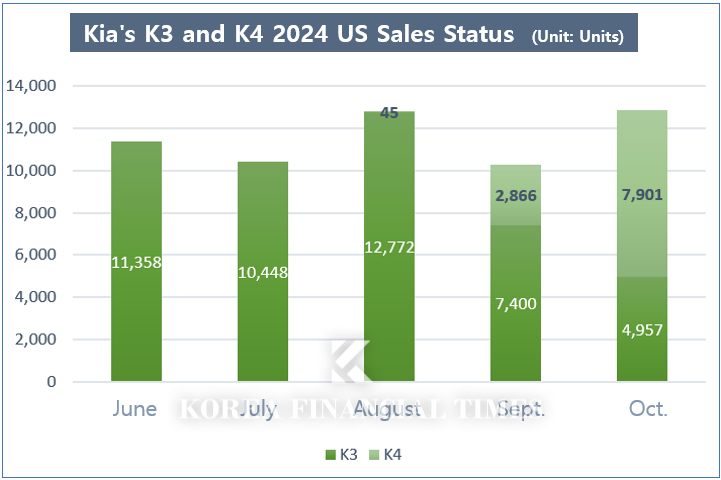

이미지 확대보기According to Kia's US sales corporation on the 18th, the K4's local sales in October were 7,901 units. Among Kia's 14 US lineups, this is the third largest after the Sportage (13,681 units) and Telluride (9,694 units). If you add in the sales of the old K3 (4,957 units), which is selling off its remaining inventory, the sales are almost on par with the Sportage.

Considering the nature of the local market, where it takes about 1-2 months for vehicles to arrive at each dealership after release, it can be said that sales began in earnest last month.

The K4 is the successor to the K3. Through the 4th generation full change (complete change), the length has been expanded by 165mm and the width by 50mm compared to the previous model. The number indicating the weight class in the car name has been changed from 3 to 4, meaning that the size has increased by about a half-weight class.

The K4 has not been released in Korea. It seems to be a measure taken in consideration of the declining popularity of domestic a compact sedans, and the fact that even those are mostly taken up by the Hyundai Avante, a competing car. The Hwaseong Plant 1 has currently stopped producing the K3 and is focusing on the mid-size SUV Sorento and the large pickup truck Tasman, which will be released early next year. The plan is to replace the compact car market with electric vehicles such as the electric SUV EV3 and electric sedan EV4.

The K4 is the core model of the Kia Mexico plant. Currently, most of the global production of the K4 is handled by the Mexican plant. The strategy is to take advantage of the geographical advantage of having lower labor costs than the US and being adjacent to the US, which is advantageous for exports.

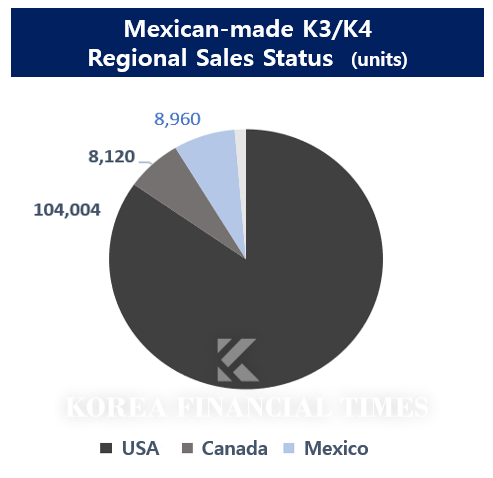

In fact, 92% of the K3 and K4 produced and sold at the Mexican factory this year (85% in the US and 7% in Canada) were exported to North America. Local sales in Mexico accounted for 7%, and the remaining volume was sold in South America and other countries.

According to Kia’s business report, the company invested KRW 186.9 billion in its Mexican plant last year. This is more than Europe and India, and the third largest after Korea and the United States. This year, Kia plans to invest KRW 388.9 billion in its Mexican plant. Of this, 74%, or KRW 286.6 billion, was invested by the end of the third quarter.

이미지 확대보기

이미지 확대보기But recently, geopolitical risks have been mounting for Kia's Mexican plants, which are at the center of its global production strategy. This is because former President Trump was re-elected earlier this month. President-elect Trump said during his campaign in Michigan last month that he would review the United States-Mexico-Canada Free Trade Agreement (USMCA). This means that tariffs could be imposed on Mexican-made cars ahead of the upcoming 2026 renegotiation talks. The agreement, which was concluded in 2018 during Trump’s first term and went into effect in 2020, includes provisions to exempt Mexican cars that contain a certain amount of North American parts.

Of course, President-elect Trump’s remarks were not aimed directly at Kia. His target was Chinese electric cars made in Mexico. His claim is that Chinese electric cars produced in Mexico are flowing into the United States. “We must protect the United States from the Chinese car threat,” said President-elect Trump, adding, “We will impose tariffs of 100%, 200%, 1,000%, whatever is necessary.”

There is a possibility that the 'tariff threat' will end up being nothing more than political rhetoric.

According to the U.S. Embassy in Mexico, Chinese companies like JAC are producing vehicles in Mexico, but these are intended for local sales in Mexico, not for export to the U.S. However, Chinese companies such as BYD and Chery are consistently exploring the possibility of setting up factories in Mexico.

Kia seems reluctant to even think about the Mexican tariff bomb. A Kia official said, “We do not adjust our production strategy considering the political situation,” and “Even when tariff issues were expected in the past (during Trump’s first term), they were rarely actually implemented.”

Gwak Horyung (horr@fntimes.com)

가장 핫한 경제 소식! 한국금융신문의 ‘추천뉴스’를 받아보세요~

데일리 금융경제뉴스 Copyright ⓒ 한국금융신문 & FNTIMES.com

저작권법에 의거 상업적 목적의 무단 전재, 복사, 배포 금지

![Tesla's Humanoid Rival Has Arrived — Boston Dynamics Eyes $70 Billion Valuation [K-Humanoid Wars, Part 1]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=284&h=214&m=5&simg=2026022010243207659141825007d12411124362.jpg&nmt=18)

![Samsung's 'Last Chance': Lee Jae-yong Pushes HBM4 as Make-or-Break Moment [KFT Topic]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=284&h=214&m=5&simg=2026012623242806011141825007d122461258.jpg&nmt=18)

![Hanwha Aerospace Stock Surges 3,500% in Six Years on 'Extraordinary Strength' [KFT Topic]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=284&h=214&m=5&simg=2026012609443900770141825007d12411124362.jpg&nmt=18)

![Tesla's Humanoid Rival Has Arrived — Boston Dynamics Eyes $70 Billion Valuation [K-Humanoid Wars, Part 1]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=110&h=79&m=5&simg=2026022010243207659141825007d12411124362.jpg&nmt=18)

!['Samsung's Bet on the Future' — Rainbow Robotics, Korea's Humanoid Pioneer [K-Humanoid Wars, Part 2]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=110&h=79&m=5&simg=2026022413501808272141825007d12411124362.jpg&nmt=18)