이미지 확대보기

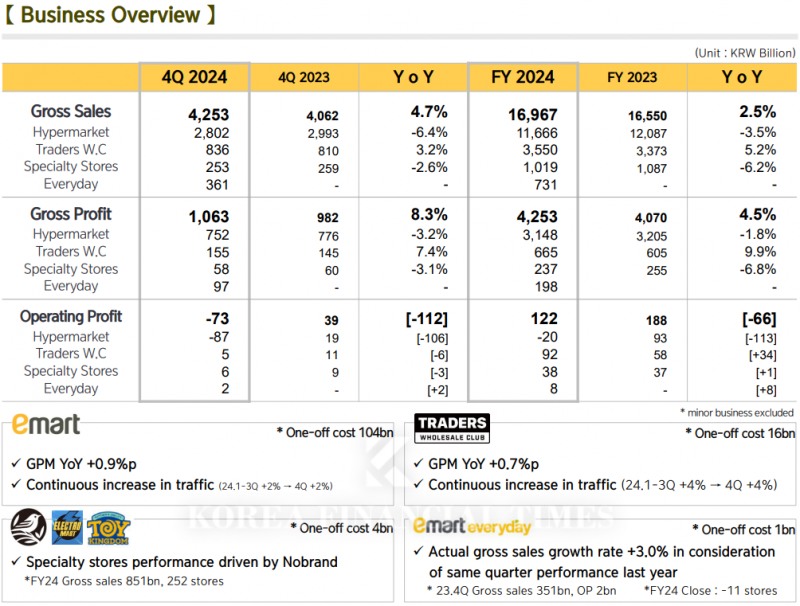

이미지 확대보기According to E-Mart on the 11th, Traders showed notable growth last year. Its annual operating profit (on a standalone basis) surged 59% year-over-year (YoY) to KRW 92.4 billion, while revenue increased by 5.2% to KRW 3.5495 trillion. The number of customers also grew by 4.8% compared to the previous year.

As e-commerce and SSMs (super supermarkets) erode the customer base of hypermarkets, Traders has emerged as a major contributor to E-Mart's performance.

이미지 확대보기

이미지 확대보기Looking at quarterly performance, Traders posted revenue of KRW 915.7 billion and an operating profit of KRW 30.6 billion in Q1 2024 (on a standalone basis), marking YoY increases of 11.9% and 313.5%, respectively. In Q2, revenue grew 3.9% to KRW 832.6 billion, while operating profit jumped 65.4% to KRW 22 billion.

For Q3, revenue increased by 2.3% to KRW 965.2 billion, and operating profit rose 30% to KRW 34.4 billion. Finally, in Q4 2023, revenue increased by 3.2% to KRW 836 billion, while operating profit declined 52.7% to KRW 5.2 billion.

Regarding Traders' growth, E-Mart explained, "In an era of high inflation, Traders’ value-for-money bulk products and differentiated product offerings have aligned with consumer needs, leading to increased customer traffic."

While the primary driver of popularity is affordable bulk products, Traders' food court, "T-Café," has also played a crucial role. Amid rising dining costs, T-Café has gained a reputation as a “cost-effective dining spot.” The double-type burger, introduced at KRW 3,500 last year, sold over 70,000 units within three weeks of launch.

Especially, T-Café continues to attract foot traffic to offline stores by regularly introducing new menu items. The buzz around its affordability draws customers to the café, leading to additional purchases at Traders and creating a spillover effect.

Another key advantage of Traders is its accessibility and ease of entry compared to other warehouse-style discount stores. Traders has the largest number of stores among domestic and international warehouse-style retailers in Korea, with 22 locations as of last year.

In comparison, Costco, the U.S. warehouse retailer operating in Korea, has 19 locations, while Lotte Mart’s warehouse-style discount store, Max, operates six locations nationwide. Additionally, unlike Costco, which requires a membership card for entry, Traders allows customers to shop without any membership fees, offering a competitive edge.

Recently, Costco announced a membership fee hike of up to 15.2% in Korea, fueling expectations that Traders may benefit from customers switching stores. This marks the first increase in seven years since 2017, and the rate is significantly higher than the 8.3% hike in the U.S. and Canada or the 9% increase in Japan. As a result, some expect a substantial number of Costco members to leave.

Meanwhile, E-Mart’s domestic competitor, Max, has not announced any new store openings since launching its Changwon Jungang branch in 2022.

E-Mart plans to capitalize on this momentum by expanding Traders’ store network. Following the opening of Traders Magok this month, the company is preparing to launch a new Guwol store in the second half of the year. An E-Mart representative stated, "Along with expanding our presence, we will further strengthen our competitive edge in the market."

Park seulgi (seulgi@fntimes.com)

[관련기사]

- Chairman Chung Yong-jin purchases all shares of Executive Chairman Lee Myung-hee… Total stake 28.56%

- Distribution CEO's Key Message for 2025... Shin Dong-bin's 'Constitution Improvement', Chung Yong-jin's 'Main Business', Chung Ji-seon's 'Cooperation'

- [2024 Retail Review - Hypermarkets] 'Shaken' by Consumption Recession & Strength of SSM... E-Mart did Well Through Main Business Reinforcement

- ‘Price destruction, strengthening of main business’ Chung Yong-jin’s ‘emergency management’… E-Mart achieves highest performance in Q3

- ‘Three Chairmen Under One Roof...’ Under General Chairman Lee Myung-hee, Chung Yong-jin of ‘E-Mart’ and Chung Yoo-kyung of ‘Shinsegae’

가장 핫한 경제 소식! 한국금융신문의 ‘추천뉴스’를 받아보세요~

데일리 금융경제뉴스 Copyright ⓒ 한국금융신문 & FNTIMES.com

저작권법에 의거 상업적 목적의 무단 전재, 복사, 배포 금지

![Tesla's Humanoid Rival Has Arrived — Boston Dynamics Eyes $70 Billion Valuation [K-Humanoid Wars, Part 1]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=284&h=214&m=5&simg=2026022010243207659141825007d12411124362.jpg&nmt=18)

![Samsung's 'Last Chance': Lee Jae-yong Pushes HBM4 as Make-or-Break Moment [KFT Topic]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=284&h=214&m=5&simg=2026012623242806011141825007d122461258.jpg&nmt=18)

![Hanwha Aerospace Stock Surges 3,500% in Six Years on 'Extraordinary Strength' [KFT Topic]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=284&h=214&m=5&simg=2026012609443900770141825007d12411124362.jpg&nmt=18)

![Tesla's Humanoid Rival Has Arrived — Boston Dynamics Eyes $70 Billion Valuation [K-Humanoid Wars, Part 1]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=110&h=79&m=5&simg=2026022010243207659141825007d12411124362.jpg&nmt=18)

!['Samsung's Bet on the Future' — Rainbow Robotics, Korea's Humanoid Pioneer [K-Humanoid Wars, Part 2]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=110&h=79&m=5&simg=2026022413501808272141825007d12411124362.jpg&nmt=18)