이미지 확대보기

이미지 확대보기Based on recent performance alone, LG Household & Health Care (LG H&H) hardly lives up to its reputation as "Korea's number one consumer goods and cosmetics company." The cosmetics division posted consecutive losses in the second and third quarters of this year, and rumors even surfaced about selling the beverage business, once considered a "cash cow." The company's market capitalization, which reached KRW 25 trillion five years ago, has shrunk to around KRW 4 trillion. The company's failure to respond nimbly to the rapidly changing global beauty and consumer goods market is cited as the root cause of this decline.

In particular, solid financial strength is cited as the foundation for future recovery. Despite shaky performance, financial stability remains intact, suggesting the company has ample capacity to support future investments and business restructuring.

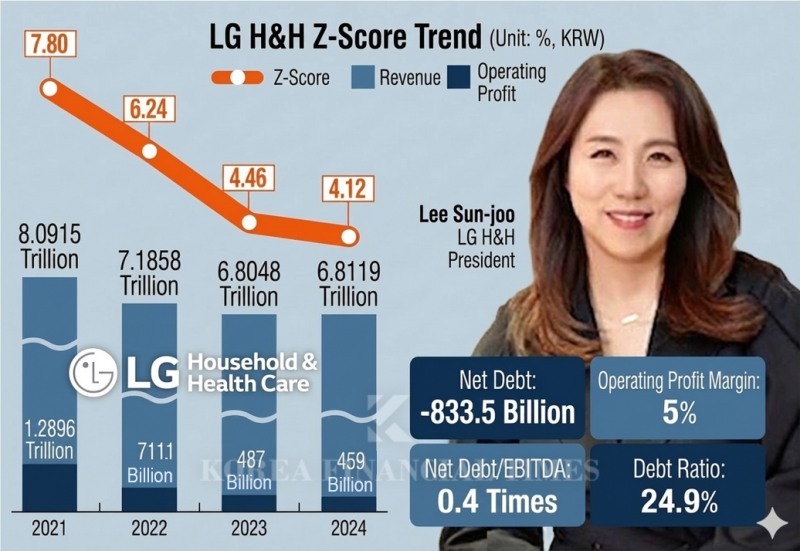

LG H&H's crisis intensified after former Vice Chairman Cha Suk-yong stepped down. LG H&H, which had achieved growth every year during the 18-year "Cha Suk-yong era," began its descent in 2022. After recording peak revenue of KRW 8.0915 trillion in 2021, the company slid to KRW 7.1858 trillion in 2022 and KRW 6.8048 trillion in 2023. Though revenue showed a slight uptick to KRW 6.8119 trillion in 2024, it remained essentially flat, leading to assessments of stagnation. Operating profit during this period plummeted from KRW 1.2896 trillion in 2021 to KRW 711.1 billion in 2022, KRW 487 billion in 2023, and KRW 459 billion in 2024.

Eventually, in the second quarter of this year, LG H&H's core beauty (cosmetics) division turned to losses. This marked the first time in approximately 20 years that the beauty division posted a loss. The division continued to record losses through the third quarter, earning LG H&H the label of being in "crisis."

While the term "poor performance" fits when looking at results alone, the story changes when examining financial indicators. LG H&H maintains solid financial stability even amid declining profitability. As of the cumulative third quarter of this year, the operating profit margin stands at 5 percent, still maintaining profitability, and the total debt-to-EBITDA ratio is just 0.4 times. The debt ratio also remains low at 24.9 percent.

The net debt structure is particularly noteworthy. LG H&H's net debt stands at negative KRW 833.5 billion, essentially operating debt-free. With more cash and cash equivalents than borrowings, financial risk remains limited even in an uncertain business environment. As of the end of September 2025, cash holdings and financial instruments total approximately KRW 1.1 trillion, with assets available as collateral estimated at around KRW 1.7 trillion. Analysts suggest the company has sufficient financial buffers to pursue investments, business restructuring, and shareholder return policies.

Financial stability is a key indicator for gauging a company's crisis response capability. The Altman Z-Score, which comprehensively evaluates this, simultaneously shows LG H&H's "decline and stability." LG H&H's Z-Score has gradually decreased from 10.60 in 2020 to 7.80 in 2021, 6.24 in 2022, 4.46 in 2023, and 4.12 in 2024.

The Altman Z-Score is one of the indicators that investors and financial institutions use to assess corporate credit risk or determine investment and lending decisions. A Z-Score above 3 is considered stable, while below 1.8 indicates high bankruptcy risk. Though there are differences by industry, business conditions, and timing, it can provide a sense of corporate competitiveness.

While LG H&H's Z-Score has dropped significantly from its peak, it remains far from the financial risk zone. Interpretations suggest the company has passed through a period of sharp performance deterioration and is now bottoming out.

In October, LG H&H embarked on management renewal by appointing Lee Sun-joo, a former L'Oréal executive and global cosmetics industry veteran, as its new CEO. While LG Group's regular personnel appointments are typically announced in November-December, LG H&H exceptionally conducted its appointment early. This is interpreted as reflecting LG H&H's sense of crisis and determination for strategic change.

Market observers suggest that while rapid high growth like in the past is difficult to expect in the short term, gradual recovery based on solid financial strength is anticipated. Though this year has been challenging with one-time costs and business restructuring, expectations are that 2026 will be a year of resurgence.

Korea Ratings said, "Gradual profitability recovery is expected as cosmetics division restructuring is completed after the first half of next year, though the magnitude of recovery will not be large," adding, "Nevertheless, the company will be able to maintain sound profitability based on diversified business and product portfolios, excellent brand recognition, and stable cost structure."

Park seulgi (seulgi@fntimes.com)

[관련기사]

- LG Household & Health Care turns to 'external DNA' to overcome crisis: can it recreate Cha Seok-yong success story?

- Why Is LG Left Behind While Holding Companies Soar?

- LG Group, 'Electronics' Defensive Power Draws Attention Amid 'Chemical' Crisis

- Trump’s Wavering Tariffs... Korean Food and Beauty Industries in Deep Concern Over Countermeasures

가장 핫한 경제 소식! 한국금융신문의 ‘추천뉴스’를 받아보세요~

데일리 금융경제뉴스 Copyright ⓒ 한국금융신문 & FNTIMES.com

저작권법에 의거 상업적 목적의 무단 전재, 복사, 배포 금지

![용산구 ‘나인원한남’ 88평, 9억 상승한 167억원에 거래 [일일 아파트 신고가]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=284&h=214&m=5&simg=2025071010042800278b372994c952115218260.jpg&nmt=18)