이미지 확대보기

이미지 확대보기The holding company SK has three main revenue streams. These are: the IT service business (SK AX) absorbed by the holding company and used to strengthen group control, royalties received from affiliates for the use of the ‘SK’ brand, and dividends received from subsidiaries or investment companies.

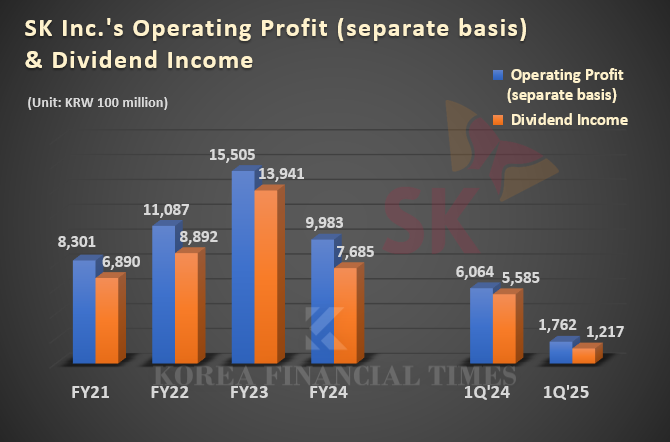

The company most responsible for this sharp decline in dividends is SK Innovation E&S. Until October last year, SK E&S was a subsidiary in which SK held a 90% stake, serving as a cash generator, but it was merged with SK Innovation.

SK does not disclose the amount of dividends received by each company, but estimates can be made based on the total dividend amount and shareholding ratios. Last year, the company received KRW 768.5 billion in dividends, with about half—KRW 360 billion—coming from SK E&S. Given the absence of E&S dividends this year, it is not surprising that operating profit has plummeted.

However, the dividend effect from E&S has not disappeared entirely, as SK still receives dividends from SK Innovation, which absorbed E&S.

Following the merger, SK’s stake in SK Innovation increased from 36.2% to 55.9%. SK Innovation has resolved to pay a dividend of KRW 2,000 per common share for 2024, with a total dividend payout of KRW 297.6 billion. Accordingly, SK is expected to receive approximately KRW 166 billion in dividends. While this is a significant reduction compared to when it held E&S directly, it is not a complete loss. The dividend was paid in April and will be reflected in second-quarter earnings, not in the first quarter.

It is worth noting that SK Innovation’s dividend decision this time was an unusual move that broke with past principles. Although the company remained profitable in 2023, it resolved to pay a ‘zero dividend’ due to a sharp drop in earnings. However, despite recording a loss in 2024, it resumed dividend payments. After the merger with SK E&S, SK Innovation’s management pledged, “We will ensure a minimum dividend of KRW 2,000 going forward.”

An industry insider commented, “Transferring E&S to SK Innovation shows the holding company’s willingness to accept short-term losses to support SK On. In the long run, it depends on whether Innovation can realize its vision as a comprehensive energy company.”

Gwak Horyung (horr@fntimes.com)

[관련기사]

- SK On Turns to Private Bonds Amid Market Challenges—Can It Stabilize Its Finances?

- SK Group Doubles Cash Generation on Semiconductor Gains... Energy Sector Increases Borrowing

- SK Innovation's Credit Rating Downgrade Spiral... Battery Division Faces KRW 1 Trillion Loss Concerns This Year

- Chairman Chey Tae-won of SK Group gives 'high praise at CES'... Who is he praising?

가장 핫한 경제 소식! 한국금융신문의 ‘추천뉴스’를 받아보세요~

데일리 금융경제뉴스 Copyright ⓒ 한국금융신문 & FNTIMES.com

저작권법에 의거 상업적 목적의 무단 전재, 복사, 배포 금지

!['From Heavy Industry to Humanoids' — Doosan Robotics Charts a New Future in Physical AI [K-Humanoid Wars, Part 3]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=284&h=214&m=5&simg=2026030310061306979141825007d12411124362.jpg&nmt=18)

!['Samsung's Bet on the Future' — Rainbow Robotics, Korea's Humanoid Pioneer [K-Humanoid Wars, Part 2]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=284&h=214&m=5&simg=2026022413501808272141825007d12411124362.jpg&nmt=18)

![Tesla's Humanoid Rival Has Arrived — Boston Dynamics Eyes $70 Billion Valuation [K-Humanoid Wars, Part 1]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=284&h=214&m=5&simg=2026022010243207659141825007d12411124362.jpg&nmt=18)

![Samsung's 'Last Chance': Lee Jae-yong Pushes HBM4 as Make-or-Break Moment [KFT Topic]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=284&h=214&m=5&simg=2026012623242806011141825007d122461258.jpg&nmt=18)

![Tesla's Humanoid Rival Has Arrived — Boston Dynamics Eyes $70 Billion Valuation [K-Humanoid Wars, Part 1]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=110&h=79&m=5&simg=2026022010243207659141825007d12411124362.jpg&nmt=18)

!['Samsung's Bet on the Future' — Rainbow Robotics, Korea's Humanoid Pioneer [K-Humanoid Wars, Part 2]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=110&h=79&m=5&simg=2026022413501808272141825007d12411124362.jpg&nmt=18)