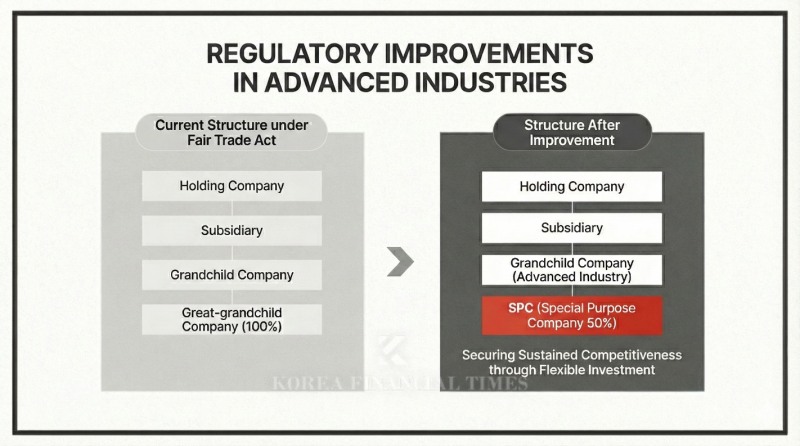

The government is pursuing a plan to ease the mandatory equity ratio for great-grandchild companies of grandchild companies in the semiconductor sector from 100% to 50% or more through special provisions under the National Advanced Strategic Industries Act. The final plan is scheduled to be confirmed by the National Assembly.

이미지 확대보기

이미지 확대보기SK Hynix currently has abundant cash thanks to the recent semiconductor boom. As of the end of the third quarter, cash and cash equivalents (including short-term financial instruments) stood at KRW 27.854 trillion, a 2.6-fold surge from KRW 10.858 trillion a year earlier. However, the company maintains that its own cash alone is insufficient for the investment amount that must be injected immediately to gain an edge in the global AI speed race.

Chey Tae-won, Chairman of SK Group, met with President Lee Jae-myung in mid-last month and stated, "KRW 600 trillion in investment in the Yongin semiconductor fab alone will continue going forward." This represents a five-fold increase from the KRW 120 trillion projected investment announced in 2019. In mid-this month, Kwak Noh-jung, CEO of SK Hynix, also told President Lee, "If we wait to earn money before investing, we'll miss the timing." President Lee responded, "We discussed the funding investment issue I talked about with Chairman Chey," adding, "It makes sense."

As regulatory easing subsequently gained momentum, some political circles and civic groups raised claims that "Isn't this customized preferential treatment for SK?"

In response, SK Hynix posted fact-check materials on its website and YouTube, stating, "This is a fundamental question of how to make advanced industry investment sustainable in a rapidly changing environment," and "It's not about a specific company or individual case." Regarding criticisms about undermining the principle of separation between financial and industrial capital, the company countered, "This is a temporary structure for investing in large-scale production facilities like semiconductor factories," and "It is completely different in nature from means to expand business areas or change governance structures."

이미지 확대보기

이미지 확대보기Gwak Horyung (horr@fntimes.com)

[관련기사]

- SK Hynix's Five-President Team Set to Usher in KRW 100 Trillion Profit Era

- 'AI Core' HBM4 Competition Strategy Poles Apart: Samsung Electronics 'Solo' vs SK Hynix 'Alliance'

- "Finally Like Buffett": SK Sheds Risks, Value-Up 2.0 Expectations Rise

- Samsung Electronics and SK Hynix Eye KRW 150 Trillion Operating Profit Era

가장 핫한 경제 소식! 한국금융신문의 ‘추천뉴스’를 받아보세요~

데일리 금융경제뉴스 Copyright ⓒ 한국금융신문 & FNTIMES.com

저작권법에 의거 상업적 목적의 무단 전재, 복사, 배포 금지

!['From Heavy Industry to Humanoids' — Doosan Robotics Charts a New Future in Physical AI [K-Humanoid Wars, Part 3]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=284&h=214&m=5&simg=2026030310061306979141825007d12411124362.jpg&nmt=18)

!['Samsung's Bet on the Future' — Rainbow Robotics, Korea's Humanoid Pioneer [K-Humanoid Wars, Part 2]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=284&h=214&m=5&simg=2026022413501808272141825007d12411124362.jpg&nmt=18)

![Tesla's Humanoid Rival Has Arrived — Boston Dynamics Eyes $70 Billion Valuation [K-Humanoid Wars, Part 1]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=284&h=214&m=5&simg=2026022010243207659141825007d12411124362.jpg&nmt=18)

![Samsung's 'Last Chance': Lee Jae-yong Pushes HBM4 as Make-or-Break Moment [KFT Topic]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=284&h=214&m=5&simg=2026012623242806011141825007d122461258.jpg&nmt=18)

![Tesla's Humanoid Rival Has Arrived — Boston Dynamics Eyes $70 Billion Valuation [K-Humanoid Wars, Part 1]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=110&h=79&m=5&simg=2026022010243207659141825007d12411124362.jpg&nmt=18)

!['Samsung's Bet on the Future' — Rainbow Robotics, Korea's Humanoid Pioneer [K-Humanoid Wars, Part 2]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=110&h=79&m=5&simg=2026022413501808272141825007d12411124362.jpg&nmt=18)