이미지 확대보기

이미지 확대보기While shareholders may welcome the rally, the mood among employees is uneasy. There is growing concern that political interference could undermine the competitiveness of Korea’s shipping industry.

The controversy centers on Lee’s claim that “HMM employees also agreed to the headquarters relocation.” However, both of HMM’s main unions—the Korea Financial Industry Union HMM Branch (onshore union) and the HMM Seafarers’ Union (offshore union)—have stated, “We have never met nor agreed to this proposal”. In fact, to reassure shocked employees, the onshore union reportedly sent an email to all staff clarifying that there had been no agreement to the move.

This is not the first time the idea of moving HMM’s headquarters to Busan has surfaced. Lee Jae-myung made a similar pledge during the 2022 presidential election, aiming to turn Busan into a shipping industry hub. Ahead of last year’s April general election, he also advocated relocating the Korea Development Bank (KDB) and HMM, in which KDB is the largest shareholder, to Busan.

Although HMM is a private company, the government currently owns over 70% of its shares, with KDB holding 36.02% and the Korea Ocean Business Corporation 35.67%. Lee Jae-myung has stated, “With government investment and support, if we make up our minds, relocating to Busan is not impossible.”

This ownership structure dates back to 2016, when the government injected public funds to rescue Hyundai Merchant Marine (now HMM) after the bankruptcy of Hanjin Shipping. KDB became the largest shareholder through debt-to-equity swaps and convertible bonds.

Industry insiders argue that the government’s stake should eventually be privatized, and that KDB is not a suitable long-term owner. They also question the business rationale for relocating HMM’s headquarters, noting that shipping is a sales-driven industry and that most key clients and financial institutions are based in Seoul, not Busan. “Unlike airlines, shipping companies operate circular routes with multiple ports of call, so there is little geographic or economic advantage to having the headquarters in Busan,” said one industry official.

As of the end of last year, HMM had 1,824 employees, including regular and contract staff. Of these, 1,063 were onshore staff based in Seoul, and 827 were seafaring crew, with onshore staff accounting for just over 58%.

이미지 확대보기

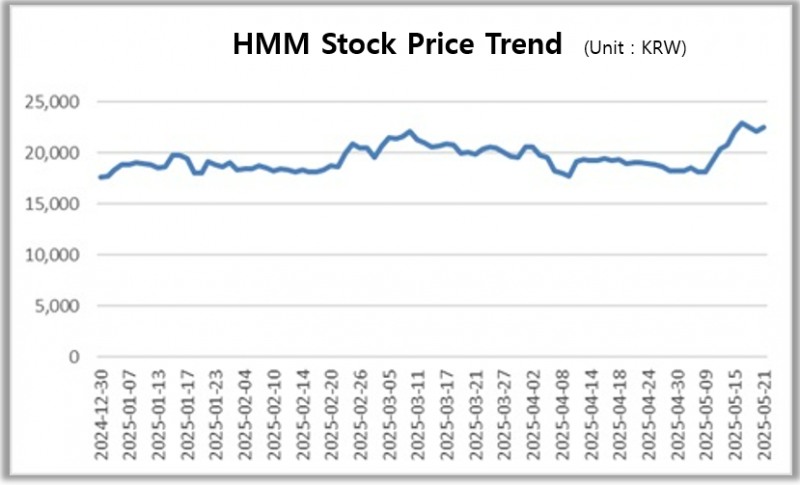

이미지 확대보기Despite the internal turmoil, HMM’s stock price surged 6.49% to KRW 22,150 on May 15, the day after Lee’s campaign rally. It marks the second-highest gain for the stock so far this year.

However, the stock’s rise also appears to reflect HMM’s solid performance in the first quarter. On May 14, just 30 minutes before the market closed, the company released its quarterly report. HMM posted revenue of 2.8547 trillion KRW and an operating profit of 613.9 billion KRW in the first quarter of this year. Revenue increased by 22.52% year-on-year, while operating profit surged by 50.84%.

Regardless of the reasons, HMM’s stock has maintained its momentum, closing at a record high of KRW 22,950 on May 16, and ending at KRW 22,100 on May 20 and KRW 22,350 on May 21.

Adding to the positive sentiment, NICE Investors Service upgraded HMM’s credit rating by two notches from ‘A- (Stable)’ to ‘A+ (Stable)’ on May 19.

HMM now boasts cash and cash equivalents of KRW 3.1303 trillion as of the end of March, up 192.41% year-on-year, putting its liquidity on par with global shipping giants.

Shin Haeju (hjs0509@fntimes.com)

가장 핫한 경제 소식! 한국금융신문의 ‘추천뉴스’를 받아보세요~

데일리 금융경제뉴스 Copyright ⓒ 한국금융신문 & FNTIMES.com

저작권법에 의거 상업적 목적의 무단 전재, 복사, 배포 금지

![Samsung Electronics and SK Hynix Engage in High-Stakes AI Chip War [KFT Topic]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=284&h=214&m=5&simg=2026013013432407964141825007d12411124362.jpg&nmt=18)

![Hyundai Mobis Posts Record Results, Pivots to Robotics and Electrification [KFT Topic]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=284&h=214&m=5&simg=2026012911595100522141825007d12411124362.jpg&nmt=18)

![One Year In: CEO Hyun Shin-kyun Transforms LG CNS into KRW 6 Trillion AI Powerhouse [KFT Topic]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=284&h=214&m=5&simg=2026012807381208149141825007d12411124362.jpg&nmt=18)

!['Chung Eui-sun Declares Robot Management Era'... Hyundai Motor Group to Lead Robotics Age with 'Physical AI' [KFT Topic]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=284&h=214&m=5&simg=20260106111449071567492587736121125197123.jpg&nmt=18)

![Lee Jae-yong and Chey Tae-won, Korea's 'Semiconductor Duo,' Head to China... What's the Status of Local Operations? [KFT Topic]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=284&h=214&m=5&simg=2026010608232205705141825007d12411124362.jpg&nmt=18)

!['Beyond Mobile to Robotics': LG Innotek Continues Portfolio Expansion [KFT Topic]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=284&h=214&m=5&simg=2026010508201109906141825007d12411124362.jpg&nmt=18)

![Doosan Enerbility Eyes Return to 'A' Credit Rating After 9 Years on Nuclear Power and Gas Turbine Boom [KFT Topic]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=284&h=214&m=5&simg=2026010208511504157141825007d12411124362.jpg&nmt=18)

!["Samsung Is Back," Chip Chief Declares, Eyeing Record Profit on HBM Recovery [KFT Topic]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=110&h=79&m=5&simg=2026011408580109459141825007d12411124362.jpg&nmt=18)

![Koo Kwang-mo's Vision for AI and Robotics Drives LG Group's Transformation [KFT Topic]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=110&h=79&m=5&simg=2026012123034202714141825007d122461258.jpg&nmt=18)

!['Expansion' S-OIL vs. 'Caution' GS Caltex [KFT Topic]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=110&h=79&m=5&simg=2026012010260905723141825007d12411124362.jpg&nmt=18)

![One Year In: CEO Hyun Shin-kyun Transforms LG CNS into KRW 6 Trillion AI Powerhouse [KFT Topic]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=110&h=79&m=5&simg=2026012807381208149141825007d12411124362.jpg&nmt=18)

![Samsung's 'Last Chance': Lee Jae-yong Pushes HBM4 as Make-or-Break Moment [KFT Topic]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=110&h=79&m=5&simg=2026012623242806011141825007d122461258.jpg&nmt=18)