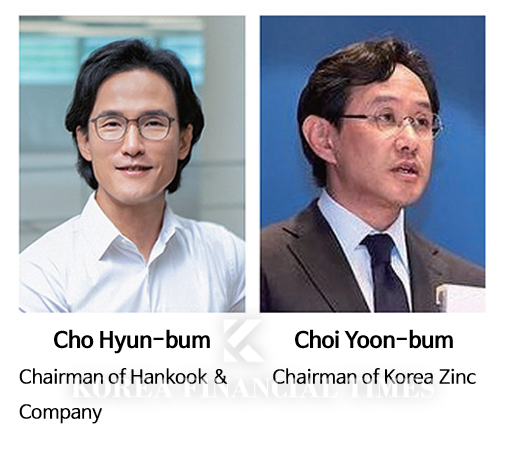

Hankook Tire, the core subsidiary of Chairman Cho Hyun-bum’s Hankook & Company Group, recorded consolidated sales of KRW 9.4119 trillion and an operating profit of KRW 1.7622 trillion in 2024. These figures mark a 5% increase in sales and a 33% surge in operating profit compared to the company’s best-ever performance in 2023.

The company also performed well in the electric vehicle (EV) market, which has been experiencing a temporary slowdown. The proportion of EV-specific tires in its original equipment (OE) tire sales jumped from 15% at the end of 2023 to 22% by the end of 2024, a seven-percentage-point increase. Securing major automakers like Hyundai, Kia, Tesla, and BYD as customers was key to this growth.

To support this expansion, Hankook Tire launched ‘iON,’ the world’s first full lineup of EV-dedicated tires for summer, all-season, and winter conditions.

Korea Zinc, led by Chairman Choi Yoon-bum, also posted solid results despite a challenging business environment. In 2024, the company’s consolidated sales reached KRW 12.0828 trillion, a 25% increase from the previous year, while operating profit rose 11.5% to KRW 736.1 billion.

Korea Zinc acknowledged difficulties in maintaining profitability due to declining non-ferrous metal prices and lower refining fees in Q4 2024. However, it exceeded its business plan targets for key products on an annual basis: zinc (113.9%), lead (100.7%), and silver (124.5%).

Uncertainties in the global economy are expected to persist this year. Nevertheless, Korea Zinc sees opportunities to expand its business due to the shutdown or downsizing of competing smelters overseas, production halts at domestic rival Young Poong Corporation, and China’s export restrictions on rare metals to the U.S.

An industry insider noted, “Owner-led management has the advantage of enabling large-scale investments with a long-term perspective. Under a professional management system that is judged on short-term performance, such bold decisions are difficult to make quickly.”

Chairman Cho Hyun-bum finalized the acquisition of Hanon Systems in November 2024, aiming to expand the group’s focus from automotive tires to thermal management systems. His vision is to transform Hankook & Company into a leading mobility group for the EV era, despite concerns about the high acquisition cost and potential financial strain.

Similarly, Chairman Choi Yoon-bum is advancing what he calls the ‘Troika Initiative,’ which focuses on hydrogen, battery materials, and resource recycling. However, MBK Partners has leveraged concerns over Korea Zinc’s financial structure to mount an attack on its leadership.

That said, owner-led management has also faced criticism for its lack of shareholder-friendly policies. Hankook & Company perfected its governance through so-called “treasury stock trick,” which restored treasury stock voting rights in the Hankook & Company-Hankook Tire spinoff in 2021.

Additionally, Hankook Tire’s acquisition of Hanon Systems was blamed for a decline in its stock price. Meanwhile, Korea Zinc’s Chairman Choi Yoon-bum faced backlash after attempting to raise KRW 2.5 trillion through a rights issue to defend his leadership. He was ultimately forced to withdraw the plan and issue an apology following opposition from investors and government intervention.

Gwak Horyung (horr@fntimes.com)

[관련기사]

- Korea Zinc to vote on shareholders' meeting next week...depends on National Pension, overseas institutions

- “To pay for the management control dispute...” Korea Zinc's interest costs soar as it pays 7% annualized interest rate on loan

- Korea Zinc Expects Shareholder Return Due to Strong Earnings...

- [2024 Retail Review - Hypermarkets] 'Shaken' by Consumption Recession & Strength of SSM... E-Mart did Well Through Main Business Reinforcement

가장 핫한 경제 소식! 한국금융신문의 ‘추천뉴스’를 받아보세요~

데일리 금융경제뉴스 Copyright ⓒ 한국금융신문 & FNTIMES.com

저작권법에 의거 상업적 목적의 무단 전재, 복사, 배포 금지

![Tesla's Humanoid Rival Has Arrived — Boston Dynamics Eyes $70 Billion Valuation [K-Humanoid Wars, Part 1]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=284&h=214&m=5&simg=2026022010243207659141825007d12411124362.jpg&nmt=18)

![Samsung's 'Last Chance': Lee Jae-yong Pushes HBM4 as Make-or-Break Moment [KFT Topic]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=284&h=214&m=5&simg=2026012623242806011141825007d122461258.jpg&nmt=18)

![Hanwha Aerospace Stock Surges 3,500% in Six Years on 'Extraordinary Strength' [KFT Topic]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=284&h=214&m=5&simg=2026012609443900770141825007d12411124362.jpg&nmt=18)

![Tesla's Humanoid Rival Has Arrived — Boston Dynamics Eyes $70 Billion Valuation [K-Humanoid Wars, Part 1]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=110&h=79&m=5&simg=2026022010243207659141825007d12411124362.jpg&nmt=18)

!['Samsung's Bet on the Future' — Rainbow Robotics, Korea's Humanoid Pioneer [K-Humanoid Wars, Part 2]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=110&h=79&m=5&simg=2026022413501808272141825007d12411124362.jpg&nmt=18)