이미지 확대보기

이미지 확대보기Officials from major power generation markets including Mexico and Indonesia are visiting Doosan Enerbility's Changwon plant to directly inspect gas turbines and core component production lines, showing high interest.

Doosan Enerbility is considering entry into Mexico's combined-cycle power generation market as a key task following this visit.

On November 6, officials from PLN Indonesia Power (PLN IP), a subsidiary of Indonesia's state electricity company PLN, visited Changwon to intensively inspect gas turbine core components such as Hot Section Parts and combustors (FSFL). As Indonesia is pursuing gas power expansion and Small Modular Reactor (SMR) introduction according to its Electricity Supply Business Plan (RUPTL), collaboration possibilities with Doosan Enerbility are growing. The company plans to strengthen cooperation in gas combined-cycle and Engineering, Procurement, and Construction (EPC) fields.

Foreign governments and public institutions are actively conducting on-site verification of Doosan Enerbility due to a combination of Korean gas turbine technology capabilities and global supply shortages.

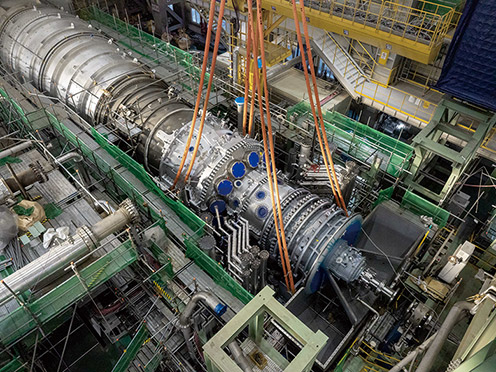

Doosan Enerbility completed technology development in 2019 and proved performance by commercially operating its self-developed large gas turbine at Gimpo Combined Heat and Power Plant in July 2023. Based on this, the company has secured total domestic projects exceeding 2.5 gigawatts (GW), including 1 unit in 2023 and 4 units in 2024, for projects such as Boryeong New Combined, Andong Combined, Bundang Heat & Power Modernization, Haman Combined, and Yeosu Combined.

The U.S. export contract signed last month is also cited as a factor increasing overseas interest. Doosan Enerbility signed a contract to supply two 380 megawatt (MW)-class gas turbines to a major U.S. tech company.

이미지 확대보기

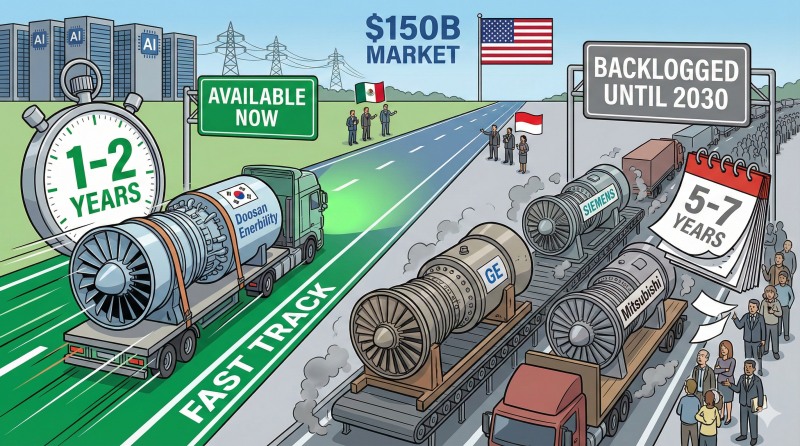

이미지 확대보기Gas turbines are core equipment for gas combined-cycle power generation using liquefied natural gas (LNG) as fuel, producing about half the carbon dioxide emissions compared to coal. They are evaluated as a major power source in the energy transition era because they can quickly adjust output and complement renewable energy sources like solar and wind, which have high variability. According to market research firm Fortune Business Insights, the global gas turbine market size is estimated to reach USD 150 billion (approximately KRW 200 trillion).

Only five companies worldwide can supply large gas turbines: Doosan Enerbility, GE Vernova, Siemens Energy, Mitsubishi, and Ansaldo Energia.

Particularly, while the lead time (delivery period) of the so-called "Big 3" companies in the global gas turbine market—GE, Siemens, and Mitsubishi—has recently extended to 5-7 years due to increased data center power demand, Doosan Enerbility is attracting attention with its remarkable "delivery competitiveness."

Na Min-sik, an analyst at SK Securities, stated, "Due to the surge in AI data center power demand, the three companies GE, Siemens, and Mitsubishi are contracting for deliveries up to 2030," and "The situation where lead times are lengthening due to surging demand and limited production capacity is becoming an opportunity for Doosan Enerbility."

He noted, "Doosan Enerbility contracted two 380MW-class units with a U.S. big tech company, with delivery scheduled for the end of 2026," and "While the Big 3 global companies' average lead time reaches 5 years, Doosan Enerbility can supply within 1 year. Considering delivery competitiveness, we expect large gas turbine orders for North American big tech companies to gain momentum in 2026."

Jung Hye-jung, an analyst at KB Securities, also stated, "Doosan Enerbility's greatest competitiveness is fast delivery," explaining, "While lead times for H-class large gas turbines from major manufacturers have extended up to 7 years as LNG combined-cycle power generation demand increases in the Middle East and U.S., Doosan can supply within 1-2 years."

Analyst Jung also noted, "The minimum condition for safety verification—15,000 hours of demonstration operation—was met at Gimpo Combined Heat and Power Plant," and "Gas turbine orders to the U.S., starting with this contract, are expected to expand in earnest, and with negotiations underway for 8 or more units with multiple big tech companies, additional orders are expected by year-end and next year."

Doosan Enerbility plans to expand production capacity from the current approximately 6 units annually to 8 units next year and 12 units by 2028. A Doosan Enerbility official said, "The visits by Mexican and Indonesian government officials and U.S. export achievements are cases that prove not only technology reliability but also global business capabilities simultaneously," adding, "We will contribute to strengthening the global competitiveness of Korea's heavy industry ecosystem by expanding cooperation with major overseas power generation markets."

Shin Haeju (hjs0509@fntimes.com)

[관련기사]

가장 핫한 경제 소식! 한국금융신문의 ‘추천뉴스’를 받아보세요~

데일리 금융경제뉴스 Copyright ⓒ 한국금융신문 & FNTIMES.com

저작권법에 의거 상업적 목적의 무단 전재, 복사, 배포 금지

!['Chung Eui-sun Declares Robot Management Era'... Hyundai Motor Group to Lead Robotics Age with 'Physical AI' [KFT Topic]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=284&h=214&m=5&simg=20260106111449071567492587736121125197123.jpg&nmt=18)

![Lee Jae-yong and Chey Tae-won, Korea's 'Semiconductor Duo,' Head to China... What's the Status of Local Operations? [KFT Topic]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=284&h=214&m=5&simg=2026010608232205705141825007d12411124362.jpg&nmt=18)

!['Beyond Mobile to Robotics': LG Innotek Continues Portfolio Expansion [KFT Topic]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=284&h=214&m=5&simg=2026010508201109906141825007d12411124362.jpg&nmt=18)

![Doosan Enerbility Eyes Return to 'A' Credit Rating After 9 Years on Nuclear Power and Gas Turbine Boom [KFT Topic]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=284&h=214&m=5&simg=2026010208511504157141825007d12411124362.jpg&nmt=18)

![Hyundai Mobis Posts Record Results, Pivots to Robotics and Electrification [KFT Topic]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=110&h=79&m=5&simg=2026012911595100522141825007d12411124362.jpg&nmt=18)