이미지 확대보기

이미지 확대보기A U.S. Defense-Recognized AI Data Company

Palantir is an artificial intelligence (AI)-based data analytics software company founded in 2003 by Peter Thiel, Alex Karp, and others. The company’s name was inspired by the “palantíri,” the far-seeing stones in J. R. R. Tolkien’s The Lord of the Rings. 이미지 확대보기

이미지 확대보기Today, Palantir’s major customers reportedly include the U.S. Department of Defense (DoD), CIA, FBI, DHS, NSA, and FDA, as well as the U.K.’s Secret Intelligence Service (SIS), totaling 367 organizations.

Palantir has developed software that integrates and analyzes vast, dispersed data to identify threats in advance, applying it to national security. The company gained attention after it was revealed to have contributed to the May 2, 2011 operation in which U.S. special forces eliminated Osama bin Laden at a residence in Abbottabad, Pakistan. Palantir uncovered terrorist networks and hidden connections through intelligence collection and analysis. Its AI-enabled military-strategy technologies are currently used in war-torn countries such as Ukraine and Israel. The company has also reportedly contributed to crime pattern analysis for the Los Angeles Police Department and cyber fraud response at JPMorgan Chase.

Palantir founder Peter Thiel has made his political stance explicit, saying, “We support the prosperity and growth of the West. We will not sell our programs to adversaries such as China and Russia.”

“

We Endured Years of Ridicule” — Growth That Converted the Skeptics

On the 2nd (local time), Palantir closed at USD 157.09 (approximately KRW 219,298) on the Nasdaq Stock Market. Its initial reference price at the time of its Nasdaq listing on September 30, 2020, was USD 10. 이미지 확대보기

이미지 확대보기Palantir recorded second-quarter revenue of USD 1.0 billion (approximately KRW 1.386 trillion) this year. The market had expected Palantir to reach the USD 1.0 billion quarterly revenue milestone in the fourth quarter, but analyses suggest that policy tailwinds from the Donald Trump administration pulled the timeline forward by two quarters.

Palantir is expected to continue posting steady revenue growth on the back of U.S. government contracts. According to the Washington Post on July 31 (local time), Palantir signed a major contract with the U.S. Army worth up to USD 10 billion (approximately KRW 14 trillion) over ten years.

Palantir CEO Alex Karp said in a letter to shareholders, “After years of investment and enduring ridicule, our business growth is now accelerating sharply; the skeptics have lost their power and capitulated.” He added, “The advent of large language models (LLMs), the chips that run them, and our software infrastructure are meshing to sustain a steep growth trajectory.”

Core Technology: A Data Analytics Platform Spanning Defense and the Private Sector

Palantir’s core software is Gotham. Gotham launched in 2008 for defense and intelligence agencies in collaboration with the CIA and designed to address post‑9/11 data-collection challenges. By visualizing maps, graphs and timelines, Gotham helps reveal hidden patterns and networks; it was cited in identifying bin Laden’s hideout and has been applied in the Russia–Ukraine war.The software that propelled Palantir’s explosive growth is Ontology. Ontology goes beyond analysis to model the meaning and relationships of discrete data—integrating heterogeneous sources such as spreadsheets, PDFs and images into a single schema to accelerate decision-making. One cited case: AT&T reportedly compressed a new-line installation project from about five years to three months using this approach.

To expand from a government-centric platform into one for private, Palantir introduced Foundry. The platform is used by hundreds of companies—including Morgan Stanley, Merck and Airbus—across sectors such as energy, aviation, shipbuilding and manufacturing. Revenue growth has been steeper in the commercial segment than in the government segment, and global commercial revenue has increased by more than 50% in just one year.

Why Is It Drawing Attention in Korea?

In the 21st century, the national security paradigm is rapidly shifting from hardware-centric approaches to software, data, and AI. In the defense industry, competitiveness is increasingly seen as hinging on software-based operating systems that fuse data and support AI-driven decision-making rather than on platform manufacturing capabilities alone.In Korea as well, the importance of AI and data is growing. Recently, in response to intensifying global AI competition, the Lee Jae-myung administration established a presidential committee to oversee national AI policy.

이미지 확대보기

이미지 확대보기Domestic information technology (IT) companies are racing to secure proprietary datasets. Their goal is to enhance corporate competitiveness by building AI capabilities on top of the data they have secured.

To achieve these goals, building AI infrastructure is foundational, and there are signs of companies moving in step with Palantir’s capabilities, which specialize in AI-based data analytics.

Palantir has noted that Korea’s AI market is growing rapidly and that there is strong demand for AI and data analytics solutions across a variety of sectors, including manufacturing, finance, and defense.

In particular, while Korea has strengths in semiconductors and 5G, its AI ecosystem is still in a developmental stage. Palantir is therefore pursuing a strategy of providing customized AI solutions and leading AI innovation through partnerships with local companies.

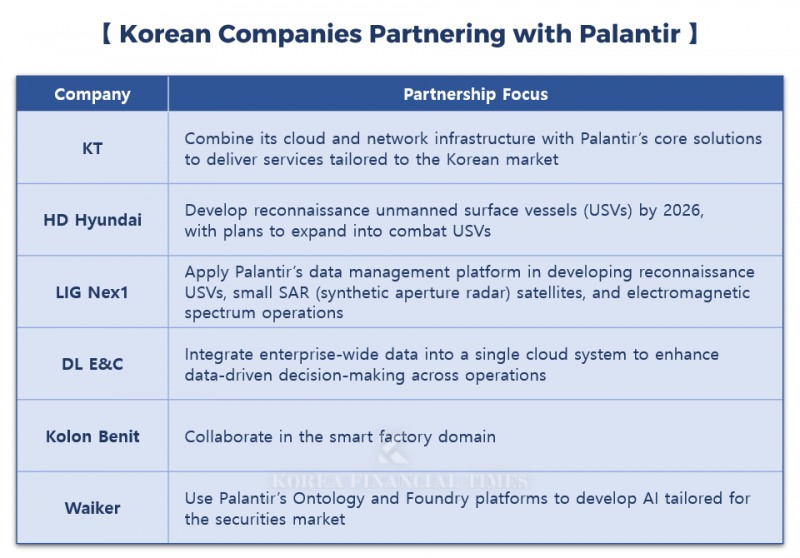

For example, KT, HD Hyundai, LIG Nex1, DL E&C, Kolon Benit, and the AI startup Waiker have each signed technology collaboration partnerships with Palantir.

In March, KT became Palantir’s first premium partner in Korea. KT plans to combine its cloud and network infrastructure with Palantir’s core solutions to provide services optimized for the Korean market.

Earlier, in April last year, HD Hyundai signed a memorandum of understanding with Palantir to develop an unmanned surface vessel (USV). The two companies plan to develop a reconnaissance USV capable of leading the global market by 2026 and subsequently expand development to combat USVs.

LIG Nex1 also signed an agreement with Palantir to utilize a big-data platform for future weapon systems in August last year. LIG Nex1 plans to apply Palantir’s data management platform to the development of reconnaissance USVs, small synthetic aperture radar (SAR) satellites, mine countermeasures, and electromagnetic spectrum operations (EMSO).

In 2022, DL E&C became the first in the construction industry to partner with Palantir to build “D-Lake,” a big-data-driven management platform. Through this system, the company integrates enterprise-wide data in a single cloud and aims to advance data-driven decision-making across all functions, including customer, product, design, construction, quality, and safety.

In addition, in November last year, Kolon Benit, the IT services arm of Kolon Group, signed a partnership with Palantir for collaboration in the smart factory domain. Last month, Waiker, a company specializing in AI application model development, began developing AI tailored to the securities market using Palantir’s Ontology and Foundry platforms.

An industry official said, “The reason Korean companies are partnering with Palantir is that customized AI data analytics and decision-automation capabilities are essential to digital transformation and enhanced competitiveness in Korea’s industries,” adding, “These are strategic choices aimed at achieving both business expansion and technological advancement in the domestic AI market.”

Jeong Chaeyun (chaeyun@fntimes.com)

[관련기사]

- K-Defense Gets an AI Boost as HD Hyundai and LIG Nex1 Join Forces with Palantir

- After Missing Out on State-Backed AI Project and Being Left Out of US Delegation, What’s Next for KT CEO Kim Young-shub?

- Why Did Kakao and KT Fall Short Against Naver and SKT in Korea’s ‘National AI’ Selection?

- HD Hyundai Raises KRW 150 Billion… How Much Synergy Will the Merger of Construction Equipment · InfraCore Bring?

- 'From Shipbuilding to Solar'... HD Hyundai’s Chung Ki-sun vs. Hanwha’s Kim Dong-kwan in a Winner-Takes-All Showdown

- US Asset Management Firm Rises to 4th Largest Shareholder of LIG Nex1 in One Swoop, Will They Engage in Shareholder Activism?

가장 핫한 경제 소식! 한국금융신문의 ‘추천뉴스’를 받아보세요~

데일리 금융경제뉴스 Copyright ⓒ 한국금융신문 & FNTIMES.com

저작권법에 의거 상업적 목적의 무단 전재, 복사, 배포 금지

![Samsung Electronics and SK Hynix Engage in High-Stakes AI Chip War [KFT Topic]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=284&h=214&m=5&simg=2026013013432407964141825007d12411124362.jpg&nmt=18)

![Hyundai Mobis Posts Record Results, Pivots to Robotics and Electrification [KFT Topic]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=284&h=214&m=5&simg=2026012911595100522141825007d12411124362.jpg&nmt=18)

![One Year In: CEO Hyun Shin-kyun Transforms LG CNS into KRW 6 Trillion AI Powerhouse [KFT Topic]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=284&h=214&m=5&simg=2026012807381208149141825007d12411124362.jpg&nmt=18)

![Samsung's 'Last Chance': Lee Jae-yong Pushes HBM4 as Make-or-Break Moment [KFT Topic]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=284&h=214&m=5&simg=2026012623242806011141825007d122461258.jpg&nmt=18)

!['Chung Eui-sun Declares Robot Management Era'... Hyundai Motor Group to Lead Robotics Age with 'Physical AI' [KFT Topic]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=284&h=214&m=5&simg=20260106111449071567492587736121125197123.jpg&nmt=18)

![Lee Jae-yong and Chey Tae-won, Korea's 'Semiconductor Duo,' Head to China... What's the Status of Local Operations? [KFT Topic]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=284&h=214&m=5&simg=2026010608232205705141825007d12411124362.jpg&nmt=18)

!['Beyond Mobile to Robotics': LG Innotek Continues Portfolio Expansion [KFT Topic]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=284&h=214&m=5&simg=2026010508201109906141825007d12411124362.jpg&nmt=18)

![Doosan Enerbility Eyes Return to 'A' Credit Rating After 9 Years on Nuclear Power and Gas Turbine Boom [KFT Topic]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=284&h=214&m=5&simg=2026010208511504157141825007d12411124362.jpg&nmt=18)

![Naver hits KRW 10 trillion revenue but premium valuation in doubt [KFT Topic]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=110&h=79&m=5&simg=2026011308484406594141825007d12411124362.jpg&nmt=18)

!["Samsung Is Back," Chip Chief Declares, Eyeing Record Profit on HBM Recovery [KFT Topic]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=110&h=79&m=5&simg=2026011408580109459141825007d12411124362.jpg&nmt=18)

![Koo Kwang-mo's Vision for AI and Robotics Drives LG Group's Transformation [KFT Topic]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=110&h=79&m=5&simg=2026012123034202714141825007d122461258.jpg&nmt=18)

!['Expansion' S-OIL vs. 'Caution' GS Caltex [KFT Topic]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=110&h=79&m=5&simg=2026012010260905723141825007d12411124362.jpg&nmt=18)

![One Year In: CEO Hyun Shin-kyun Transforms LG CNS into KRW 6 Trillion AI Powerhouse [KFT Topic]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=110&h=79&m=5&simg=2026012807381208149141825007d12411124362.jpg&nmt=18)