이미지 확대보기

이미지 확대보기APLP had secured a 5.02% stake in LIG Nex1 in September 2024, but after repeated buying and selling, they reduced their stake to 3.89% by late November. However, they have resumed additional purchases this year.

Some in the business community are suggesting the possibility of APLP making a shareholder proposal at the upcoming LIG Nex1 shareholders' meeting on the 31st, citing past cases of active management intervention in companies where they held stakes.

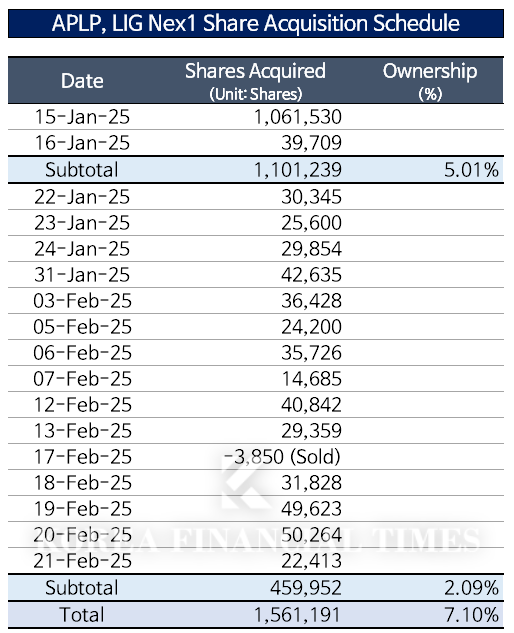

APLP recently increased their stake in LIG Nex1 from 5.01% to 7.10%. From January 22 to February 21, they conducted a total of 15 share transactions, purchasing a total of 2.09% stake in the market, except for one instance. On February 17, they sold 3,850 shares. With this, they surpassed the previous 4th largest shareholder, the Government of Singapore, and are now only 0.28% behind the 3rd largest shareholder, GIC Private Limited.

According to Article 147 of the Capital Markets Act, holding 5% or more of a listed company's shares classifies one as a "major shareholder." APLP became a major shareholder of LIG Nex1 shares from January this year. On January 15, APLP purchased 1,061,530 shares of LIG Nex1, and the next day, on the 16th, they additionally purchased 39,709 shares, exceeding the 5% stake.

이미지 확대보기

이미지 확대보기Generally, a limited partnership means providing investment without participating in management activities. Simple investment also implies no intention to influence management rights, with the main purpose being simple voting rights exercise and profit realization.

However, in the case of APLP, as a shareholder of Seven & i Holdings, the holding company of the convenience store chain 7-Eleven in Japan, they urged Seven & i Holdings to actively participate in acquisition negotiations proposed by the Canadian retailer Alimentation Couche-Tard (ACT), judging that Seven & i Holdings' restructuring plan to sell its supermarket business was insufficient.

Currently, the agenda for the LIG Nex1 shareholders' meeting includes the re-appointment of three existing outside directors and the appointment of one new outside director.

There is also an agenda to change the business purpose. They plan to delete the role as a "general partner (GP) of an institutional private equity fund" and add "processing, assembly, regeneration, modification, maintenance, and improvement" to the existing "manufacturing and sales of communication, electronic, electrical, mechanical equipment for ships and naval vessels" to specify the maintenance, repair, and overhaul (MRO) business.

A LIG Nex1 official said, "It is difficult to disclose the shareholder letters submitted to this shareholders' meeting."

Meanwhile, LIG Nex1, which recorded consolidated sales of KRW 3.2771 trillion and operating profit of KRW 230.8 billion last year, will pay a cash dividend of KRW 2,400 per share as a settlement dividend. The dividend yield is 1.15%, and the total dividend amount is KRW 52.3 billion. The dividend record date is December 31, 2024.

Shin Haeju (hjs0509@fntimes.com)

[관련기사]

- LIG Nex1 Breaks KRW 3 Trillion Revenue Mark in Defense Industry After 20 Years

- 'K-Defense is in a house fight'... Hanwha Ocean - HD Hyundai heavy in Poland, Hanwha - LIG Nex1 in Iraq 'in conflict'

- Hanwha Aerospace's market capitalization increases by 609% after the appointment of the 'son of the chairman'... Kim Dong-kwan's strategy worked

가장 핫한 경제 소식! 한국금융신문의 ‘추천뉴스’를 받아보세요~

데일리 금융경제뉴스 Copyright ⓒ 한국금융신문 & FNTIMES.com

저작권법에 의거 상업적 목적의 무단 전재, 복사, 배포 금지

!['Chung Eui-sun Declares Robot Management Era'... Hyundai Motor Group to Lead Robotics Age with 'Physical AI' [KFT Topic]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=284&h=214&m=5&simg=20260106111449071567492587736121125197123.jpg&nmt=18)

![Lee Jae-yong and Chey Tae-won, Korea's 'Semiconductor Duo,' Head to China... What's the Status of Local Operations? [KFT Topic]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=284&h=214&m=5&simg=2026010608232205705141825007d12411124362.jpg&nmt=18)

!['Beyond Mobile to Robotics': LG Innotek Continues Portfolio Expansion [KFT Topic]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=284&h=214&m=5&simg=2026010508201109906141825007d12411124362.jpg&nmt=18)

![Doosan Enerbility Eyes Return to 'A' Credit Rating After 9 Years on Nuclear Power and Gas Turbine Boom [KFT Topic]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=284&h=214&m=5&simg=2026010208511504157141825007d12411124362.jpg&nmt=18)

![Hyundai Mobis Posts Record Results, Pivots to Robotics and Electrification [KFT Topic]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=110&h=79&m=5&simg=2026012911595100522141825007d12411124362.jpg&nmt=18)