After joining Hanwha Group, Hanwha Ocean overcame long-standing financial difficulties inherited from its Daewoo Shipbuilding & Marine Engineering days, returning to profit within just 17 months. The company also became the first Korean shipyard to win a contract for maintenance of U.S. Navy vessels.

Daewoo Shipbuilding & Marine Engineering officially changed its name to Hanwha Ocean on May 23, 2023. At that time, five Hanwha Group affiliates-Hanwha Aerospace, Hanwha Systems, Hanwha Impact Partners, Hanwha Energy (then Hanwha Convergence), and Hanwha Energy Singapore-invested a total of KRW 2 trillion to acquire a 49.3% stake, completing the acquisition.

Currently, Hanwha Aerospace is the largest shareholder of Hanwha Ocean, holding a 46.28% stake. Recently, Hanwha Aerospace increased its shareholding by acquiring all Hanwha Ocean shares held by Hanwha Energy and Hanwha Energy Singapore, as well as part of the stake owned by Hanwha Impact Partners.

This additional acquisition by Hanwha Aerospace is aimed at facilitating a credit rating upgrade for Hanwha Ocean.

On April 8, An Byung-chul, CEO & Head of Strategy at Hanwha Aerospace, stated, “Hanwha Ocean’s credit rating remains relatively weak, and considering the situation of competitors supported by European governments, it is impossible to win orders based solely on product performance and price competitiveness.”

He emphasized the intention to bolster Hanwha Ocean’s credit standing by leveraging the high AA- (Stable) credit rating of its parent company. Ultimately, however, it is also necessary for Hanwha Ocean to enhance its own credit profile.

An industry insider commented, “If a shipbuilder’s credit rating is low, the company not only faces difficulties in securing financing and increased financial costs, but also risks disadvantages in order competition. Given the long-term contract nature of the shipbuilding industry, a low credit rating can undermine trust in the company’s sustainability, making it difficult to even participate in bidding for new contracts.”

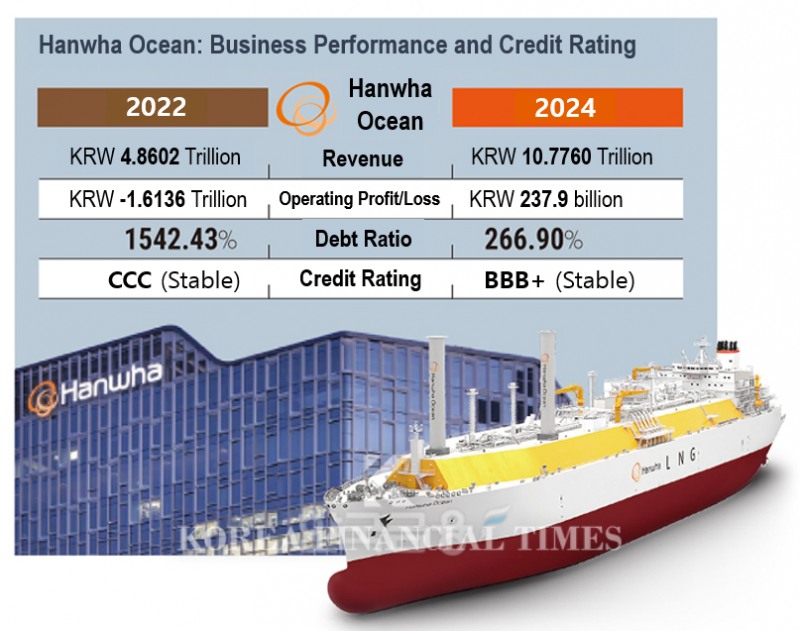

As of the end of last year, Hanwha Ocean’s debt ratio stood at 266.90%. This was a 43.62 percentage point increase from the previous year, but was largely due to increased borrowing in response to a surge in business activity amid a shipbuilding boom. Nevertheless, the company managed to overcome past deficits and achieved an operating profit of KRW 237.9 billion last year, successfully returning to profitability.

Previously, Hanwha Ocean recorded massive operating losses of nearly KRW 2 trillion in both 2021 and 2022, severely weakening its financial soundness. The debt ratio soared from 379.04% in 2021 to 1,542.43% in 2022. However, after joining Hanwha Group, the company reduced its net loss to KRW 196.5 billion by the end of 2023 and improved its debt ratio to 223.28% through a group-level capital increase.

Shin Haeju (hjs0509@fntimes.com)

[관련기사]

- HD Hyundai Heavy Industries Tops Foreign Exchange Gains Among Big Three Shipbuilders in 2024 with KRW 457.1 Billion

- Hanwha’s Kim Seung-youn and Kim Dong-kwan: Will the Father-Son 'Parallel Theory' Be Completed?

- Why HD Hyundai Heavy Industries Focuses on 'Surface Ships' and Hanwha Ocean on 'Submarines'

- Hanwha Group recruits successive foreign talents to lead defense and shipbuilding overseas business

- 'The shipbuilding industry is booming...' Samsung Heavy Industries sells its headquarters building again after 23 years

가장 핫한 경제 소식! 한국금융신문의 ‘추천뉴스’를 받아보세요~

데일리 금융경제뉴스 Copyright ⓒ 한국금융신문 & FNTIMES.com

저작권법에 의거 상업적 목적의 무단 전재, 복사, 배포 금지

![Tesla's Humanoid Rival Has Arrived — Boston Dynamics Eyes $70 Billion Valuation [K-Humanoid Wars, Part 1]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=284&h=214&m=5&simg=2026022010243207659141825007d12411124362.jpg&nmt=18)

![Samsung's 'Last Chance': Lee Jae-yong Pushes HBM4 as Make-or-Break Moment [KFT Topic]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=284&h=214&m=5&simg=2026012623242806011141825007d122461258.jpg&nmt=18)

![Hanwha Aerospace Stock Surges 3,500% in Six Years on 'Extraordinary Strength' [KFT Topic]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=284&h=214&m=5&simg=2026012609443900770141825007d12411124362.jpg&nmt=18)

![Naver hits KRW 10 trillion revenue but premium valuation in doubt [KFT Topic]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=284&h=214&m=5&simg=2026011308484406594141825007d12411124362.jpg&nmt=18)

![Three Generations of Hyundai's American Challenge: From Budget Cars to Premium EVs [KFT Topic]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=284&h=214&m=5&simg=2026011209372904936141825007d12411124362.jpg&nmt=18)