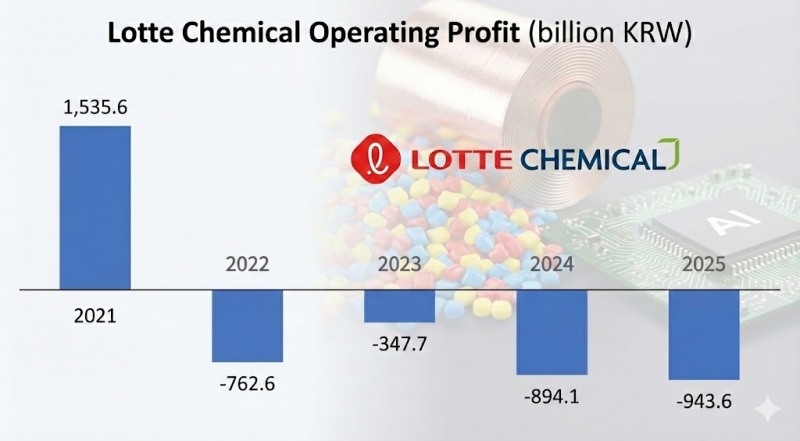

Net loss widened from KRW 1.8256 trillion in 2024 to KRW 2.4901 trillion in 2025, an increase of KRW 664.5 billion. The fourth quarter of last year alone added a net loss of KRW 1.609 trillion.

이미지 확대보기

이미지 확대보기'Diversified Investment' Resumes

Regarding this year's management direction, Lotte Chemical stated, "We plan to implement strategies centered on two axes: reducing the proportion of commodity petrochemical business within our business portfolio and establishing a foundation for future growth," adding, "We will accelerate the expansion of functional materials and eco-friendly energy business."The company also plans to proceed sequentially with new facility investments that were postponed during last year's business restructuring process.

In the Advanced Materials division, the company plans to complete construction of a new compounding plant at the Yulchon Industrial Complex in South Jeolla Province in the second half of this year. Approximately KRW 306.1 billion has been invested in the new plant. It will produce 500,000 tons annually of high-performance engineering plastics such as ABS and PC used for automotive materials.

The joint venture cathode foil project in the United States will also complete factory construction within this year. The company plans to expand its battery materials business to areas such as circuit boards for AI applications.

Minimum Dividend Despite Large-Scale Net Loss

Lotte Chemical decided on a cash dividend of KRW 500 per common share as a year-end settlement dividend. Including the interim dividend (KRW 500 per share), the 2025 dividend is KRW 1,000 per share.This is half of the KRW 2,000 per share paid in 2024. Compared to 2021 (KRW 8,300 per share) when the company was profitable, it is one-eighth of that level.

This is understood as paying dividends to enhance shareholder value despite having no distributable earnings capacity. Lotte Chemical applies a shareholder return policy of paying 30% of standalone net income (excluding one-time profits) as dividends. Based on standalone net income, the company has been in deficit since 2024.

Gwak Horyung (horr@fntimes.com)

[관련기사]

- 'Specialty expert' Lee Young-jun seeks to rescue LOTTE CHEMICAL from quagmire

- From LOTTE and SK to LG and EcoPro… Battery and Petrochemical Firms Turn to Price Return Swap (PRS) for Fundraising

- SK, LG, LOTTE: 'Secure Cash!' — Restructuring, Liquidity Drive 'All-In'

- Petrochemical Restructuring Underway… Will S-OIL’s ‘Time Bomb’ Go Off?

- Lotte Corporation Responds to Credit Rating Downgrade : “Uncertainty Resolved… Full Commitment to Improving Financial Soundness”

가장 핫한 경제 소식! 한국금융신문의 ‘추천뉴스’를 받아보세요~

데일리 금융경제뉴스 Copyright ⓒ 한국금융신문 & FNTIMES.com

저작권법에 의거 상업적 목적의 무단 전재, 복사, 배포 금지

!['Chung Eui-sun Declares Robot Management Era'... Hyundai Motor Group to Lead Robotics Age with 'Physical AI' [KFT Topic]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=284&h=214&m=5&simg=20260106111449071567492587736121125197123.jpg&nmt=18)

![Lee Jae-yong and Chey Tae-won, Korea's 'Semiconductor Duo,' Head to China... What's the Status of Local Operations? [KFT Topic]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=284&h=214&m=5&simg=2026010608232205705141825007d12411124362.jpg&nmt=18)

!['Beyond Mobile to Robotics': LG Innotek Continues Portfolio Expansion [KFT Topic]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=284&h=214&m=5&simg=2026010508201109906141825007d12411124362.jpg&nmt=18)

![Doosan Enerbility Eyes Return to 'A' Credit Rating After 9 Years on Nuclear Power and Gas Turbine Boom [KFT Topic]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=284&h=214&m=5&simg=2026010208511504157141825007d12411124362.jpg&nmt=18)

!['Expansion' S-OIL vs. 'Caution' GS Caltex [KFT Topic]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=110&h=79&m=5&simg=2026012010260905723141825007d12411124362.jpg&nmt=18)

![Koo Kwang-mo's Vision for AI and Robotics Drives LG Group's Transformation [KFT Topic]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=110&h=79&m=5&simg=2026012123034202714141825007d122461258.jpg&nmt=18)

![One Year In: CEO Hyun Shin-kyun Transforms LG CNS into KRW 6 Trillion AI Powerhouse [KFT Topic]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=110&h=79&m=5&simg=2026012807381208149141825007d12411124362.jpg&nmt=18)

![Samsung's 'Last Chance': Lee Jae-yong Pushes HBM4 as Make-or-Break Moment [KFT Topic]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=110&h=79&m=5&simg=2026012623242806011141825007d122461258.jpg&nmt=18)

![Kia's U.S. EV Sales Plunge 39%... What's Happening? [KFT Topic]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=110&h=79&m=5&simg=2026011909411301855141825007d12411124362.jpg&nmt=18)