이미지 확대보기

이미지 확대보기According to industry sources on the 23rd, SK Telecom is reportedly negotiating with prospective buyers for SK Stoa. SK Stoa officially announced commencement of the sale process through an internal email under CEO Yang Maeng-seok's name on the 15th.

SK Stoa originated from Btv Shopping, the data home shopping business division of SK Broadband in 2015. It became independent through physical division in December 2017, and SK Telecom acquired 100 percent stake in 2019, incorporating it as a wholly owned subsidiary.

SK Stoa specialises in interactive broadcast home shopping based on digital TV. Building on SK Telecom's telecommunications infrastructure and customer base, the company quickly established itself as the number one player in data home shopping within the home shopping market, which grew rapidly during COVID-19.

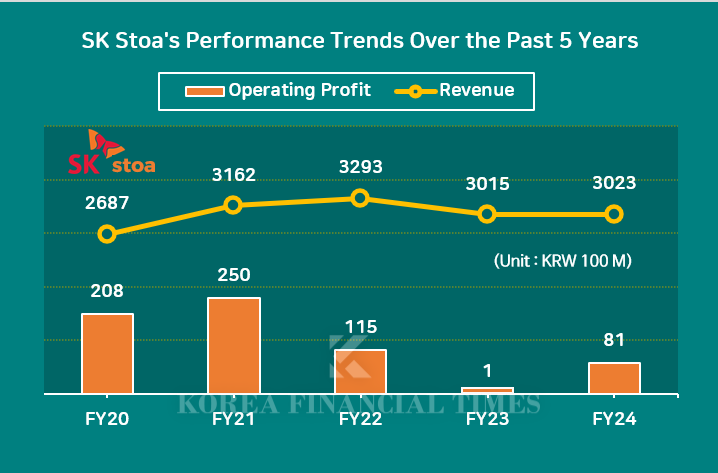

SK Stoa increased operating profit from KRW 1.4 billion in 2019 to KRW 20.8 billion in 2020 and KRW 25 billion in 2021. SK Stoa's growth momentum continued through 2022, when sales recorded KRW 329.3 billion.

From 2023, as the overall home shopping industry downturn and intensified market competition converged, SK Stoa's operating profit, which had increased during the COVID-19 windfall, decreased significantly to only KRW 100 million. Fortunately, last year the company succeeded in structural improvement, recording sales of KRW 302.3 billion and operating profit of approximately KRW 8.1 billion.

이미지 확대보기

이미지 확대보기Behind SK Stoa's solid performance lies adoption of various AI technologies. Since last year, SK Stoa has begun leaping toward AI commerce to transcend data home shopping limitations. Early this year, the company launched an AI Commerce Task Force.

Despite SK Stoa's performance improvement, SK Telecom chose to sell due to accumulated spending burden. SK Telecom is estimated to have incurred total expenditures of approximately KRW 1.5848 trillion from the USIM hacking incident that occurred in April.

Specifically, anticipated costs include: USIM replacement and dealer loss compensation of KRW 250 billion, proprietary customer compensation plan of KRW 500 billion, proprietary information protection measures of KRW 700 billion, Personal Information Protection Commission penalty of KRW 134.8 billion, and penalty fee exemptions (amount undisclosed).

An SK Telecom official stated: "It is difficult to specify total expenditures precisely. It is comprehensive and intertwined with financial circumstances, making it difficult to break down specifically how much was spent in which areas."

Securities firms project SK Telecom's third-quarter operating profit at KRW 23.8 billion, down approximately 96 percent from the same period last year (KRW 533.3 billion). While funds spent on USIM replacement and dealer loss compensation were reflected in the second quarter, the Personal Information Protection Commission penalty is expected to impact through the third quarter.

SK Stoa's sale price is expected between KRW 100 billion and KRW 200 billion. Final acquisition negotiators reportedly include small department store operators, multiple TV home shopping operators, and retail platform companies.

If this sale materialises, it will mark the first home shopping merger and acquisition (M&A) in 18 years since Lotte Shopping acquired then-Woori Home Shopping (now Lotte Home Shopping) in 2007. The sale decision is scheduled for the end of next month.

SK Telecom is expected to invest funds secured from selling SK Stoa and restructuring non-core businesses into new ventures. Choi Chang-won, chairman of SK SUPEX Council, is also known to have strongly directed non-core asset restructuring.

Indeed, SK Telecom is restructuring its business structure around telecommunications and AI dual pillars. Early this year, SK Telecom integrated the MNO Business Division, B Wireline and Media Business Division, and Enterprise Business Division into the 'Telecommunications Business Competitiveness Enhancement Sector'.

Subsequently, the company categorised the Adot Business Division, GPAA (Global Personal AI Agent) Business Division, AIX Business Division, and AI DC (Data Centre) Business Division into the 'AI Business Execution Enhancement Sector'.

An industry insider stated: "Once this sale completes, considerable changes in the home shopping market landscape are expected depending on the acquiring entity. However, given that home shopping is a declining industry and competition is intensifying from e-commerce, live commerce, and social media-based commerce beyond home shopping, we believe the sale outcome must be monitored until the end."

Jeong Chaeyun (chaeyun@fntimes.com)

[관련기사]

가장 핫한 경제 소식! 한국금융신문의 ‘추천뉴스’를 받아보세요~

데일리 금융경제뉴스 Copyright ⓒ 한국금융신문 & FNTIMES.com

저작권법에 의거 상업적 목적의 무단 전재, 복사, 배포 금지

!['Chung Eui-sun Declares Robot Management Era'... Hyundai Motor Group to Lead Robotics Age with 'Physical AI' [KFT Topic]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=284&h=214&m=5&simg=20260106111449071567492587736121125197123.jpg&nmt=18)

![Lee Jae-yong and Chey Tae-won, Korea's 'Semiconductor Duo,' Head to China... What's the Status of Local Operations? [KFT Topic]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=284&h=214&m=5&simg=2026010608232205705141825007d12411124362.jpg&nmt=18)

!['Beyond Mobile to Robotics': LG Innotek Continues Portfolio Expansion [KFT Topic]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=284&h=214&m=5&simg=2026010508201109906141825007d12411124362.jpg&nmt=18)

![Doosan Enerbility Eyes Return to 'A' Credit Rating After 9 Years on Nuclear Power and Gas Turbine Boom [KFT Topic]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=284&h=214&m=5&simg=2026010208511504157141825007d12411124362.jpg&nmt=18)

!['Expansion' S-OIL vs. 'Caution' GS Caltex [KFT Topic]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=110&h=79&m=5&simg=2026012010260905723141825007d12411124362.jpg&nmt=18)

![Koo Kwang-mo's Vision for AI and Robotics Drives LG Group's Transformation [KFT Topic]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=110&h=79&m=5&simg=2026012123034202714141825007d122461258.jpg&nmt=18)

![One Year In: CEO Hyun Shin-kyun Transforms LG CNS into KRW 6 Trillion AI Powerhouse [KFT Topic]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=110&h=79&m=5&simg=2026012807381208149141825007d12411124362.jpg&nmt=18)

![Samsung's 'Last Chance': Lee Jae-yong Pushes HBM4 as Make-or-Break Moment [KFT Topic]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=110&h=79&m=5&simg=2026012623242806011141825007d122461258.jpg&nmt=18)

![Kia's U.S. EV Sales Plunge 39%... What's Happening? [KFT Topic]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=110&h=79&m=5&simg=2026011909411301855141825007d12411124362.jpg&nmt=18)