이미지 확대보기

이미지 확대보기However, examining the share prices of these four companies reveals something unusual. The gap between the first and fourth-ranked companies is too stark. First place is Hanwha Aerospace, and fourth is KAI.

As the Russia-Ukraine war, Middle East conflicts, and US-China tensions expand global defense spending, domestic defense firms are experiencing a boom. Amid this, Hanwha Aerospace and KAI showed stark differences in shareholder returns over the past four years.

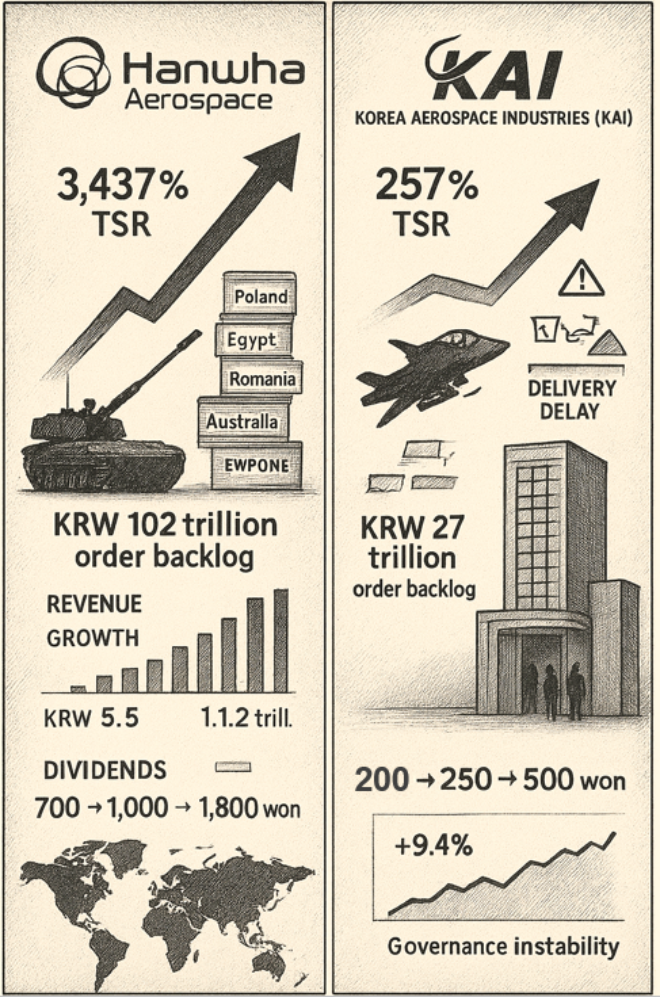

Korea Financial Times calculated both companies' total shareholder return (TSR) from June 1, 2021 to June 30, 2025 through corporate data platform DeepSearch, finding Hanwha Aerospace at 3,437 percent and KAI at 257 percent. TSR is an indicator showing the return shareholders can obtain from investing in company stock by adding share price fluctuation rate and dividend yield over a given period.

For example, if a shareholder purchased KRW 10 million worth of each company's stock in June 2021 and calculated valuation gains as of end-June 2025, Hanwha Aerospace would be approximately KRW 343.7 million, while KAI would be approximately KRW 25.7 million.

Both enjoyed the defense boom, so why did such a gap emerge?

According to the Stockholm International Peace Research Institute (SIPRI), global defense spending has steadily increased: 3.6 percent in 2022, 6.8 percent in 2023, and 9.4 percent in 2024. Domestic defense firms benefited from this trend.

KAI also signed FA-50 delivery contracts with Poland in 2022 and Malaysia in 2023, increasing order backlogs from KRW 17 trillion to KRW 27 trillion. By order volume alone, Hanwha Aerospace has approximately four times more than KAI.

The issue lies not in the scale difference. KAI's order volume converted to sales at a slower pace due to delivery delays and schedule changes. The Air Force TA-50 project contract was delayed in the first quarter of 2023, and the company is currently negotiating FA-50PL delivery dates with Poland, maintaining a policy of ensuring smooth delivery through close cooperation.

Operating performance also showed a clear gap between Hanwha Aerospace and KAI. Hanwha Aerospace's consolidated sales surged 103 percent from KRW 5.5414 trillion in 2021 and operating profit 525 percent from KRW 277.1 billion to KRW 11.2401 trillion in sales and KRW 1.7319 trillion in operating profit in 2024.

Second-quarter sales this year were KRW 6.311 trillion and operating profit KRW 864.5 billion, increases of 127 percent and 141 percent respectively year-on-year. Operating margin at year-end last year recorded 15.41 percent.

During the same period, KAI sales increased 42 percent from KRW 2.5623 trillion to KRW 3.6337 trillion, and operating profit rose 313 percent from KRW 58.3 billion to KRW 240.7 billion.

However, second-quarter sales this year decreased 7 percent year-on-year to KRW 828.3 billion, while operating profit increased only 15 percent to KRW 85.2 billion. Operating margin at year-end last year was 6.63 percent.

This performance gap was directly reflected in share prices. Over the past four years, Hanwha Aerospace's cumulative share price appreciation reached 3,415 percent, while KAI rose 254 percent.

Hanwha Aerospace's share price surged from KRW 48,650 closing price on June 1, 2021 to KRW 848,000 on June 30, 2025.

On September 11, it broke through KRW 1 million on a closing basis, surpassing KRW 50 trillion in market capitalisation.

During the same period, KAI's share price rose from KRW 34,850 to KRW 89,800, and has remained in the KRW 100,000 range since September 16.

Cumulative dividend yields were compiled at 21.97 percent for Hanwha Aerospace and 3.94 percent for KAI. Both companies paid settlement dividends from 2021 to 2024, but showed major differences in dividend amounts. By year, Hanwha Aerospace paid KRW 700, KRW 1,000, KRW 1,800, and KRW 3,500, while KAI only paid KRW 200, KRW 250, KRW 500, and KRW 500.

Meanwhile, KAI has the weakness of vulnerable governance stability, with CEOs being replaced whenever regimes change. As soon as the current administration took office, former CEO Kang Gu-young immediately resigned. Former CEO Ha Sung-yong received a guilty verdict for solicitation and embezzlement charges.

Shin Haeju (hjs0509@fntimes.com)

[관련기사]

- Hanwha DK, the Only 1980s-born Heir to Complete Succession

- ‘Another K-Miracle’ Hanwha Aerospace, Hyundai Rotem, and LIG Nex1

- Hanwha Aerospace’s Kim Dong-kwan Partners with Coulter to Target the U.S. Defense Market

- Hanwha Aerospace, Nears Export of K9 Self-Propelled Howitzers to Vietnam

- HD Hyundai, LIG, and KAI Team Up for 'Futuristic Unmanned Vessel Project' — Hanwha Left Out?

가장 핫한 경제 소식! 한국금융신문의 ‘추천뉴스’를 받아보세요~

데일리 금융경제뉴스 Copyright ⓒ 한국금융신문 & FNTIMES.com

저작권법에 의거 상업적 목적의 무단 전재, 복사, 배포 금지

![Hyundai Mobis Posts Record Results, Pivots to Robotics and Electrification [KFT Topic]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=284&h=214&m=5&simg=2026012911595100522141825007d12411124362.jpg&nmt=18)

![One Year In: CEO Hyun Shin-kyun Transforms LG CNS into KRW 6 Trillion AI Powerhouse [KFT Topic]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=284&h=214&m=5&simg=2026012807381208149141825007d12411124362.jpg&nmt=18)

![Samsung's 'Last Chance': Lee Jae-yong Pushes HBM4 as Make-or-Break Moment [KFT Topic]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=284&h=214&m=5&simg=2026012623242806011141825007d122461258.jpg&nmt=18)

![Hanwha Aerospace Stock Surges 3,500% in Six Years on 'Extraordinary Strength' [KFT Topic]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=284&h=214&m=5&simg=2026012609443900770141825007d12411124362.jpg&nmt=18)

!['Chung Eui-sun Declares Robot Management Era'... Hyundai Motor Group to Lead Robotics Age with 'Physical AI' [KFT Topic]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=284&h=214&m=5&simg=20260106111449071567492587736121125197123.jpg&nmt=18)

![Lee Jae-yong and Chey Tae-won, Korea's 'Semiconductor Duo,' Head to China... What's the Status of Local Operations? [KFT Topic]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=284&h=214&m=5&simg=2026010608232205705141825007d12411124362.jpg&nmt=18)

!['Beyond Mobile to Robotics': LG Innotek Continues Portfolio Expansion [KFT Topic]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=284&h=214&m=5&simg=2026010508201109906141825007d12411124362.jpg&nmt=18)

![Doosan Enerbility Eyes Return to 'A' Credit Rating After 9 Years on Nuclear Power and Gas Turbine Boom [KFT Topic]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=284&h=214&m=5&simg=2026010208511504157141825007d12411124362.jpg&nmt=18)

![Naver hits KRW 10 trillion revenue but premium valuation in doubt [KFT Topic]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=110&h=79&m=5&simg=2026011308484406594141825007d12411124362.jpg&nmt=18)

![Three Generations of Hyundai's American Challenge: From Budget Cars to Premium EVs [KFT Topic]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=110&h=79&m=5&simg=2026011209372904936141825007d12411124362.jpg&nmt=18)

!['Expansion' S-OIL vs. 'Caution' GS Caltex [KFT Topic]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=110&h=79&m=5&simg=2026012010260905723141825007d12411124362.jpg&nmt=18)

![Koo Kwang-mo's Vision for AI and Robotics Drives LG Group's Transformation [KFT Topic]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=110&h=79&m=5&simg=2026012123034202714141825007d122461258.jpg&nmt=18)

!["Samsung Is Back," Chip Chief Declares, Eyeing Record Profit on HBM Recovery [KFT Topic]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=110&h=79&m=5&simg=2026011408580109459141825007d12411124362.jpg&nmt=18)