이미지 확대보기

이미지 확대보기According to Nasdaq, Webtoon Entertainment's stock closed at USD 21 on the 17th, marking a 0.96% increase from the previous day's close and recovering its initial public offering (IPO) price.

However, the situation changed dramatically with recent news of Disney's expanded content collaboration and equity investment in Webtoon Entertainment. Prompted by the announcement from both companies, Webtoon Entertainment's stock surged by 39.04% on the Nasdaq market on the 16th, reaching USD 20.8 compared to the previous day's close.

이미지 확대보기

이미지 확대보기Earlier on the 16th, Webtoon Entertainment signed a non-binding term sheet with Disney for the development of a digital comics platform.

Under this agreement, Webtoon Entertainment is set to develop and operate a platform for the digital distribution of approximately 35,000 comic IPs owned by Disney, including Disney, Marvel, Star Wars, Pixar, and 20th Century Studios.

In conjunction with this collaboration, both companies also entered into a non-binding term sheet for Disney to acquire a 2% stake in Webtoon Entertainment. This agreement is contingent upon the finalization of the contract and completion of customary closing procedures.

이미지 확대보기

이미지 확대보기Industry observers note that while Webtoon Entertainment is building high expectations with the Disney equity investment and platform development partnership, Kakao Entertainment continues to struggle.

Kakao Entertainment is currently facing a shortage of new IPs. Since 2016, the company has serviced the 'Solo Leveling' webnovel IP. Subsequently, from 2018, it actively expanded into secondary IP businesses, including 'Solo Leveling' webtoon IP projects and global adaptation for video and gaming.

Through the 'Solo Leveling' webtoon and webnovel IPs, Kakao Entertainment achieved significant milestones, including the highest award at a global animation ceremony and topping charts on local platforms in North America, Japan, and Europe.

Furthermore, it secured achievements in IP expansion and live-action adaptations, such as the launch of the mobile game 'Solo Leveling: ARISE' in cooperation with Netmarble, and the initiation of a 'Solo Leveling' live-action drama production with Netflix.

The problem, however, is the lack of a successor IP that can replicate the global success and industrial impact of 'Solo Leveling'. While Naver and Kakao form the duopoly of the domestic webtoon and webnovel market, Webtoon Entertainment has now secured Disney IPs, encompassing Marvel, Star Wars, and Pixar, leaving Kakao Entertainment without a clear growth engine.

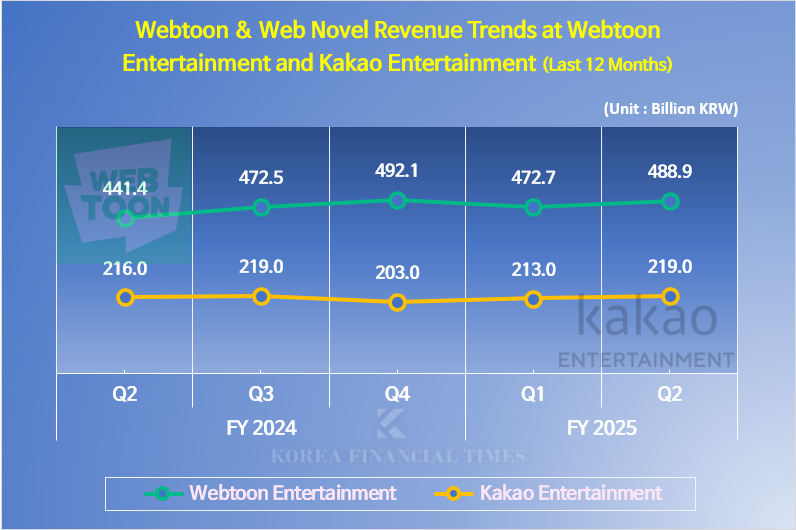

Its financial performance also shows a stark contrast with Webtoon Entertainment. Kakao Entertainment's story division (Pikcoma and entertainment combined), which compiles webtoon and webnovel sales, recorded revenues of 216 billion KRW in Q2 2024, 219 billion KRW in Q3, 203 billion KRW in Q4, 213 billion KRW in Q1 2025, and 219 billion KRW in Q2 2025.

이미지 확대보기

이미지 확대보기Attracting external investment for new IP creation and acquisition has also proven difficult. The 1 trillion KRW in investment that Kakao Entertainment secured from entities like the Saudi Arabian sovereign wealth fund and the Singapore sovereign wealth fund in early 2023 was mostly injected into the acquisition of SM Entertainment's management rights.

Hopes of securing investment through an IPO have also stalled. Kakao Entertainment's IPO effectively collapsed in April this year.

Previously, Kakao Entertainment had accumulated investments from Anchor PE, GIC, PIF, and Tencent over a long period, pushing its valuation above 11 trillion KRW. Riding this momentum, Kakao Entertainment selected NH Investment & Securities and KB Securities as lead underwriters in 2019 and planned to submit its preliminary IPO review application in 2022.

However, during this process, its parent company Kakao became embroiled in controversies surrounding "spin-off listings of subsidiaries" and legal risks arising from the SM Entertainment acquisition. Kakao Entertainment's IPO process was effectively halted amidst related allegations.

Some critics suggest that Kakao Entertainment's webtoon and webnovel platform business structure acts as an impediment to attracting investment.

이미지 확대보기

이미지 확대보기Webtoon Entertainment operates a bifurcated business structure with separate webtoon and webnovel platforms. Examples include Naver Webtoon and Naver Series domestically, LINE Manga and ebookjapan in Japan, and Webtoon and Wattpad in North America.

Kakao also operates two platforms domestically, Kakao Page and Kakao Webtoon, but the differentiation between them is not distinct. Not only are the same webtoons often featured on both platforms, but promotional strategies also vary between platforms for identical webtoons, potentially causing confusion among users.

An industry insider commented, "Naver, by operating specialized platforms tailored to regional characteristics, has relatively systematic and scalable global IP and monetization strategies. While Kakao also has regional platforms like Japan's Piccoma and North America's Tapas, applying different promotions to the same content can actually diminish the platform's appeal."

Jeong Chaeyun (chaeyun@fntimes.com)

[관련기사]

- Kakao Grapples with Growing Legal Risks... Pinning Hopes on AI Growth

- Why Did Kakao and KT Fall Short Against Naver and SKT in Korea’s ‘National AI’ Selection?

- On the Same Boat with Alibaba? Shinsegae Still Has a Long Way to Go

- A New Game in E-commerce: Will the 'Kurly & Naver' Alliance Shake Coupang?

- Naver Cloud, “Inference AI is Essential to Sovereign Strategy… Launch Set for First Half of This Year”

가장 핫한 경제 소식! 한국금융신문의 ‘추천뉴스’를 받아보세요~

데일리 금융경제뉴스 Copyright ⓒ 한국금융신문 & FNTIMES.com

저작권법에 의거 상업적 목적의 무단 전재, 복사, 배포 금지

![Tesla's Humanoid Rival Has Arrived — Boston Dynamics Eyes $70 Billion Valuation [K-Humanoid Wars, Part 1]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=284&h=214&m=5&simg=2026022010243207659141825007d12411124362.jpg&nmt=18)

![Samsung's 'Last Chance': Lee Jae-yong Pushes HBM4 as Make-or-Break Moment [KFT Topic]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=284&h=214&m=5&simg=2026012623242806011141825007d122461258.jpg&nmt=18)

![Hanwha Aerospace Stock Surges 3,500% in Six Years on 'Extraordinary Strength' [KFT Topic]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=284&h=214&m=5&simg=2026012609443900770141825007d12411124362.jpg&nmt=18)

![Tesla's Humanoid Rival Has Arrived — Boston Dynamics Eyes $70 Billion Valuation [K-Humanoid Wars, Part 1]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=110&h=79&m=5&simg=2026022010243207659141825007d12411124362.jpg&nmt=18)

!['Samsung's Bet on the Future' — Rainbow Robotics, Korea's Humanoid Pioneer [K-Humanoid Wars, Part 2]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=110&h=79&m=5&simg=2026022413501808272141825007d12411124362.jpg&nmt=18)