이미지 확대보기

이미지 확대보기Do Ki-wook, Netmarble’s chief financial officer overseeing the company’s finances, is a traditional finance professional who prioritizes stability and efficiency. Born in 1973, Do graduated from Daewon Foreign Language High School and Chung-Ang University (Business Administration), and worked at Hollys F&B, Indies Air, and CJ E&M before joining Netmarble in 2014 as head of finance & administration. He has served as CFO since 2021 and as co-CEO alongside former CEO Kwon Young-sik from 2022 to 2024; since this year, he has returned to focusing solely on CFO duties.

However, as Netmarble pursued growth engines with large-scale M&A—acquiring Coway in 2021 and SpinX in 2022—its debt burden rose. By end-2022, when both deals had closed, total borrowings had surged to about KRW 2 trillion—more than a 400-fold increase in just two years. The financial burden was compounded by back-to-back annual net losses in 2022 and 2023.

Around that time, Do was elevated to co-CEO, reflecting the rising importance of financial management. Despite heavier leverage, he maintained a conservative stance—eschewing refinancing (repaying loans with new loans) in favor of asset disposals and cash repayments to reduce borrowings, while tightening marketing and personnel expenses. For example, last year Netmarble sold 2.66% out of its 12.1% stake in HYBE to raise about KRW 220 billion in cash.

CFO Do said at the time that the proceeds would be used to repay debt. The company also recently sold its North American subsidiary Jam City, reducing interest expenses from about KRW 100 billion to the KRW 20 billion range as of the second quarter this year. Fortunately, beginning last year with “Solo Leveling: ARISE,” a series of new titles has performed well, driving earnings improvement and stronger cash inflows.

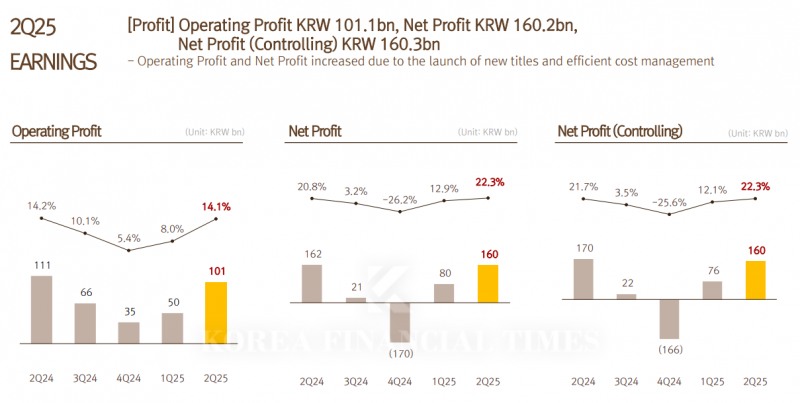

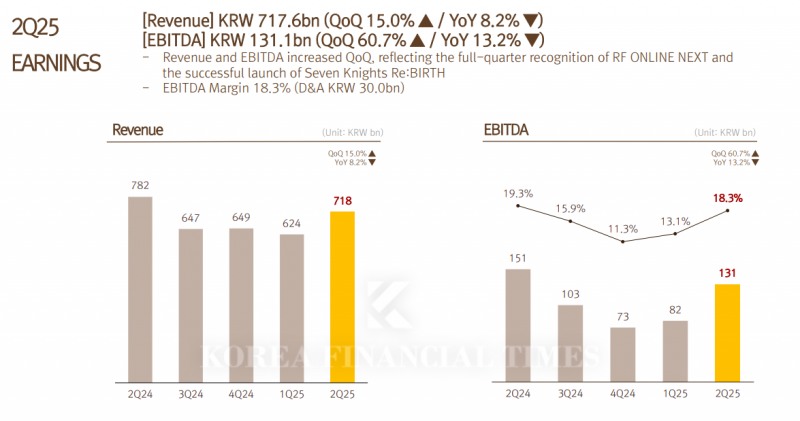

On a consolidated basis last year, Netmarble posted revenue of KRW 2.6637 trillion and operating profit of KRW 215.6 billion, returning to profit after about three years. For the first half of this year, cumulative revenue was KRW 1.3415 trillion, EBITDA KRW 212.7 billion, operating profit KRW 150.8 billion, and net profit KRW 240.4 billion. Versus a year earlier, revenue fell 1.9%, while EBITDA, operating profit, and net profit rose 9.8%, 31.2%, and 57.7%, respectively.

For full-year 2025, the company is projected to sustain the recovery, with estimated revenue of KRW 2.8253 trillion and operating profit of KRW 339.1 billion. Operating cash flow also swung to an inflow of about KRW 287.7 billion as of end-2024, with this year’s operating cash flow forecast at KRW 421.1 billion, up 46.4% from last year.

이미지 확대보기

이미지 확대보기Despite the favorable trend, Do remains conservative, citing the remaining task of securing liquidity to achieve full financial stabilization.

At present, Netmarble faces a bunching of debt maturities within less than one year. Current assets increased 11.10% from KRW 998.9 billion in Q2 last year to KRW 1.1098 trillion in Q2 this year, but current liabilities climbed 66.44% from KRW 971.6 billion to KRW 1.6171 trillion over the same period. As a result, the current ratio plunged from 102.81% in Q2 last year to 68.62% in just one year. Generally, a current ratio of 100–150% is viewed as appropriate.

Meanwhile, the coffers for repaying borrowings have thinned. On a separate basis, cash and cash equivalents fell from KRW 1.0411 trillion in 2019 to KRW 39.4 billion as of Q2 this year. Even on a consolidated basis—including subsidiaries—cash and cash equivalents declined from KRW 1.5748 trillion in 2019 to KRW 513.0 billion over the same period, an “evaporation” of roughly KRW 1 trillion. This is why CFO Do says it is not yet time to relax.

CFO Do Ki-wook said the company will continue to focus on cost control while actively reviewing the use of existing assets.

“Fundamentally, we will maintain a company-wide cost-efficiency stance,” he said during last month’s Q2 earnings conference call. “We will continue to manage personnel and marketing costs, and will ensure that the cost ratio does not rise even if absolute amounts change.”

On borrowings repayment and asset monetization, he added: “Debt repayment decisions will inevitably be tied to asset monetization. We will closely monitor multiple factors—including trends in global capital markets—to determine the optimal timing for asset monetization.”

Kim JaeHun (rlqm93@fntimes.com)

[관련기사]

- 9 Companies, Including SHIFTUP, Set to Go Public in July [Korean IPO market]

- Netmarble's Surprise Leadership Change... Signal for Netmarble Neo's IPO Relaunch?

- NC Soft Reports 'First Annual Loss', Aims for Turnaround with Global Releases

- Kakao Grapples with Growing Legal Risks... Pinning Hopes on AI Growth

가장 핫한 경제 소식! 한국금융신문의 ‘추천뉴스’를 받아보세요~

데일리 금융경제뉴스 Copyright ⓒ 한국금융신문 & FNTIMES.com

저작권법에 의거 상업적 목적의 무단 전재, 복사, 배포 금지

![용산구 ‘나인원한남’ 88평, 9억 상승한 167억원에 거래 [일일 아파트 신고가]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=284&h=214&m=5&simg=2025071010042800278b372994c952115218260.jpg&nmt=18)

![최호권 영등포구청장, 구청 별관 옥상녹화 조성사업 준공식 참석 [우리 구청장은 ~~]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=284&h=214&m=5&simg=2025082408191103533dd55077bc221924192140.jpg&nmt=18)

![박강수 마포구청장, 녹지 개발 ‘댕댕이 공원' 개장식 참석 [우리 구청장은 ~~]](https://cfnimage.commutil.kr/phpwas/restmb_setimgmake.php?pp=006&w=284&h=214&m=5&simg=2025082318434900738dd55077bc212411124362.jpg&nmt=18)